These communication strategies streamline your processes and mitigate inefficiencies.

This is the first in a short series of articles covering the practical aspects of creating and maintaining efficient operations processes.

Operations is a living, breathing “entity” that evolves with the size, speed, and growth of your business. They are fluid, not a one-and-done task.

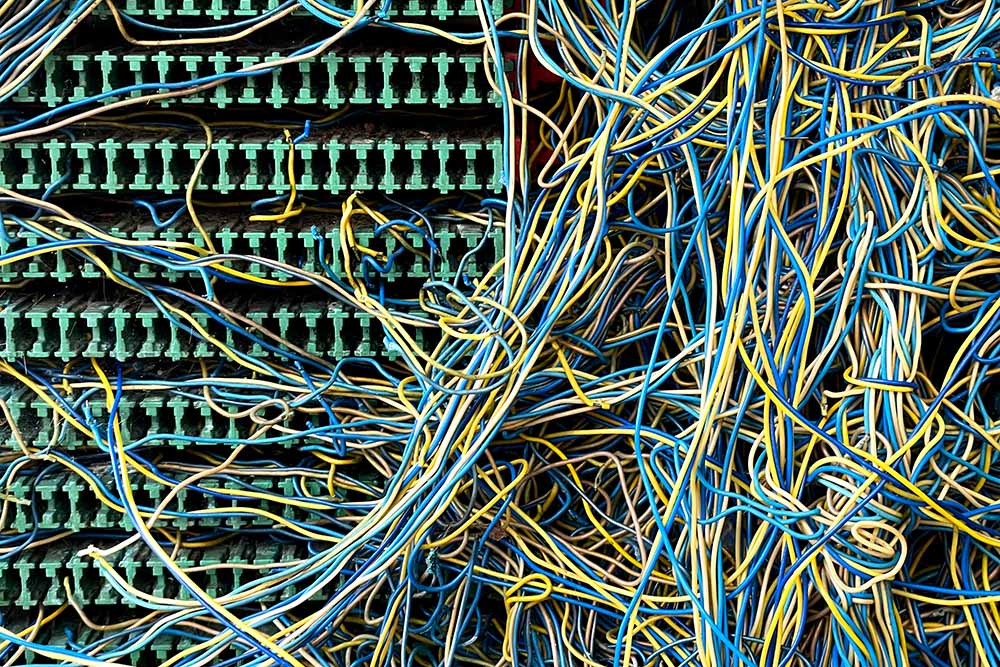

Like many companies, you likely created your processes, or operations, on the fly as the company got started. You continued to build them out as needs changed. Then the company got bigger. And you got busier and did whatever seemed to work to keep the train running. Now, 10 years have passed and your team is weighed down by a disorganized mess of complex tasks and little to no communication processes. Your company is stagnating as a result.

The solution to this situation is developing a well-run lending operation. As you might guess, this is where many business leaders—and businesses—fail. Rather than looking at operations as all the processes required for managing loans from start to finish, they simply view it as originations.

Let’s consider a simple analogy. Think of operations as your entire human body. The body is comprised of many parts and systems, each with their own name and functions, but they cannot complete any function without overlapping with other systems and parts.

Your operations are no different. You likely have teams for collections, draw management, originations, fund management, analytics, underwriting, processing, insurance, extensions, modifications, note sales, and other tasks. These teams must work together to convert a lead to a customer, close and service the loan, and then discharge it. Even if you are using a third party for some of these tasks, you must still manage that third-party process and tie into your operations.

As you may be beginning to see, lending operations isn’t just about numbers and spreadsheets. It’s about navigating a labyrinth of departments and people to making the seemingly endless stream of paperwork, phone calls, and emails efficient. Solid lending operations help limit irate customers or employees as well. Most important, effective operations will help you exponentially grow your company.

One key component of an effective operating system is communications. If you made no other changes to the way your company operates, shoring up your communications would make you more money, hands down.

Why Communication is Key

So, picture this: Your top-notch asset-based lending company has been running smoothly—or you think it has—for years. But as you reflect, you have to admit there are always fires, emergencies, and something that could ensure smoother closings. Most of the time, these situations result from a breakdown in communication among departments, co-workers, and borrowers. The miscommunication often results in an uncoordinated mess and unhappy customers. It’s a scenario that plays out all too often in businesses.

That’s why communications is so critical to your operations. It’s the oil that keeps the gears of a successful operation turning. Clear and concise communication ensures everyone is on the same page. Let it be known internally that your company’s policy is to state even the obvious. And state it specifically: who you are, what you want, when you want it, and any consequence of not doing so.

Let’s place this in context:

“Hi, this is Alex. I need some additional information on your 30-year DSCR loan to fully quote you. I need answers to the following questions (state questions) by 3 p.m. today. If I don’t get them, your quote and closing will be delayed. Will I have these by 3 p.m.?”

Both you and your staff must communicate with purpose and direction, internally among yourselves and externally with prospects, clients, and vendors. Someone in the conversation must drive the conversation to get the results you want. Let’s face it, all communication is a negotiation—of persuading the parties involved to spend their time to do something mutually beneficial.

Communication vs. Effective Communication

There is a difference between communication and effective communication. Effective communication requires time, effort, and good listening skills.

People who communicate effectively spend more of time listening than talking and giving orders. They are, first and foremost, problem solvers, which requires listening skills. Understand that any dialog in your office about actual work is a problem-solving negotiation.

Train your staff to effectively communicate problems, listen to others who are conveying information about problems, and try solutions to fix the issue. These actions will increase the conversion rates of loans closed versus loans lost.

At its essence, effective communication involves listening to a problem, repeating the problem to make sure you have correctly understood everything that was conveyed, and then offering a collaborative solution to the problem. Getting your loan officers to help borrowers do the same will exponentially increase your closings.

Here’s an example that illustrates how effective communication and active listening can be used to solve problems in your operations:

Despite reaching out through numerous emails and phone calls, your originations team hasn’t heard back from a prospective borrower after the initial phone call in which the team finalized all the necessary details for the application. The application appeared to be ready to move on to the next stage toward closing the loan. So, the problem is the borrower didn’t follow up, right?

Wrong.

Yes, your team attempted to communicate, but was it effective? No. You can get to the real problem by examining what happened during the initial phone call. Sure, your origination team went line-by-line through the application to get the missing information, but in doing so, it relegated the phone call to a transaction instead of using the call as a relationship-building opportunity. Because the borrower perceived your team to be simply transactional, when the borrower got a better offer (or better interaction) from someone else, that’s who they went with.

To prevent potential buyers from “ghosting” you, train your origination team to turn that initial phone call into a listening opportunity. Ask them to hunt for what your borrower really cares about (e.g., money out of pocket, terms, rate, closing date, etc). The fact that you asked and then listened to their needs changes the relationship dynamic. The borrower now feels they have some control or are at least on more equal footing (meeting of the minds). Even if they responded “low interest rate,” suddenly that might not be as important as working with a lender who “gets me.” When that type of relationship dynamic occurs, the borrower is much more receptive and may stay with you even if offered a lower interest rate elsewhere. The borrower feels understood and taken care of by your team. This kind of communication takes active listening.

As it is in closing loans, communication is paramount when you make adjustments in your operations. With a staff that can effectively communicate issues and problems, you can make minor—and sometimes major—adjustments to your procedures without the angst that usually accompanies change. When you have everyone working as a team moving in the same direction, you have growth ahead of you.

Leave A Comment