What are the rules—and who do they apply to?

NOTE: The dust is still settling with respect to the regulation changes covered here and their impact on funds in the real estate lending space, specifically as it relates to funds that rely on the 506c and 506b exemptions. There are various schools of thought on their applicability, and it’s crucial that you discuss your specific situation with your legal counsel before acting. Further note that there are currently active lawsuits attempting to appeal the rulings discussed in this article.

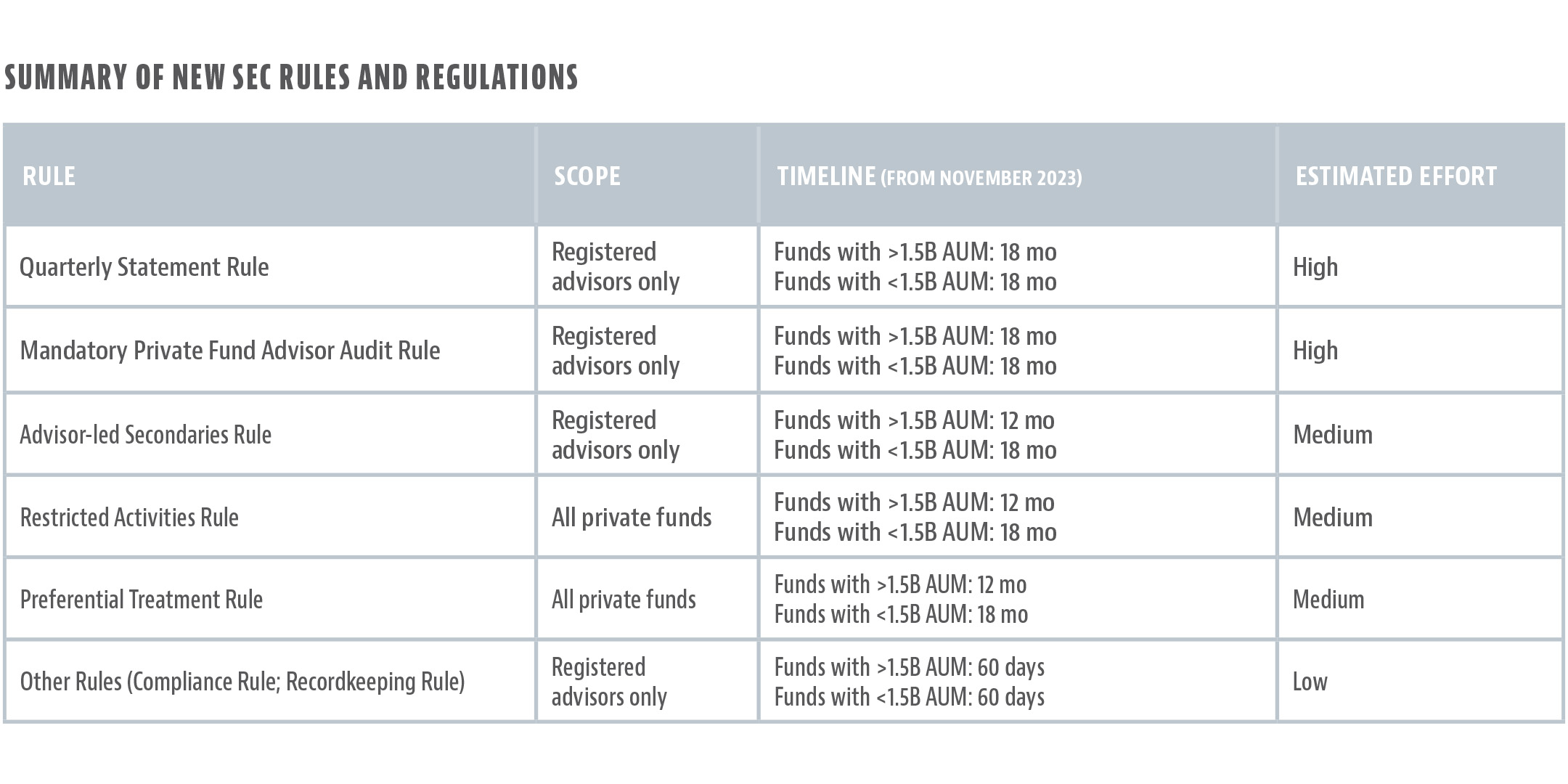

On Aug. 23, 2023, the Securities and Exchange Commission (SEC) adopted a new set of rules and regulations for private funds. The rules can be broken into six categories, summarized in the accompanying table.

As noted in the table, a portion of the rules apply only to funds whose advisors are registered with the SEC (often referred to as a Registered Investment Advisor or RIA), and a portion apply to all private funds. The final rule adopted by the SEC is over 600 pages, and the dust is yet to settle on exactly how all the rules will be applied by fund managers and enforced by the SEC. That being said, lawyers, compliance teams, fund administrators, and other professionals in the space have been actively engaged in conversations to flush out the details in time for implementation.

According to the SEC final rule, it is “designed to protect investors who directly or indirectly invest in private funds by increasing visibility into certain practices involving compensation schemes, sales practices, and conflicts of interest” and is “designed to prevent fraud, deception, or manipulation by the investment advisers to those funds.” The SEC also clearly is thinking about future advisor and fund inspections, as they also note that part of the reason for the adoption is “to better enable our staff to conduct examinations.”

Let’s discuss whether the rules apply to you as well as what the new rules are. We’ll cover the main points of the release, but it’s important for you to discuss your specific situation and the impact the new rules have on your fund with your legal, compliance, and accounting team.

Although not everyone in the private lending space will be impacted by the rule, many lenders will. There are a large and growing number of private debt funds that are managed by RIAs—meaning they will have to comply with all rulings. But there are also a large and growing number of private debt funds that are not registered that will also have to ensure compliance with certain rules that were adopted.

Do the Rules Apply to You?

The adopted ruling, at some level, will impact all private funds. So, if you are a fund manager for, or an investor in, a private debt fund, be sure you understand what you will be required to do to remain compliant.

As noted in the table, the quarterly statement rule, audit rule, and advisor-led secondaries rule only apply to RIAs, and the restricted activities rule and the preferential treatment rule apply to all private funds.

RIAs. These are advisors that have registered with the SEC or at a state level. The good news is that if you’re an RIA, you likely already know it. Under the Investment Advisors Act of 1940, certain private fund advisors are required to register with the SEC. Although there are certain exemptions that can often be taken, generally if you have $150 million of assets under management (AUM) and uncalled committed capital, you are required to register.

Private Funds. Per the ruling, “private funds are privately offered investment vehicles that pool capital from one or more investors and invest in securities and other instruments or investments.” If you are relying on an exemption that prevents you from needing to register with the SEC and you’re pooling private investor capital in a fund that you then use to originate or purchase loans, you would fall under this category.

What Are the New Rules?

The SEC provided a detailed listing that describes all the adopted rules in detail. Here is an overview of the rules:

Quarterly Statement Rule (registered funds only). For many, this is considered the most significant adopted rule because it substantially increases the reporting required for fund managers to provide to their investors. Registered funds are required to provide quarterly statements to their investors within 45 days after the end of the first, second, and third quarters and 90 days after the end of the fourth quarter. (Note: If you’re a fund of fund, the timeline is 75 days and 120 days, respectively.)

In terms of the substance of the reporting, some have referenced the existing Institutional Limited Partners Association (ILPA) reporting framework as a comparable reference point for fund managers thinking through updates to be made.

Covering the specific reporting requirements is outside the scope of this article, but it’s worth noting that the reporting includes a detailed accounting of fees paid to the manager and its affiliates, detailed fees paid by the fund, details on calculations of fees, inception-to-date annual performance returns (total returns for liquid funds and IRR and multiples for illiquid funds). Fund managers should discuss the reporting updates and plans with their fund administrators and compliance teams.

Because of the additional burdens of complying with this rule, you should expect your costs to increase both in-house and with your outsourced accounting or fund administration teams.

Audit Rule (registered funds only). This rule requires registered funds to hire an independent audit firm to perform an audit of the fund’s financial statements. The audit must be performed by a Public Company Accounting Oversight Board (PCAOB) registered audit firm. The report, along with financial statements, must be distributed to investors within 120 days after year-end. In addition to the financial cost associated with hiring an audit firm, fund managers should also consider the in-house resources required to coordinate and manage the audit team during their fieldwork.

Advisor-Led Secondaries Rule (registered funds only). Advisor-led secondaries are defined by the SEC as transactions that offer “fund investors the option between selling all or a portion of their interests in the private fund and converting or exchanging them for new interests in another vehicle advised by the adviser or any of its related persons.” Given the advisor’s involvement in both sides of the transaction and the conflict of interest that comes with that, the new rule requires fund managers to obtain a valuation opinion or fairness opinion from an independent party. There are also other written summaries and communications with investors that are detailed in the rule for these transactions.

Restricted Activities Rule (all private funds). The rule restricts (but not prohibits) private funds from the following activities, unless certain consent and disclosure criteria are met:

- Charging or allocating fees to the fund associated with a governmental or regulatory investigation of the advisor or related party to the advisor.

- Charging or allocating any advisor “regulatory, examination, or compliance fees or expenses” to the fund.

- Reducing any fund-level clawbacks by advisor taxes.

- Non-pro rata allocation of fees and expenses by a portfolio company when more than one of the advisor’s entities are invested in the same portfolio company.

- The advisor borrowing money from a private fund client.

For each of the restricted activities, there is generally a disclosure-based or consent-based exception. Ensure you discuss and review each with your compliance team.

Preferential Treatment Rule (all private funds). If you are a fund manager, you likely are familiar with or have engaged in investor side letters, which are separate agreements with individual investors that have specific, oftentimes preferential, terms for the investor compared to other fund investors. The adopted rule prohibits all private fund advisors from the following preferential treatment (via side letter or otherwise):

- Providing preferential redemption rights to an investor the advisor reasonably expects will have a material negative effect on other investors, unless legally required by law or unless it is extended to all fund investors.

- Providing preferential information to an investor about portfolio holdings or exposure the advisor reasonably expects will have a material negative effect to other investors, unless extended to all fund investors.

- Providing preferential treatment to an investor without providing written disclosure to both current investors and prospective investors. Information needs to be provided to prospective investors before they invest in the fund. For existing investors in an illiquid fund, information needs to be provided as soon as reasonably practicable after the fund’s fundraising period. For existing investors in a liquid funds, the information needs to be provided as soon as reasonably practicable following the investor’s investment in the fund.

Other Rules (registered funds only). Registered advisors need to document their annual review of policies and procedures in writing. They also are required to keep various books and records as it relates to the rules.

As noted, these rule summaries are a high-level look at the adopted rules. The SEC provided a robust and detailed write-up, and it’s key for fund managers to discuss implications of the rules with their compliance and accounting teams.

Leave A Comment