A real estate investor provides advice on developing creative financing strategies that could carry both lenders and investors through a softer market.

As a real estate investor for 15 years, I have worked with my share of private lenders. During that time—and through economic turmoil—I have seen the industry evolve from offering individually-customized loan terms for every deal to standardized products, operating processes and underwriting procedures.

These days, private lenders still take on the deals that institutional lenders will not or cannot touch, but streamlining to finance more debt at a faster pace than ever has naturally made a private lender’s processes look more like a bank’s.

That is not a bad thing. It has brought the industry to borrowers who would never have had the opportunity or patience to work with private lenders otherwise. And, it has elevated the industry to a “yes, I’m working with a real business” stature. It lets you offer better, more competitive products, and it helped get me to close faster and at a lower cost to my bottom line.

But this standardization also means a certain lack of flexibility for deals that do not fit into the (admittedly much wider than banks’) parameters that private lenders’ standardized loan products and underwriting allow. Standardization also means it’s operationally slower and more difficult to change from modus operandi.

As the market shifts, whether part of a natural cycle or as part of larger economic issues, real estate investors will find themselves thinking: “Contractors are in short supply and the profit from fix-and-flips is just not there right now. But, I still want to focus on real estate investment to build wealth and monthly cash flow. How am I going to fund my deals if they no longer fit the standard bank or private lender loan products?”

In markets that feel like they can change on a dime based on hundreds of competing factors, standardization cannot always serve. Private lenders need to think long and hard about supplementing their bottom line with options outside of 2 points/10% interest. They must be willing to get creative with borrowers. Working outside the box may be what helps keep both the real estate investment and the private lending industries afloat during the next inevitable downturn.

Flexibility is what has kept many private lenders operational while banks had to receive bailouts. I worry that technology and ever-increasing structure around private lending will be a double-edged sword. These developments have served extremely well during prosperity but may not serve as well when deals are thin on the ground and previously profitable loan products become less so.

Following are some strategies I’ve seen developing and that have worked quite well for both me and the lenders I partner with. In harder times, lenders who demonstrate their willingness to negotiate and customize their offerings will be the ones I go to first for every real estate investment deal I do.

The Buy-And-Hold Strategy

With end-homebuyers struggling to find and qualify for traditional financing during harder economic times, many prospective homeowners will instead remain renters. Lenders who capitalize on this by switching gears from fix-and-flip terms to competitive—and longer—buy-and-hold terms will find that the market itself will help them survive as fix-and-flip demand retracts. With banks only willing to finance a certain number of loans from a single real estate investor, the private lending industry can do much to supplement this area as renting continues to grow.

The same holds true for investors. Lenders having conversations with worried fix-and-flippers (many of whom are considering getting out of the business entirely until the market corrects) should encourage them to look at different exit strategies.

The Owner-Financing Strategy

As affordable housing and financing becomes unavailable for many homeowners, investors will start looking for creative ways to get their properties to prospective buyers. Owner financing is one such solution, allowing the real estate investor to “wrap” the loan.

Coupled with longer-term loan products, this strategy would allow the lender to create structured programs for real estate investors that allow the underlying mortgage to be wrapped with the buyer vetted through the RMLO process.

The Equity-Sharing Strategy

When the economy and financing is on shakier ground, relationships become the deciding factor on who survives and who doesn’t. Private lenders who take on an equity-sharing strategy will get to know their borrowers’ business practices and be able to form a solid lender/investor relationship. It’s a strategy I also suggest for private lenders new to real estate. They’ll get a closer look at the process, which will enable them to better figure out the right deals for their goals.

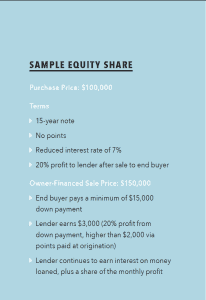

Here’s a sample equity share to demonstrate:

This is just one of several scenarios that can be negotiated between investor and lender. Other options for lenders not keen on owner financing might include a shorter-term business-purpose loan, with the lender instead taking a portion of the sale profits.

While equity sharing does necessitate the lender taking on higher risk if the profit isn’t there at the end of the deal, combining equity share with a loan can mitigate some of this risk. It also allows the earning of a higher rate of return than a more standard deal. As markets thin, equity sharing may mean the difference in the lender and the investor keeping their doors open until fairer weather. The lender earns more return on each deal, while the investor can now bring more deals to the table via a deeper partnership and more favorable loan terms.

At minimum, lenders should look first to investors who:

- Have a successful track record.

- Demonstrate willingness to build solid relationships.

- Demonstrate willingness to negotiate flexible/nonstandard terms.

- Have an exit strategy if the deal goes awry.

- Have a plan around worse-case-scenarios like death, divorce or health issues.

- Can be diligent about the structured agreement and length of partnership.

- Are willing to make regular reports (monthly at minimum) to the lender.

Although most private lenders would prefer not to use these three strategies on a regular basis because they require acceptance of longer loan periods and/or additional risk than a more standard loan, they should be carefully considering them now—ahead of any financial crisis. The lender who can even temporarily abandon old products in order to survive through more creative means will be able to capitalize ahead of competitors who rely on market-mismatched products until too late.

Leave A Comment