Institutional investors may be pulling back, but smaller, local investors see opportunity.

There’s been some recent buzz about institutional investors pulling back on property acquisitions, but the small-volume local investors who account for the majority of investment property purchases are bullish about ramping up acquisitions in 2024 after being constrained by a lack of inventory in 2023.

“We just need more inventory,” wrote one Tennessee-based real estate investor in response to an Auction.com buyer survey in January 2024. “How I long for the days when we’d win two or three auctions a month!”

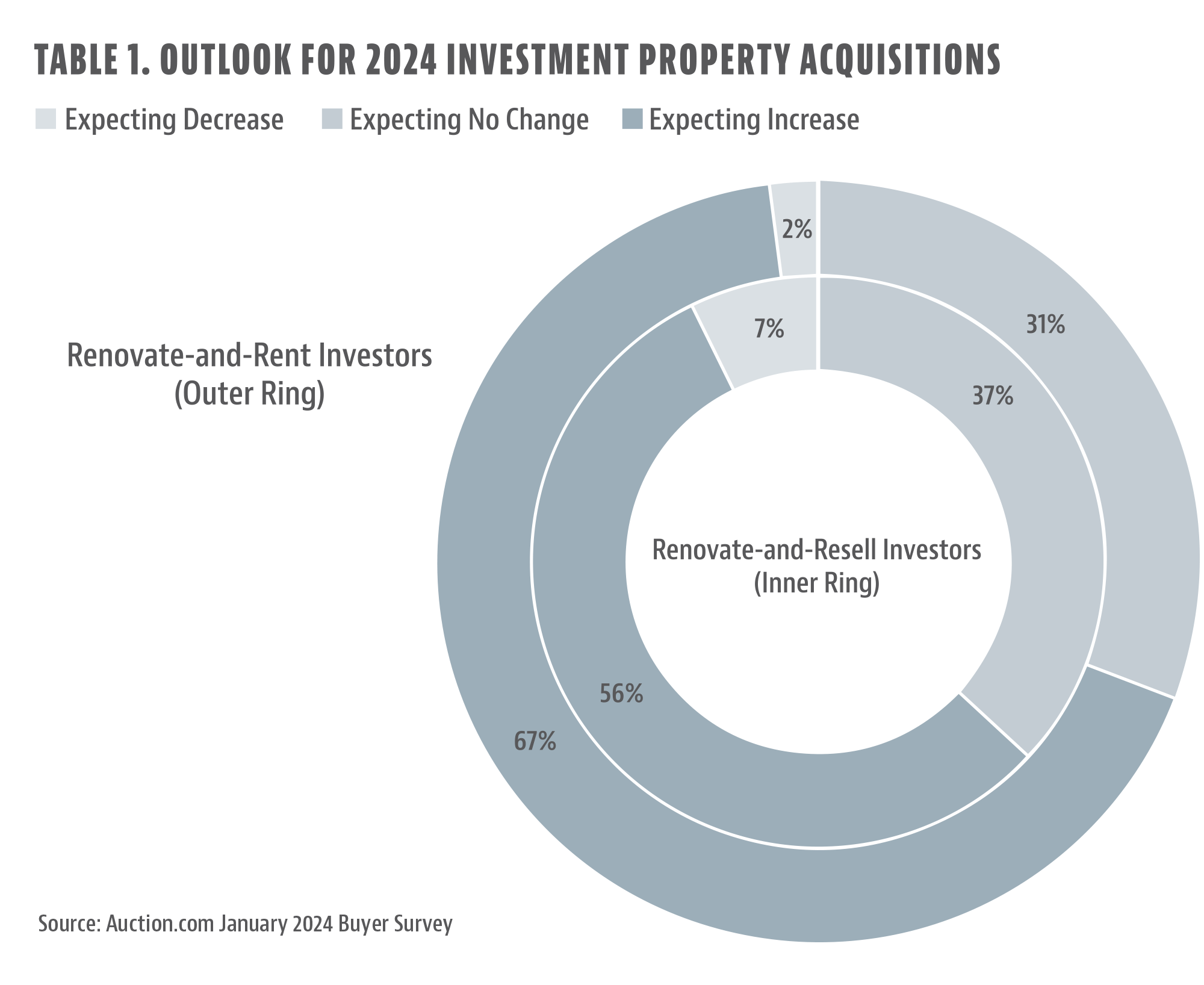

That sentiment was echoed by a majority of survey respondents, with 60% saying they expect their investment property acquisitions to increase in 2024 compared to 2023. Another 34% said they expect their investment property acquisitions to stay the same in 2024. Only 6% said they expect their acquisitions to decrease in 2024.

Caring for Communities

Buyers with a primary investing strategy of renovate-and-rent were more likely to say they plan to increase property acquisitions next year (see Table 1), with 67% of survey respondents with renovate-and-rent as their primary investing strategy saying they expect acquisitions to increase in 2024.

Fifty-six percent of buyers who said their primary investing strategy was renovating and reselling to owner-occupants expect their property acquisitions to increase in 2024, while 37% expect acquisitions to remain the same as in 2023, and 7% expect acquisitions to decrease.

Regardless of investing strategy, most Auction.com buyers are typically local community developers who purchase properties locally and care about the communities where they invest.

“We’ve revitalized entire areas … and have greatly increased property values and decreased crime rates in every area we buy,” wrote the Tennessee-based investor, contrasting his small business with mammoth institutional investors who buy thousands of properties a year across the country in a variety of markets.

More than three-fourths (78%) of survey respondents described themselves as local community developers or local investors. Another 13% described themselves as owner-occupant buyers, while only 3% described themselves as institutional investors.

Institutional Investor Retreat

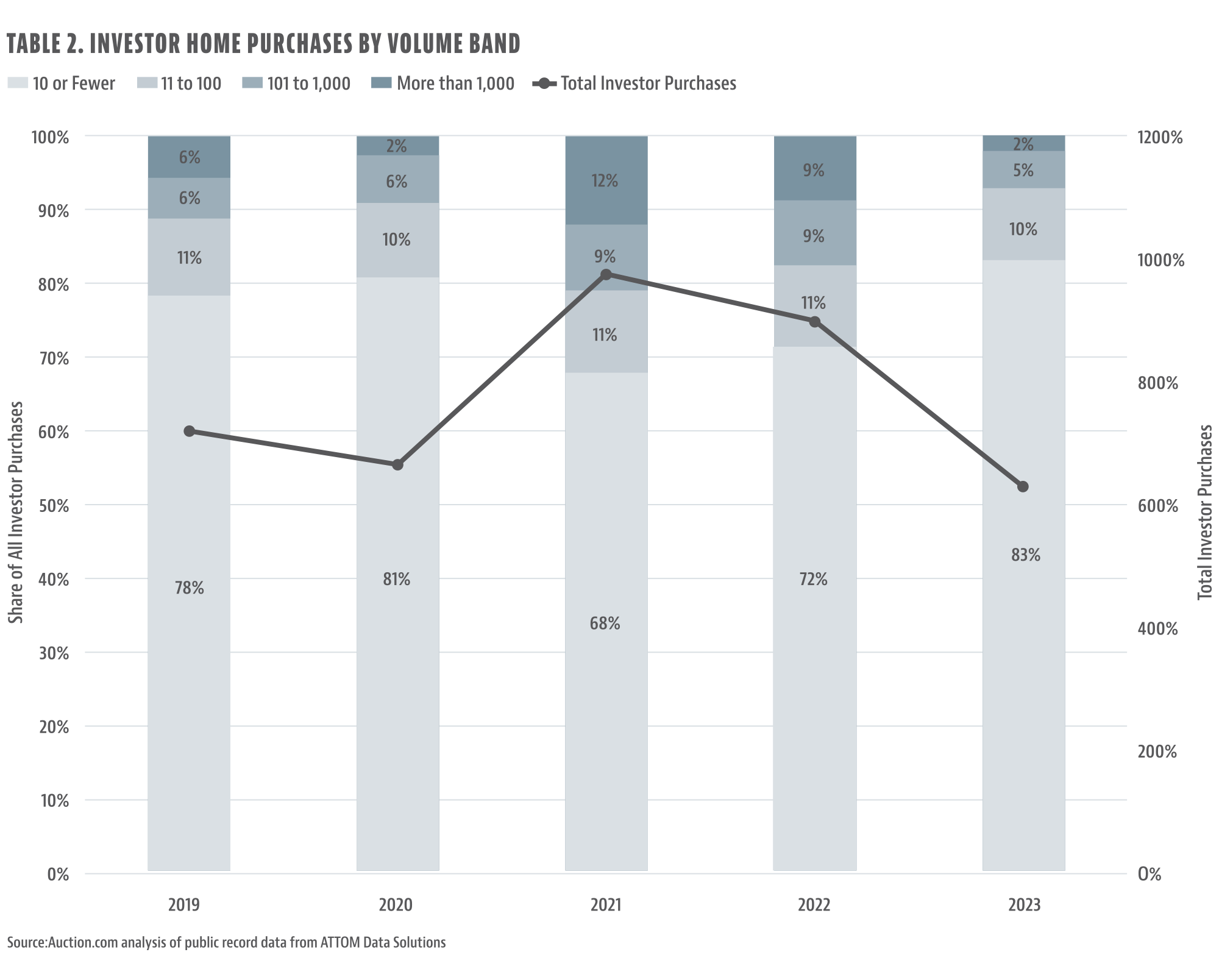

An analysis of public record data from ATTOM Data Solutions in Table 2 shows that the biggest decrease in investor purchases in 2023 came among the large institutional investors purchasing more than 1,000 properties a year. Purchases by those investors were down 84% from 2022 to 2023, while purchases among investors purchasing between 100 and 1,000 properties a year were down 60%.

Notably, buying entities associated with many iBuyers and single-family rental operators saw property acquisitions decrease dramatically in 2023 compared to 2022. Purchases by Opendoor Property Trust 1 were down 67%, and purchases by SFR JV 2 Property LLC, an entity associated with Tricon Homes, were down 86%.

Purchases among all investors were down 30% between 2022 and 2023, which was just slightly higher than the overall decline in home sales of 26%. Purchases by investors buying 10 or fewer properties a year were down 18% in 2023, outperforming the overall decline in home sales by 8 points.

And purchases by those smaller-volume buyers accounted for the majority of investor purchases in 2023. Buyers purchasing 10 or fewer properties a year accounted for 83% of all 2023 home sales to investors, while buyers purchasing 100 or fewer properties a year accounted for 93% of all investor purchases, leaving just 7% for buyers purchasing more than 100 properties a year. Buyers purchasing more than 1,000 properties a year accounted for only 2% of all 2023 home sales.

Local Investor Profile

Data from the survey of Auction.com buyers align with the public record data: 70% surveyed said they purchased two or fewer properties in 2023, and an additional 26% said they purchased between three and 10 properties for the year. Only 4% said they purchased 11 or more properties in 2023.

Many of the smaller-volume investors driving the majority of investor purchases are buying close to where they live. The median distance between properties purchased and buyer mailing addresses was just 16 miles for properties purchased on the Auction.com platform in 2023. Even for sales of properties sold via online auction, which allows buyers from anywhere in the country to bid, the median distance was 21 miles.

Although most small-volume investors using Auction.com are buying locally, many prefer to leverage technology to make buying more convenient: 46% said their preferred acquisition method was an online auction or remote bid auction, both of which allow buyers to bid from anywhere with an internet connection. Another 37% said their preferred acquisition method was in-person foreclosure auction, 10% said they prefer the multiple listing service (MLS), and 7% said they prefer to acquire off-market properties.

“I still work full time so I can only explore online auctions,” wrote a Kentucky-based Auction.com buyer, who said her primary investing strategy is to renovate and live in homes for three to five years. “I enjoy old homes with character that flippers don’t want to mess with.”

Although building wealth for themselves and future generations was the top motivation for all buyers surveyed, improving neighborhoods ranked second highest in terms of motivation for investing in real estate.

“My completed renovations provide homes to locals at prices below what they can find on the Realtor MLS … and I still make money!” wrote a Maine-based real estate investor, who said his primary investing strategy is renovating and reselling to owner-occupants. This investor said he spends between $50,000 and $100,000 on average renovating the properties he purchases on Auction.com.

Where Local Investors Are Most Bullish

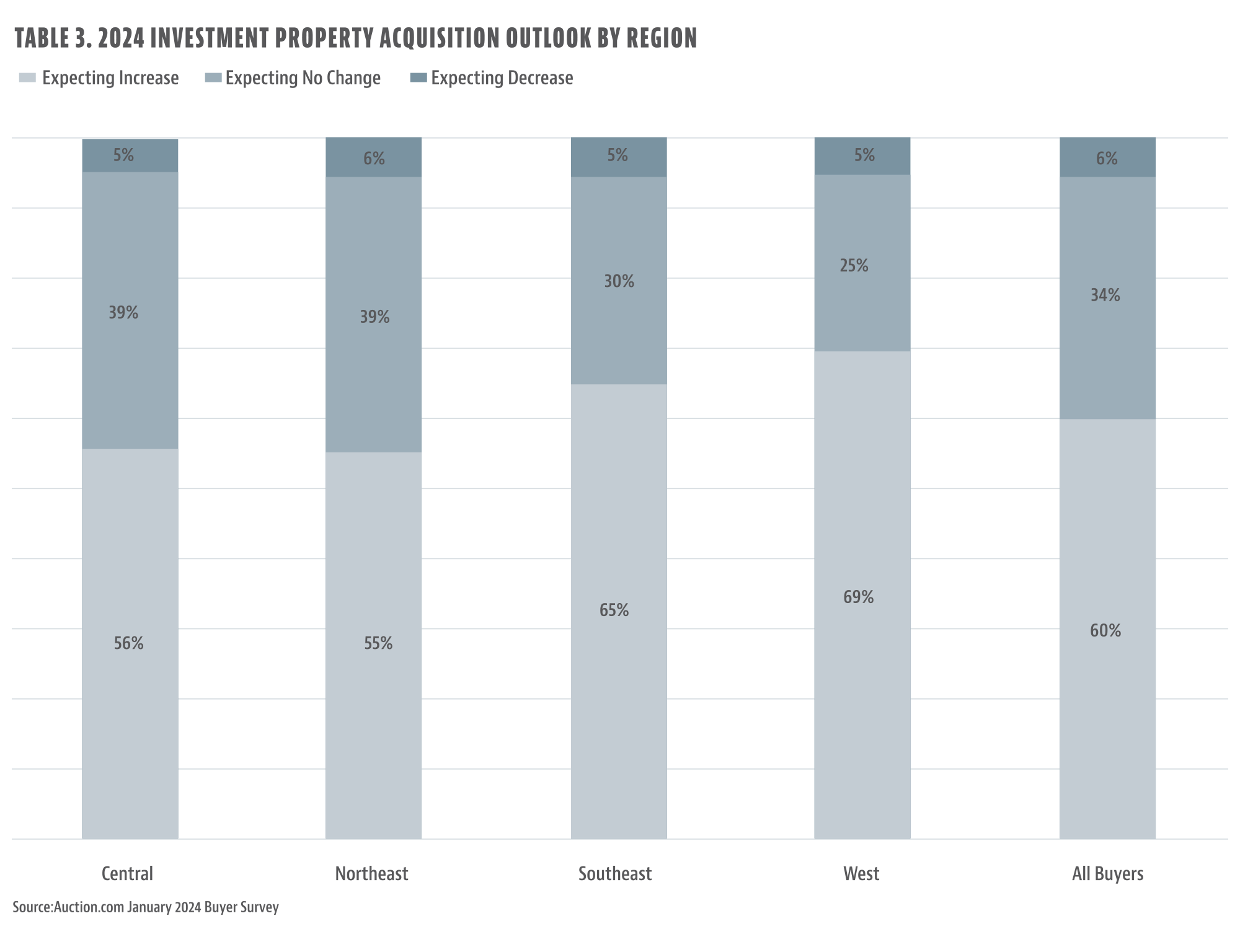

Auction.com buyers in the Southeast and West regions of the country were most bullish on increasing property acquisitions in 2024 (see Table 3), with more than two-thirds of buyers in both those regions saying they expect acquisitions to increase. Buyers in the Northeast were least bullish, but more than half of them (55%) still expect acquisitions to increase in 2024, and 56% of buyers in the Central region of the country expect their property acquisitions to increase.

Buyers are generally bullish about increasing acquisitions in 2024 despite a majority in most regions describing their local markets as overvalued with a correction possible. Nationwide, 49% of buyers described their local market as overvalued, but in the Northeast, 58% described their local market that way—the most of any region, followed by the Southeast and West, both at 52%. The Central region was the only one where a minority of buyers (41%) described their local market as overvalued with a correction possible.

Owner-Occupant Buyers Also Bullish

Somewhat surprisingly, 59% of Auction.com buyers describing themselves as owner-occupants said they expect to increase property acquisitions in 2024. That could be because many buyers who purchase a home for themselves end up purchasing more properties as investments.

“I bought my current home [on Auction.com] 10 years ago and wish there were as many listings for [my ZIP code] as there were in 2013 to 2014,” wrote a California-based survey respondent who described himself as an owner-occupant buyer. “We have a dearth of affordable homes. I’m always looking for ways to improve this situation.”

Leave A Comment