Understanding appropriate coverages for the situation and working with reputable agents goes a long way to protect both the lender and the borrower.

Insurance, often viewed as the less glamorous side of a business transaction, tends to be a topic that receives minimal attention. Yet, its significance cannot be overstated: Insurance is a crucial part of mitigating risk. By including appropriate coverages and limits as well as recommending reputable agents or agencies, you can significantly reduce both your exposure and that of the borrower.

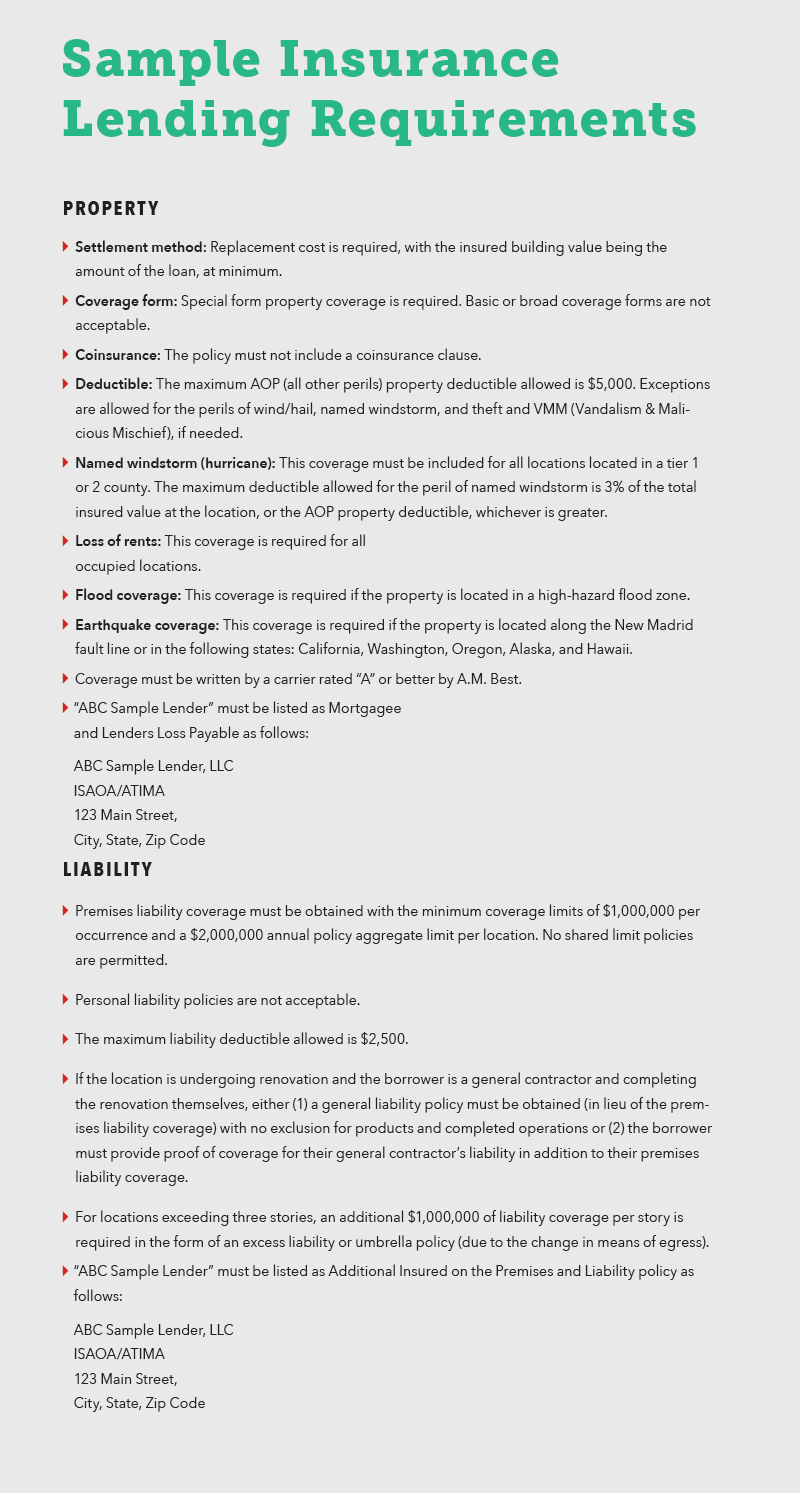

Your insurance lending requirements should be one of the first things you provide to a potential borrower. Regardless of property type, always require the borrower to carry insurance that meets or exceeds the outstanding loan. That means the loan value must be the minimum of what the property is insured for. If the outstanding loan is $150,000, do not let the borrower insure to $140,000.

To ensure the borrower keeps coverage active, you should be listed as the mortgagee. If you should be listed on any payout from the insurance company following a property loss, you must also be listed as loss payee. Require that you are listed as Additional Insured (AI) on your borrower’s liability coverage as well. These stipulations guarantee you will be notified if the borrower’s coverage is in jeopardy of lapsing for underwriting, non-payment, or any other reason, including a coverage cancellation request from the borrower.

When it comes to property coverage, consider requiring the following, regardless of property type:

- Special Form coverage (Special has the least exclusions, therefore minimizing your exposure.)

- Replacement cost (Actual Cash Value is a depreciated amount and opens the door for the borrower to experience financial hardship that could jeopardize their ability to repay the loan.)

- Add-ons such as earthquake or flood

- Other structures (if applicable)

Appropriate Coverages for Specific Situations

Let’s take a quick look at some of the essential policies and limits to consider specific to fix and flip, ground-up construction, and rental properties.

Fix and flip. Builder’s Risk is a policy form that covers structures under construction or renovation. The outstanding loan value should be the minimum requirement for property coverage. On the liability side, ensure the borrower’s policy is at least $1 million per occurrence/$2 million aggregate. It’s important to note that almost everywhere yo ur borrower goes, a Builder’s Risk policy is property only unless the borrower specifically requests premises liability coverage as well. Not only is this exposure for the borrower, but it is also exposure for you. If your borrower gets sued for $1 million, what are the chances they can pay back their loan?

You may also consider requiring the following with regard to the liability policy:

- Ensure the carrier underwriting the premises liability policy is aware the location is under renovation. Properties undergoing renovation are more susceptible to liability losses that arise from slip-and-fall injuries resulting from uneven surfaces, debris, trespassing, etc. If the carrier was not made aware of the location’s renovation status, they may have grounds to deny a claim.

- Any general contractor (GC) hired must have their own liability coverage, and the borrower must be listed as AI. If the contractor faces a lawsuit due to negligence and the borrower becomes involved, the liability of the contractor (including defense expenses) would also extend to the borrower. The GC’s coverage may cover losses for negligent hiring or construction accidents. Defense costs must be outside the per occurrence and annual aggregate limits.

Ground-up construction. This property type also involves the Builder’s Risk form, but it is handled a little bit differently, because the borrower will not have two separate limits from the get-go. The most common strategy is to require the borrower to insure to the anticipated build cost from day one. However, if the borrower is insured on a monthly reporting form (a program that allows the borrower to update and adjust the value of the property on a month-to-month basis) and the lender is OK with it, the carrier will sometimes allow the borrower to increase the value as time goes on.

For new construction on Builder’s Risk, coverage is always limited to invested capital at the time of loss. Let’s say the borrower expects the end build to cost $1 million, so they insure to that value. If just the frames have been built and a fire burns them to the ground, the borrower isn’t going to get $1 million. They can get whatever capital has been invested at the time of loss. This is why lenders will often fund these deals in percentages or over time. On the liability side, the recommended requirements remain the same as those mentioned under fix-and-flip properties.

Rental properties. Depending on how deep you want to go, there are quite a few things to look out for when it comes to insurance on your borrower’s rental property. In addition to the items listed below, you may also want to look at the deductible structures to make sure the borrower isn’t over-extended.

For property coverage, consider requiring the following, if applicable:

- Loss of rents (at least six months’ worth)

- Renters insurance (the caveat being there is no way for you to track that this coverage stays in force; you cannot be listed as an Additional Interest on this policy)

- Contents coverage (for vacation rentals)

On the liability side, consider requiring the following:

- $1 million per occurrence/$2 million aggregate

- Defense costs outside the limits

- Canine liability or coverage for dog bites

- Carbon monoxide coverage

- If the property is more than two stories, add an additional $1 million of coverage (a third floor changes the means of egress and your exposure)

Vetting Carriers and Agents

Any insurance carrier your borrower works with should be AM Best “A” Rated or better. This rating system considers the strength of the company, its ability to pay claims, and its outlook. Meaning, for the last two years, has the company been insuring profitable businesses and have they been paying out what was expected or less on losses? Do not allow the borrower to go through an unrated or under A- carrier.

If you really want to dive in deep, you can look into the insurance agent or broker the borrower is going through. Make sure they are licensed to do business in the state the property is in and obtain proof of their Errors & Omissions coverage. It is wise to advise your borrower to look for agents familiar with the aforementioned types of policies and coverages. Agents or agencies with multiple markets and experience in this line of business have a better chance of finding cost-effective coverage with policies that minimize exposure.

Valuable Agent/Agency Insights

If you have a relationship with an agent or agency, they can likely provide you with useful information about the premises itself, the surrounding area, and loss history for an existing property (if they have access to it). In some instances, the agent/agency can even provide specifics on rebuild costs and potential return on investment.

Some insurance providers will assist you in assembling an insurance lending requirements list. A property in Florida has different needs than a property in Colorado. Blanket requirements do not always work and can leave you exposed.

Other Considerations

It will always be favorable to you if the agent the borrower is working with also offers a lender-placed option. If the borrower were to default on their insurance, leaving you exposed, you would either let it ride and hope a loss doesn’t occur or scramble to find coverage quickly. With a lender-placed alternative, the property can quickly move to a policy that covers your interest.

Although you can require anything when it comes to coverage (because those are the conditions of funding the loan), you should never require your borrowers to use a particular agent, agency, or carrier. If a borrower feels their claim wasn’t settled favorably and you required them to go through that agent or carrier, you can be dragged into a lawsuit. “Highly recommending” is one thing, but requiring is another. Consider including a note like the following on your insurance lending requirement document: “Please feel free to shop your insurance with [Agent Name].”

In a lender-borrower relationship, it is crucial to strike a balance between protecting your interest and maintaining requirements that allow the borrower to gain cost-effective coverage. Insurance should not just be an item for you and the borrower to check off your lists at closing. The more time you can give a borrower’s agent to secure sufficient coverage, the more markets they can shop, the more aggressive pricing they can get, and the better coverage options they’ll be able to find. Insurance is the most common thing that delays a deal or prevents it from closing altogether. Don’t let inadequate coverage create stress, waste time, and cost you more money. Make insurance a focal point from day one.

Leave A Comment