Does your budget add up to your ARV?

In residential private lending, we often say the asset is everything. When it comes to renovation loans, however, the truth is more complicated and includes the asset, the budget, the market/neighborhood, and the vision.

At its core, renovating real estate has been proven to create value throughout various economic cycles, in both downturns and upturns, since investors can increase asset values above and beyond the costs to purchase, renovate, carry and complete the project. We have all seen this successfully executed in up markets and down markets, and it’s a key reason why renovation loans have been a reliable core of private lending for decades.

Although it can be profitable and fun, renovation lending can carry significant risk beyond a straight bridge loan, DSCR rental loan, or traditional long-term mortgage. In fact, the minute an investor starts swinging a hammer, your underlying asset value actually decreases below the original As Is Value (AIV) before reaching its projected After Repair Value (ARV). And if that project goes sideways or “south” during mid-construction, or worse, right after the demolition phase, a lender faces significant risk in taking back the property in its new deconstructed state.

The key is to identify critical risk factors before you end up in a tough situation. It’s true that a lender cannot avoid all risk on every deal if they expect to keep operating and lending, but it’s also true that many of the “worst” projects lenders had to deal with might have been avoidable with deeper diligence into some key factors.

First, let’s understand the dynamic of the industry. The level of experience and sophistication of borrowers vary greatly. That’s why many successful lenders underwrite their borrowers and track records as a key part of their diligence. However, even experienced borrowers can face pressure in their career, causing them to make poor decisions or mismanage their projects.

Because “desperate people do desperate things,” lenders cannot solely rely upon trust and assume a borrower is a good one. Rather, they should conduct consistent diligence on each and every project to ensure quality isn’t slipping, or worse, desperation isn’t about to hijack your next project.

After reviewing thousands of projects and renovation budgets, we found there are three key areas you should investigate prior to funding a loan. Performing diligence in these areas has resulted in our clients experiencing fewer servicing problems and/or deep REO situations compared to lenders who did not apply the same level of rigor.

Let’s take a look at each of the three items.

1. Does the Renovation Budget Add Up to the Target ARV?

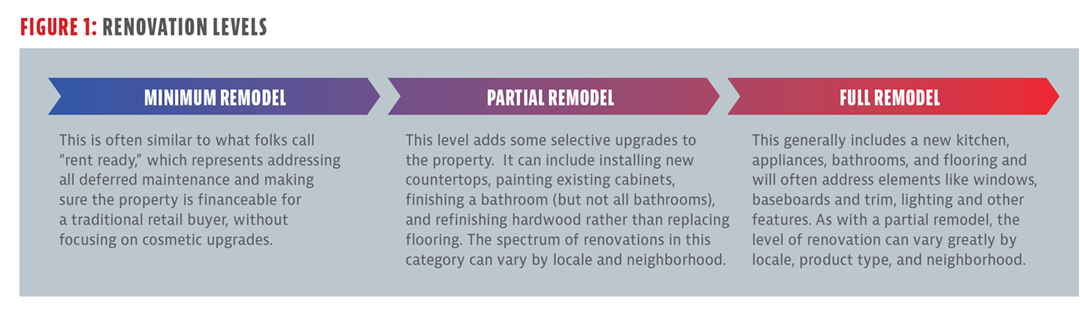

This question requires lenders to first understand the budget and its proposed spec level, finishes, and materials. To help evaluate, it is useful to bucket the proposed project based on both renovation level and quality level. For renovation level, Figure 1 provides three buckets that can be helpful.

In addition to these buckets, it’s important to understand the proposed quality level associated with the budget. You can use the appraisal standards if you’re familiar with those (Q1-Q6, http://bit.ly/appraisal-standards), or you can use a set of descriptive categories such as rental grade, basic, standard, upgraded, premium, luxury and elite.

Once you identify the renovation level and grade, you will be in a fantastic position to scrutinize your ARV estimate on hand and determine whether your renovation budget “adds up” to your target ARV. Different lenders have different approaches to determining ARV, which could include using internal valuations, obtaining a full appraisal, or ordering an alternative valuation such as the Renovation Analysis reports RicherValues provides.

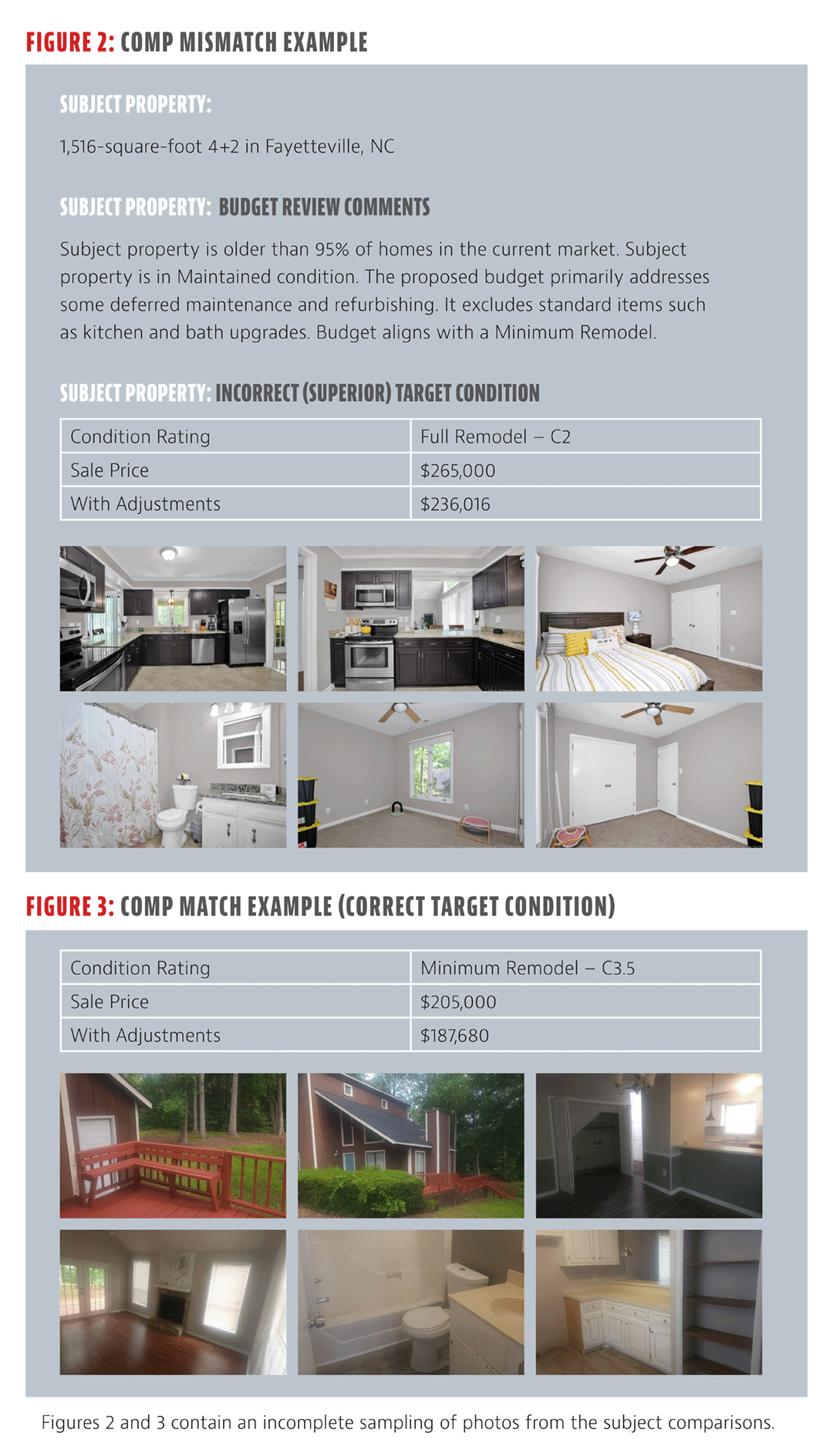

In all cases, make sure the market comparables used to determine ARV actually represent a comparable level and quality to the proposed budget. In many cases, traditional appraisers and other valuation professionals who do not have the renovation experience fail to conduct the budget analysis just described. Using market comparables that are renovated at the top of their market and that may not actually be representative of the subject property’s proposed project level and budget may lead to unintentional errors.

For example, we pulled a Renovation Analysis for a property in Fayetteville, North Carolina, whose target budget aligned with a minimum remodel (C3.5) based on our team’s assessment (see figure 2). Here you can see how using the wrong comps for ARV can lead to implications of a $235,000+ ARV versus comps using the correct match for the target condition and lead to implications around $185,000 ARV. This is a $60,000 swing, or roughly 30% in this market. That 30% swing is likely to represent the entire pro forma profit margin for an investor. If their entire profit margin is wiped out or was “phantom profit” to begin with, then this project would be at high risk for falling to REO or servicing default down the road.

Catching these mistakes upfront can prevent a huge amount of risk. Quite often, the investors themselves might be working from false information they obtained from professionals who are evaluating the “comps” without having matched them to the true proposed budget.

2. Is the Budget Sufficient to Complete the Project?

The next area of diligence is a budget analysis to determine whether the proposed renovation with all its line items is feasible at the proposed cost level. Sometimes, a situation might involve borrowers who run their own construction firms or provide labor to their projects at discounted or no costs, as part of their setup as an investor. Although this may be feasible and result in successful projects, as a lender, it’s important to understand what your exposure might look like if you had to take back the project. After all, it might not be realistic to assume you would be able to line up subcontractors at discounted labor rates to help complete a stalled project.

The quality and depth of budgets, particularly in residential renovation, fix-and-flip lending varies greatly, which presents its own challenges. Just as with valuations for ARV, lenders have different approaches for evaluating this budget risk, and these methods can include having internal staff with construction expertise review each budget before approving, hiring an outside firm to conduct a project feasibility study, or using the same Renovation Analysis reports from RicherValues they ordered to evaluate ARV (and come with their own budget analysis).

Remember, none of these approaches is guaranteed. There will always be project and execution risk associated with every residential and renovation loan. At the same time, you must do your best to conduct the level of diligence necessary to minimize risk wherever reasonably possible. Evaluating whether a budget is sufficient is an important step.

3. Is the Budget Excessive or Too High for the Project or the Area?

This third area can be a huge warning sign for fraud that potentially awaits in the weeks and months post-closing.

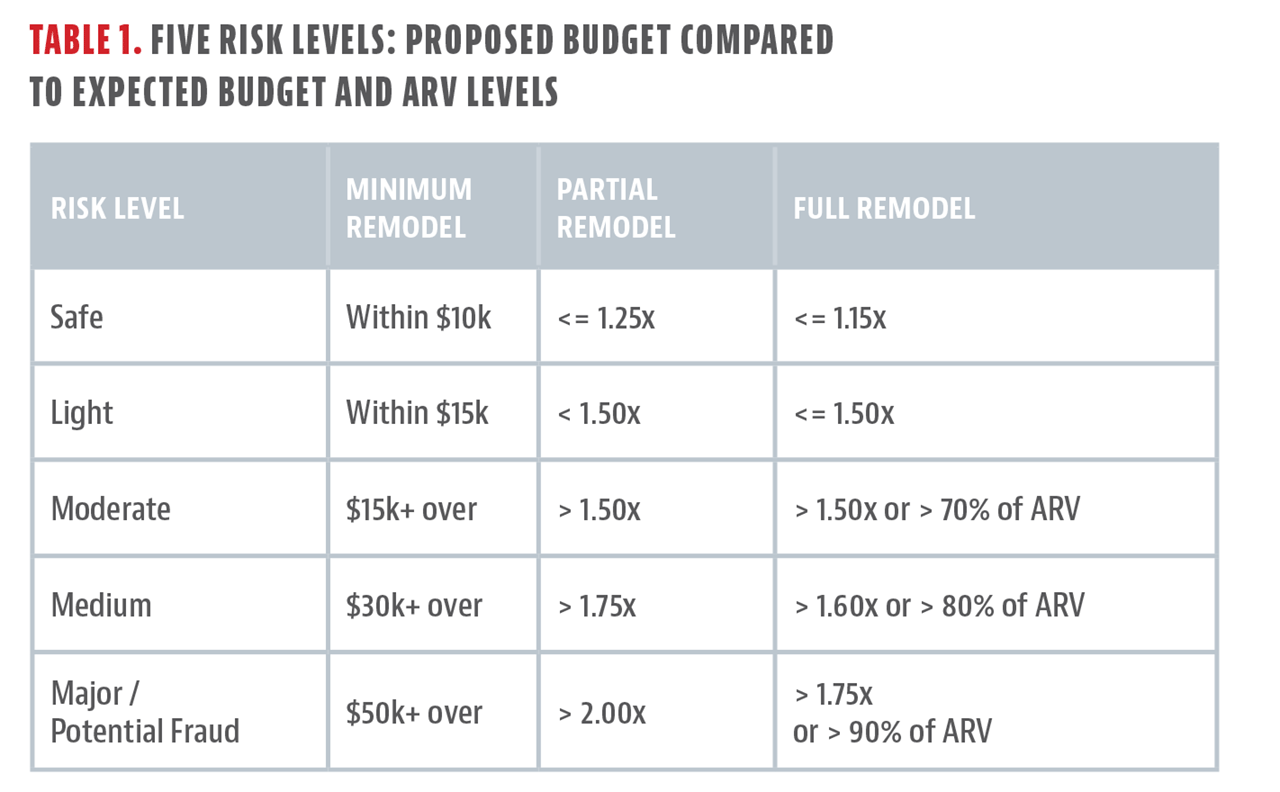

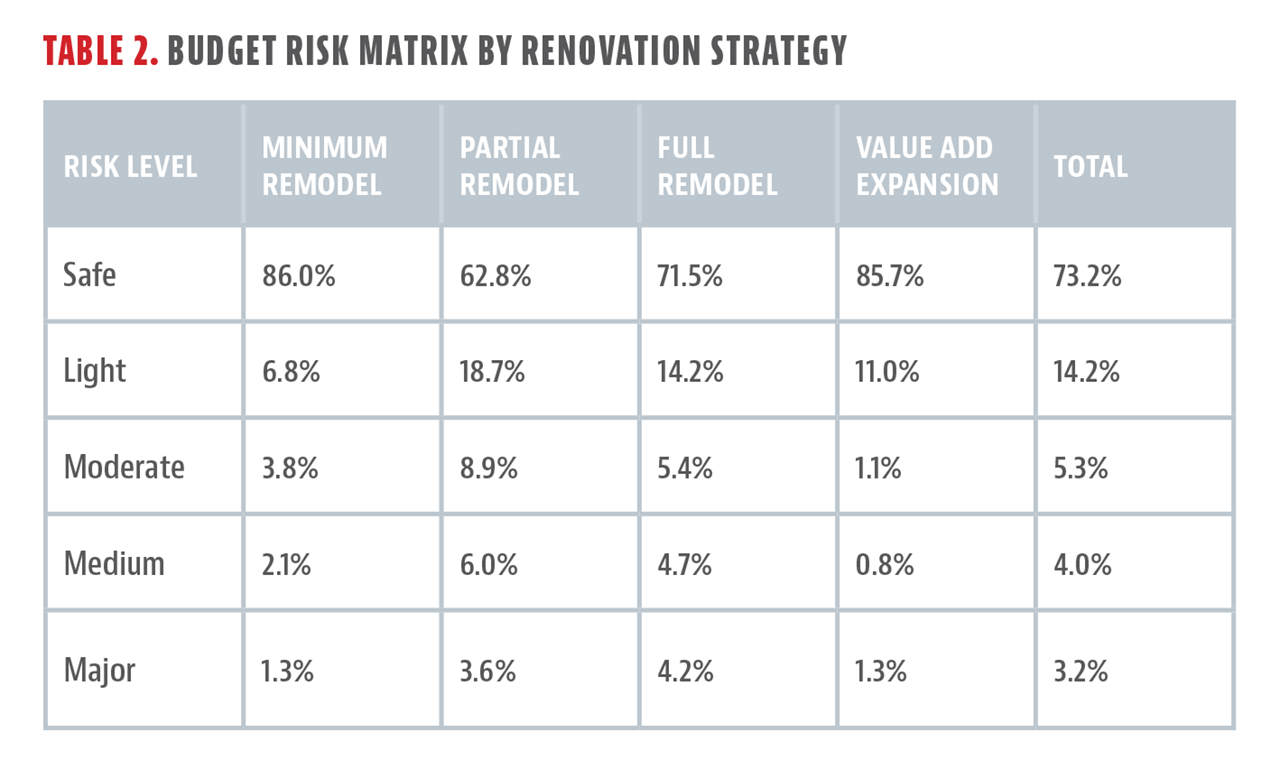

For our diligence process, we developed the five risk categories shown in Tables 1 and 2, based on data from more than 3,000 budgets that exceeded expected costs over the past 12 months. Of these 3,000 budgets, 3.2% of them fell into the Major Risk category.

In our opinion, this is a large number. Although it doesn’t mean for certain there is fraud risk, it is an important flag signaling the lender to dig deeper. It could just mean the expected costs for the project are incorrect. Or, it could mean the investor and/or contractor is trying to pull funds from one project to pay for another project that’s going south. Worse, it could be true fraud with intent to simply pull the construction budget and not perform the work.

We have found, based on informal discussions with our clients, lenders who dig deeper elect to pass on the majority of these loans. Further, they believe that eliminating this risk is significant to their long-term success. What’s surprising is that most standard project feasibility reports generally do not include this level of analysis; therefore, this fraud risk often goes unnoticed—until it emerges in the worst form.

Identifying this risk requires having a decent metric as you start estimating a range of expected costs to conduct the proposed renovation, in its market, and at its quality level and market price point. Once you arrive at that renovation estimate, run a comparison as a simple multiple of proposed budget divided by expected costs. In addition, proposed budgets should be evaluated in context of the estimated ARV (as you determine the ARV, not as the borrower states). Table 1 provides some ballpark metrics to gauge risk level by comparing the proposed budget with expected budgets and ARV levels, when the proposed budget is above the expected costs.

As mentioned, these are not hard-and-fast rules indicating there is definite fraud or risk. These are simply guideposts that can be helpful to identify situations that may need to be investigated further.

Using our data over the past 12 months, Table 2 presents how the budgets were distributed across these category flags, which varies by renovation strategy. With potentially 3%-4% of your loans requiring greater investigation, isn’t this something you might want to be keeping an eye out for?

Although renovation lending will always include risk, these three areas can help you avoid or restructure deals that might result in significant headaches and/or financial losses. Identifying potential issues at the outset is often the most important way to ensure your long-term stability, profitability, and performance.

Reach out with any questions and continue protecting your capital so you can keep on lending with confidence!

Leave A Comment