Underwriting corrections and stronger sponsor quality have fueled a sharp rebound in multifamily residential transition loans while other segments remain volatile.

By Sam Kaddah, Liquid Logics, and Aleksandra Simanovsky, Adige Advisory

In the historically opaque and fragmented world of residential transition loans (RTLs), standardized performance data has been difficult to come by. But thanks to advances in digital infrastructure and a growing push toward institutional transparency, this is beginning to change.

Since 2014, Liquid Logics has recorded more than $40 billion in short-term real estate loans originated by more than 300 private lenders. This normalized, loan-level data—sourced through direct API integrations with lenders and servicers—offers a uniquely detailed view into the short-term, real estate-backed lending market. In 2024, the dataset reflects roughly 25% of the estimated $60 billion in RTL originations, offering investors valuable insight into market trends and borrower behavior at scale.

RTL Performance

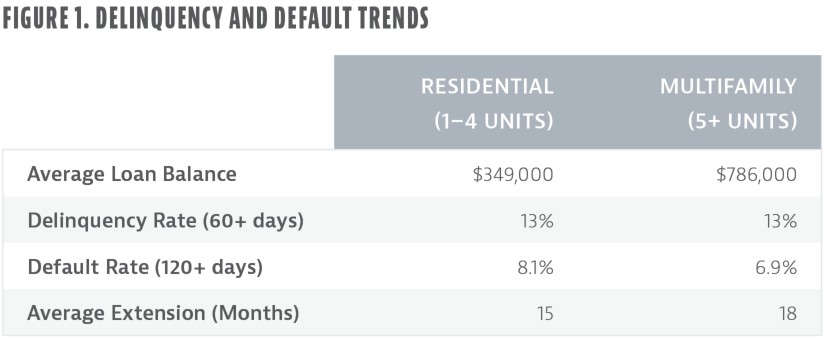

Figure 1 shows nationwide and state-level performance metrics, dissecting patterns in delinquencies, defaults, losses, and extension behavior, while offering commentary on key differences between residential (1–4 units) and multifamily/commercial (5 or more units) asset classes.

Multifamily loans, though typically larger in size, post slightly lower default (6.9% vs. 8.1%) rates, suggesting better borrower vetting, stronger property fundamentals, or more institutional-quality underwriting in this segment. However, they also experience longer average extensions (18 months vs. 15 for residential), reflecting the more complex nature of repositioning larger assets and often lengthier sales or refinance timelines.

The parity in 60 days or more delinquency rates (13% for both asset types) underscores a shared sensitivity to macroeconomic conditions (e.g., interest rate fluctuations and housing demand). Still, the faster transition from delinquency to default in residential RTLs may reflect thinner borrower reserves or tighter servicing timelines.

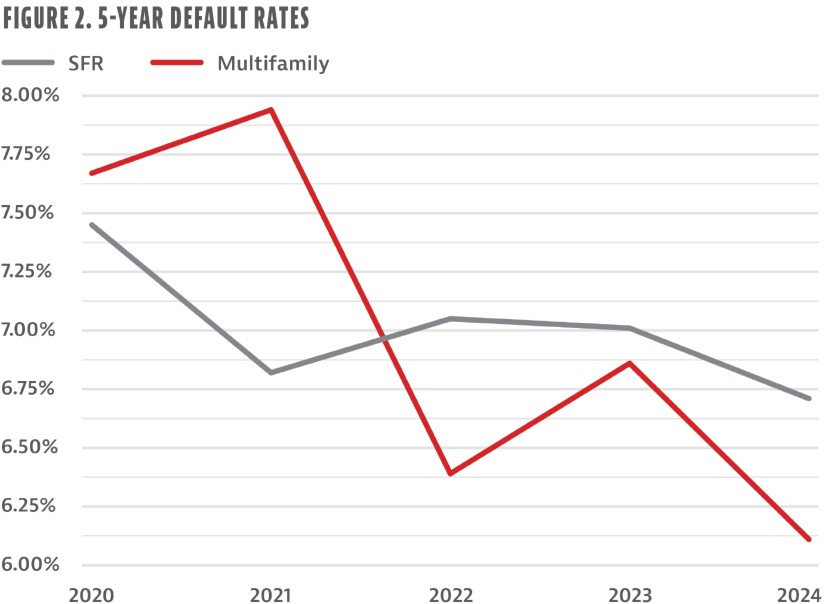

During the past five years, defaults on multifamily loans initially exceeded those of single-family loans in 2020 and 2021. But since 2022, multifamily default rates declined sharply and consistently. By 2024, the default rate for multifamily loans dropped to its lowest point in the observed period, significantly below that of single-family loans (see Fig. 2).

This marked improvement in the multifamily RTL trend suggests more than just market stabilization; it points to a structural correction. The sharp early defaults exposed a lack of underwriting expertise among certain sponsors and lenders who did not grasp the complexities unique to the multifamily asset class. As a result, many of these lenders either exited the space or were forced to restructure, replacing leadership and liquidating poorly underwritten loans to restore portfolio health.

The subsequent withdrawal of these lower-quality originators helped reset underwriting standards across the sector. The improved performance since then can be attributed to a combination of stronger sponsor quality, tighter credit standards, and a deeper understanding of the nuanced underwriting required for multifamily assets.

These changes, coupled with growing investor demand that facilitates more stable exits, have driven multifamily loan resilience. In contrast, single-family loan defaults have remained relatively stable but did not experience the same level of improvement, highlighting the growing relative strength of the multifamily segment within an otherwise opaque and fragmented lending landscape.

Market Contrasts and Comparisons

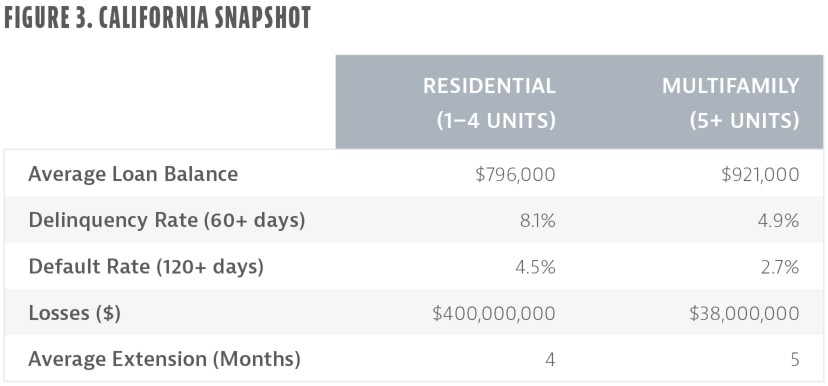

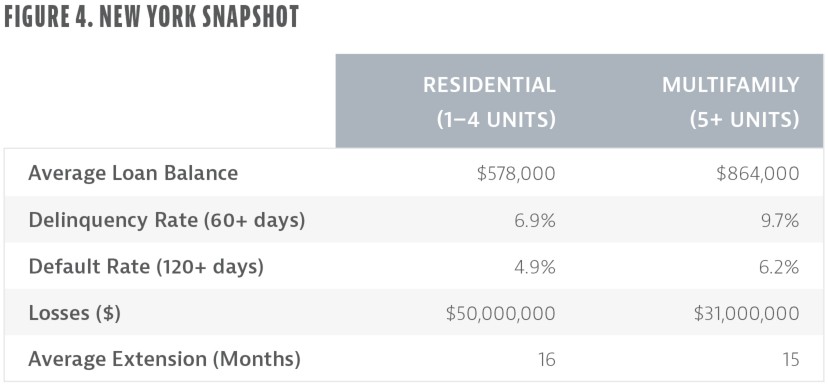

In-depth RTL performance analysis is featured for California and New York markets because these two states offer both contrast and similarity. Both states are characterized by high-value properties with strong housing demand and similar borrower profiles. However, the stringent foreclosure processes in New York and extended resolution timelines significantly impact loan resolution timelines upon liquidation. These shared and differing factors provide valuable insight into how regional dynamics influence RTL risk and strategy.

In California, multifamily loans dramatically outperform residential loans in credit performance. Delinquencies and defaults are nearly half those of residential properties, and losses are an order of magnitude lower, even though average loan balances are higher (see Fig. 3). This suggests more stable rental demand or stronger operator quality in the multifamily segment, which often involves experienced sponsors with institutional backing.

Interestingly, extension periods in both categories are relatively short in California, possibly reflecting faster permitting, more liquid real estate markets, or aggressive servicing practices that favor quick resolutions. That said, residential losses totaling $400 million highlight the risk of borrower-level distress, particularly in volatile or overheated submarkets.

In contrast to California, New York’s data reveals more mixed performance (see Fig. 4). Multifamily loans, though larger in size, are underperforming relative to residential assets. With higher delinquency and default rates, these loans likely reflect continued challenges in urban rental markets, regulatory constraints, or post-COVID shifts in demand. New York’s highly regulated eviction environment may also increase credit risk, particularly for multifamily operators dependent on consistent rental cash flow.

Extension periods remain long for both asset classes, suggesting either borrower-requested delays or lender hesitancy to force resolutions in a legally complex environment. Residential loans appear more resilient in this geography, possibly due to strong underlying demand for single-family homes or smaller-scale rehab projects.

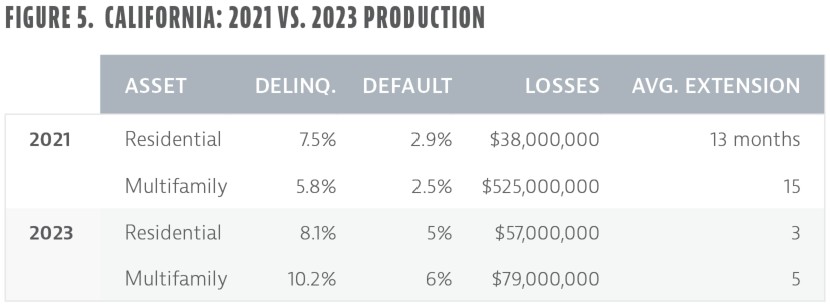

In California, performance metrics deteriorated between 2021 and 2023, especially for multifamily assets (see Fig. 5). Delinquencies and defaults rose sharply, and losses more than doubled in both asset classes. Surprisingly, average extensions fell, perhaps reflecting more proactive servicing strategies, tightened exit timelines, or lenders preparing for market volatility by accelerating resolution processes. This drop in extension periods may also signal a shift toward institutional best practices or reduced borrower flexibility.

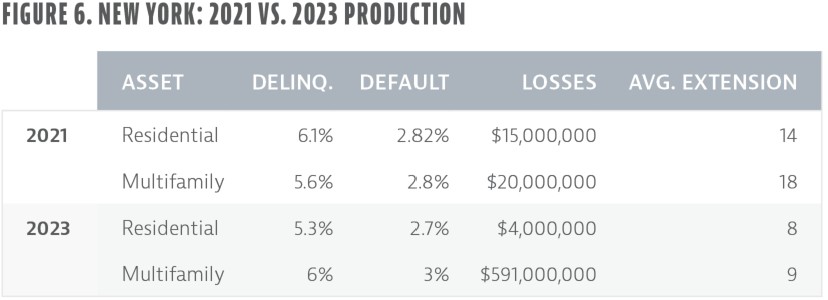

New York, in contrast, showed greater stability and even improvement in some residential metrics (see Fig. 6). Losses declined significantly, and average extensions were halved, pointing to quicker project turnaround or enhanced borrower capabilities. Multifamily loan metrics remained fairly stable, though the modest increase in defaults suggests persistent stress among large-scale operators, possibly due to higher operating costs or tenant churn in urban centers.

Takeaways: Residential vs. Multifamily RTLs

The data reveal important distinctions between residential and multifamily RTLs that go beyond surface-level performance metrics. These key takeaways highlight how asset type, geography, and borrower behavior interact to shape credit outcomes and risk exposure.

Loan size and loss exposure. Multifamily loans consistently carry higher balances, which increases the dollar impact of each distressed loan. However, their more stable performance in several geographies offsets this risk to some extent.

Delinquency patterns. Residential loans exhibit greater volatility, particularly in markets with a high concentration of smaller or newer investors. Multifamily performance varies more by geography and policy environment, particularly in states with strong tenant protections or rent control.

Extension behavior. Longer extensions in multifamily deals suggest more complex repositioning strategies and longer lead times to refinance or sell. In contrast, residential assets (often “fix and flip”) are quicker to turn but are more sensitive to housing market cycles.

Geographic volatility. California’s sharp performance decline in 2023, especially in multifamily, underscores the importance of market-specific risk. New York, on the other hand, displayed surprising resilience, particularly in the residential segment.

Delinquency vs. defaults. There is a clear pattern that delinquency levels do not equate to corresponding default levels. It may reflect the resiliency and flexibility of the industry and willingness to provide flexible payment terms, extensions, and close mentoring of borrowers to see loans to performance and successful payoffs.

As the RTL sector matures into an increasingly institutional product and attracts greater institutional capital, access to standardized, granular data will be crucial.

The distinctions in performance across geographies, time periods, and credit factors will highlight how credit risk is shaped by borrower profile, project complexity, market conditions, and policy environment.

Reliable, loan-level data enables lenders, investors, and policymakers to assess risk more accurately, allocate capital more efficiently, and develop responsive underwriting and servicing strategies.

In a market where performance can shift quickly and vary widely by region and asset type, the ability to recognize patterns (e.g., rising default rates, shortening extensions, or growing loss severity) is critical to managing portfolio exposure and pricing credit appropriately.

Without credible, consistent data, stakeholders are left to navigate the RTL space with guesswork. With it, the market has the foundation to scale responsibly and withstand economic cycles with greater resilience.

Sam Kaddah

Sam Kaddah is the president and CEO of Liquid Logics. With his broad background in complex environments, he is skilled in building consensus, producing results, and streamlining operations. His career is characterized by leadership that achieves efficiencies and revenue while maintaining quality. Liquid Logics provides fintech and NextGen SaaS for the private equity lending space.

Aleksandra Simanovsky

Aleksandra Simanovsky is the founder of Adige Advisory, which guides the private lending industry in navigating institutional capital markets. A finance professional with more than 20 years’ experience, she specializes in credit risk, underwriting, securitization, and structured finance and capital raising.

Simanovsky pioneered the first-ever rated Residential Transitional Loans (RTL) securitization, securing institutional investor acceptance. At Toorak Capital Partners, she spearheaded strategy and capital markets initiatives. As vice president at Deutsche Bank, she led over $40 billion in commercial real estate securitizations.

Leave A Comment