Staying on top of REIT and CECL trends is a good “defensive” move.

Earlier this year, we said goodbye to Bill Russell, the biggest winner in the history of basketball. Russell was never the flashiest player, but by relying on strong fundamentals and a disciplined defense, he consistently won two high school state championships, two national titles with the University of San Francisco, and 11 NBA championships during the 13 years he played in the NBA.

Tax and accounting won’t score you points, but you can still apply Russell’s winning principles to your debt fund. In addition to keeping your fundamentals strong, it’s critical to play defense by staying on top of the latest technical and strategic updates.

Here, we’ll explore two topics we’ve seen trending across the industry:

- Tax and other investor benefits of REITs (real estate investment trusts)

- How the CECL (current expected credit loss) GAAP (generally accepted accounting principles) update might impact your fund

Investor Benefits of REITs

There are four primary reasons to be enthusiastic about REITs:

- REITs block UBTI and ECI.

- REITs avoid multiple state filings for your investors.

- Investors take a 20% taxable deduction on REIT income.

- REITs give fund managers more flexibility with allocations and distributions.

UBTI and ECI. When a REIT is a corporation for tax purposes in a direct lending mortgage REIT context, it will eliminate two taxes at the shareholder level that are present in a traditional partnership structure:

- Unrelated business taxable income (UBTI)

- Effectively connected income (ECI)

Investment through a corporate structure blocks this type of income, which is beneficial if you have either offshore or tax-exempt investors who are averse to these taxes. It is also worth noting that you should have over 50% ownership by U.S. persons to be classified as a Domestically Controlled REIT to avoid the Foreign Investment in Real Property Tax Act (FIRPTA) tax on disposition of any physical real estate the REIT could own (e.g., through a loan foreclosure).

State filings. Lending entities structured as partnerships often have multiple state filing requirements. Many states require apportionment and the filing of tax returns if you are lending to customers in such state. The partnership will also potentially have a withholding obligation in such state to the extent income is allocated to non-resident partners and, in many cases, the partners will also have to file tax returns and pay taxes in those states. For lending entities that operate in multiple states, meeting the tax filing requirement for each investor in multiple states is costly and administratively burdensome for your investors.

In a REIT structure, dividends paid to investors are generally taxable only in the investor’s resident state; thus, there is no need for multiple state filings at the investor level.

20% deduction. The Tax Cuts and Jobs Act made REITs much more attractive. Investors in a REIT are eligible for Section 199A treatment: Recipients of the dividend income receive a 20% deduction to the taxable income generated by your REIT. Many lending entities structure as REITs to take advantage of this provision.

Unfortunately, Section 199A has a limited window of utility, as it is set to sunset at the end of 2025 unless future legislation is enacted to extend it or make the tax benefit permanent.

It is important to understand the legal and tax requirements for operating a REIT to ensure it can be allowed the deduction for dividends paid to shareholders. The key here is that your lending activity must be collateralized by “good” REIT assets.

REIT rules require that income be primarily generated by real estate sources, including lending collateralized by real estate assets. You also must distribute out the profits each year. In addition, a REIT must be owned by 100 or more shareholders, and five or fewer individuals cannot own more than 50% of a REIT. If you have a problem meeting the 100-shareholder test, there are REIT shareholder accommodations services that can help secure additional shareholders to invest in the REIT. These shareholders typically own a different class of stock with no voting rights and receive an annual dividend for their investment.

Flexibility with allocations and distributions. For fund managers who wish to retain a partnership structure, a traditional fund can own the REIT, which allows for both normal partnership allocations and the fund manager to be allocated a carried interest. Additionally, having a partnership own the REIT allows the fund manager to reinvest required REIT distributions. As mentioned previously, a REIT is required to distribute the majority of its profits each year. Having a partnership between the REIT and its shareholders gives the fund manager flexibility to reinvest the profits in the REIT as opposed to giving them to the investors and then asking for additional funding to invest in the REIT.

If you are thinking of using a REIT, you need to be aware of the various regulatory tests and metrics that must be followed. Once you complete the first reporting cycle, you should begin feeling more comfortable, even if you do not have a background in tax. Even after Section 199A sunsets, REITs can be a powerful tool in your structuring conversation, limited mainly by whether the activity you contemplate undertaking will meet the REIT asset and income rules.

In summary, if your lending activity can be qualifying REIT transactions, you should at least consider using a REIT somewhere in your direct lending platform. In general, funds that have scaled above the $20 million to $25 million mark in AUM (assets under management) begin seeing the economic benefits of a REIT outweigh the additional compliance costs.

How CECL Impacts You

Debt funds have two GAAP reporting frameworks that could apply:

1. Operating GAAP

2. Investment company GAAP

If you report under investment company GAAP, here’s the good news: the commentary that follows does not apply to you. If you do not report as an investment company, that’s OK, because we’re here to help.

For financial reporting years beginning on or after Dec. 15, 2022, and interim periods therein, GAAP requires you to implement ASU 2016-13 “Financial Instruments – Credit Losses” and subsequent amendments that are codified in ASC 326. This is a significant change in the way you will be assessing and recording credit losses on your loans.

This new guidance adds an impairment model, the current expected credit loss (CECL) model, which is based on expected losses rather than incurred losses. You will recognize as an allowance an estimate of expected credit losses at the time the loan is made that is adjusted accordingly at each reporting period. The CECL allowance includes expected losses on not only the actual loan funded but also the unfunded commitment. This allowance will reflect the expected losses over the contractual life of the asset, even if that risk is remote. The model takes into account historical loss experience, current macroeconomic factors, and supportable forecasts.

You can use various methods to determine this allowance, such as the discounted cash flow method, the loss-rate method, or the probability of default method, among others. One of the keys in implementing the CECL model will be to assess the sources of data. You may use internal loss information or third-party vendor models to assist in the development of the allowance. You may need to develop processes and procedures to effectively implement the CECL model, and this could take effort and expenses.

Keep in mind that the treatment will be quite different for tax purposes: With the exception of certain financial institutions, you must use a specific charge-off method and demonstrate that a loan is worthless before it can be written off.

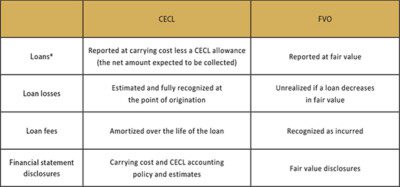

The Financial Accounting Standards Board (FASB) provided some transition relief. ASU 2019-05 “Targeted Transition Relief” allows you to make a one-time irrevocable election to adopt the fair value option (FVO) for eligible assets upon the adoption of ASC 326 for financial assets that are in scope of ASC 326 and are eligible to apply the fair value option under ASC 825. You would record those existing assets at their fair value on a recurring basis. Any new loans made or acquired would need to elect the FVO at the time of origination or purchase. Additionally, reporting loans under the FVO changes the way origination and exit fees are recognized: Instead of amortizing the fees over the life of the loan, they are recognized at the time they are contractually owed.

*Note that debt securities classified as available for sale are not within the scope of the CECL standard.

The accompanying chart summarizes these differences.

You will need to assess whether CECL or the FVO is best for you based on your business, resources available, and the cost to implement. But time is running out: You will need to determine your CECL roadmap in the next few months—2023 is just around the corner.

Any advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues. Nor is it sufficient to avoid tax-related penalties. This has been prepared for information purposes and general guidance only and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice specific to, among other things, your individual facts, circumstances, and jurisdiction. No representation or warranty (express or implied) is made as to the accuracy or completeness of the information contained in this publication, and CohnReznick LLP, its partners, employees and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

Leave A Comment