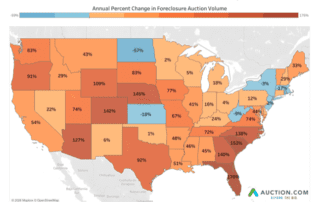

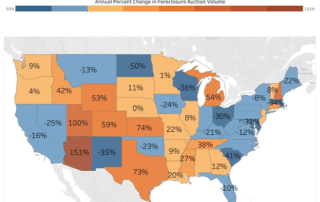

Forclosure Auction Volume Increased 48% In Q4 2025 To A Nearly Six-Year High, Still 39% Below Pre-Pandemic Level

Irvine, Calif. — Jan. 29, 2026 — Auction.com, the nation’s leading distressed real estate marketplace, today released its Q4 2025 Auction Market Dispatch, which shows that foreclosure auction volume in the fourth quarter of 2025 increased 48 percent from a year ago to the highest level since Q2 2020 — although still 39 percent below [...]