Lenders who have a comprehensive understanding of their costs can strategically position themselves in the market and leverage their knowledge to create a better profit margin.

In the intricate world of mortgage lending—regardless of forward, reverse, or private lending—understanding the costs associated with producing a loan is crucial. Such knowledge is necessary for mortgage origination companies to maintain or grow profitability and to offer competitive interest rates and fees to borrowers.

Understanding your cost to produce a loan is one area all private lenders should know and understand. However, many private lenders entering the industry do not have a deep or extensive mortgage background and, therefore, may not know which best practices to use to measure their lending business’ success.

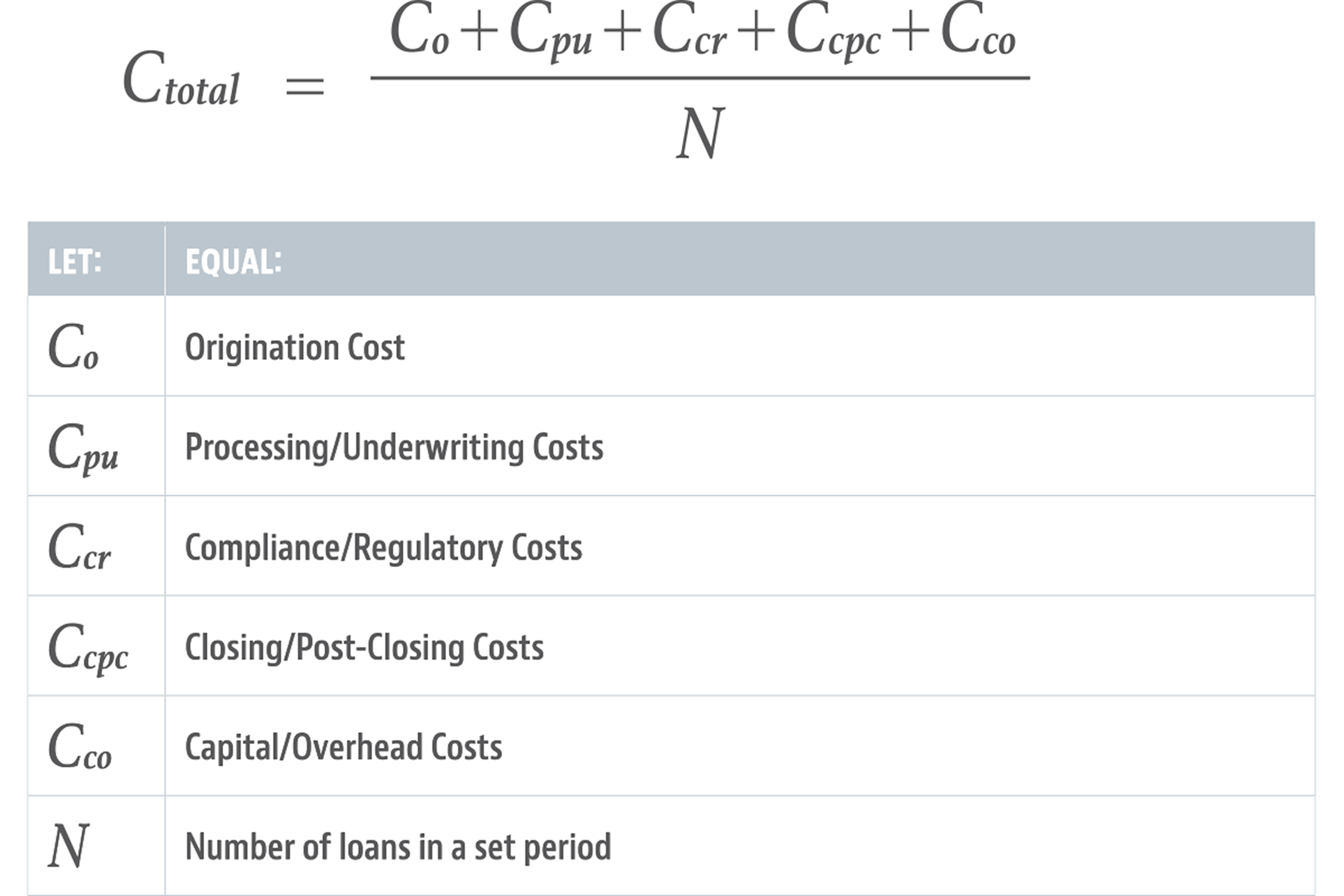

Cost Formula

Although there are some variations among lenders regarding a standardized formula for determining the cost of a loan, the most widely used is:

Let’s do an example for a period we will call Q4 2024:

- The lender shop produced 264 loans for just over $99 million with a gross revenue profit of $2,481,600.

- The breakdown of costs based on the previous formula is $868,000 for loan officer compensation, $74,000 for marketing (origination costs) plus $205,000 in processing/underwriter salaries plus $1,500 in compliance/regulatory costs plus $180,000 in closing/post-closing costs plus $32,000 in capital/carry costs. The total of these costs is $1,360,500.

The easy math here is in calculating profit pretax: Revenue minus costs, which in this exercise nets $1,121,100, which is a healthy profit margin of 45%. But to understand it as a cost per loan, the math needs to take another step. You must divide by the number of loans: Costs = $1,360,500/264 loans = $5,153 to produce each loan in Q4 of 2024.

Inaccurate calculations or not doing this exercise at all prevents you as a lender from intimately knowing your shop and where you are spending the dollars you have worked so hard to earn. Without understanding your cost per loan, how will you assess where you have potential cost savings? Or whether you are able to lower your profit margin to lower rates and thereby potentially increase volume?

Breaking Down the Costs

Let’s break down each of the cost categories:

- Origination Costs. Loan officer compensation will usually be the largest cost in this formula. There are different schools of thought about compensating originators, but generally they are calculated based on basis points (BPS) times total loan production or by a percentage of revenue per loan. Although loan origination compensation will be the largest cost in the origination bucket, marketing/advertising must also be part of the origination cost calculation. These expenses may include things like lead generation services, conferences, or the creation of a website.

- Processing/Underwriting. There are two components to consider in the processing/underwriting category: personnel costs and technology. Depending on the size of your lending shop, you may not utilize processors; instead, the originator may fill that role. Whatever your model, the total salaries tied to a processor or underwriter involved in the total loan production should be used. Technology costs would include any tool being used in your production model such as CRMs, LOS, and/or servicing platforms. Depending on the size of your shop, these tools can vary widely, as well as the costs associated with them.

- Compliance and Regulatory. For the most part, private lending has very few regulatory requirements that have a significant impact on the cost of producing a loan. However, several states require lenders to be licensed. If you are lending in these states, or if you require your originators to be NMLS registered, make sure you are including these types of costs in your calculation. An additional, often overlooked, oversight component is quality control. Whether you have an in-house QC group or you are using a vendor to provide this service, don’t forget to group that cost into the compliance and regulatory cost bucket.

- Closing and Post-Closing. Much like processing and underwriting, this bucket is primarily made up of salaries for any positions supporting the closing and post-closing functions. However, if there are other costs (e.g., legal documents) and you don’t pass those costs through to the consumer, they should be included in your calculation.

- Capital and Overhead. As a lender, the cash you are using to fund your loan production usually comes with a cost. This cost can vary with the source as well as the time that cash (capital) is being extended. Additionally, depending on the size, type of product you offer, and your overall model, the cost of capital can wildly vary from lender to lender. While cash is most certainly king, don’t forget to include any general overhead costs. Things like rent, phone systems, etc. are part of the overhead associated with mortgage loan production.

Although what makes up the cost to produce a loan is generally considered to be standard, the actual cost to produce a loan varies. Lenders located in states with lower costs of living may be able to take advantage of lower salaries versus lenders in California, for example.

The dynamic nature of the private lending industry requires lenders to adapt continuously. Understanding costs enables you to identify areas of improvement and implement changes that help you stay competitive and resilient. By understanding the cost of producing a loan, you have a deeper understanding of the profit (or loss) within your shop, which is essential for making informed decisions about the types of loans to offer and the markets to target or expand to. Lenders who have a strong or comprehensive understanding of their costs can strategically position themselves in the market and potentially leverage this knowledge in their loan products while creating a profit margin.

Consider doing a deep cost analysis of your lending firm if you haven’t already. The results can lead to a quicker, more efficient loan process and/or loan decision. This in turn can bring down the cost of producing a loan and improve the customer experience. Additionally, knowing the cost per loan will help you develop more accurate budgets and forecasts. This facilitates better financial planning and helps in allocating resources efficiently.

Depending on the size of your lending shop, you may want to consider a third-party financial consulting company to dig into your costs and evaluate your spending. If you do your review internally, at minimum, using an accounting tool or even a simple Excel spreadsheet will help illustrate your cost to produce a loan.

Leave A Comment