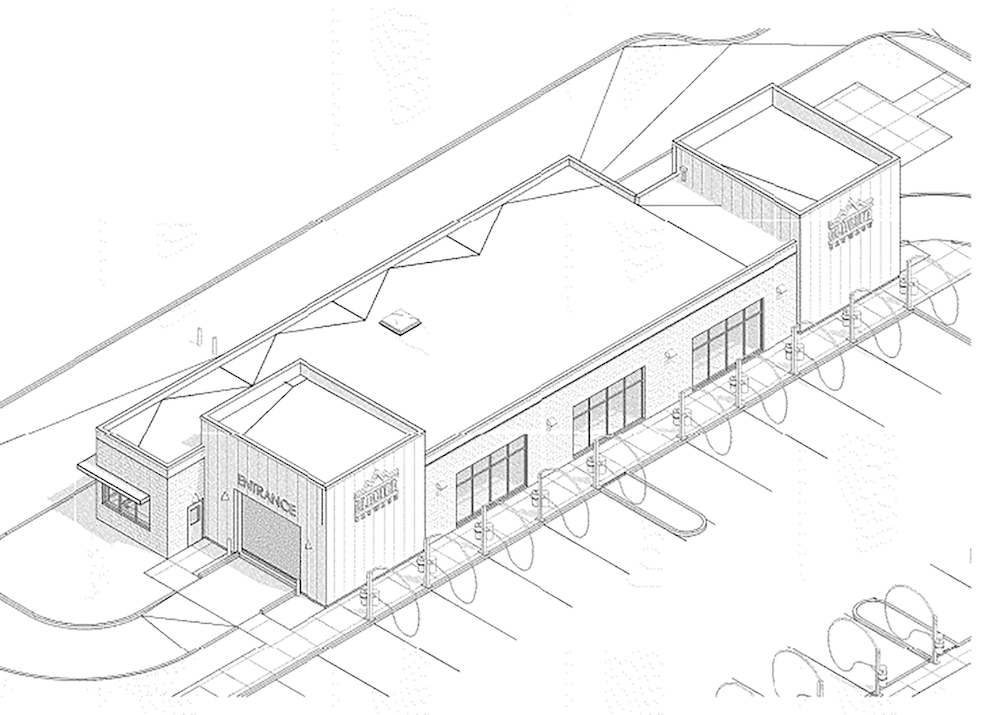

A hard-working military veteran renovated an 8-unit multifamily property in the FEMA Flood Zone X region of New Orleans.

The dilapidated property was purchased in May 2018 as an investment property. The vision was a straightforward fix-and-flip. Renovation began shortly after the purchase.

As with many fix-and-flip projects, significantly more items needed repair than first thought, including the foundation, subflooring, exterior walls and trim. All were suffering from termite damage or rot. They were completed before a loan was needed.

After realizing that more funding would be needed to complete the project, the borrower sought out a fix-and-flip loan. After the loan was funded, work resumed on installation of a new

roof, exterior staircases at the back of units, new front and rear exterior doors and new windows and casings.

Interior renovations included new lighting, flooring, painting, cabinetry and granite countertops in kitchens as well as the installation of new mini-split A/C systems. New appliances and bathroom fixtures, including bathtubs and sinks, were also installed.

All units featured two bedrooms, one bathroom, a living room and a kitchen.

Lender // Jcap Private Lending

Borrower // Shinnah Brown

Location // New Orleans, Lousiana

Originally Built // 1920

Square Feet // 5,706

Loan Amount // $675,000

LTV // 99.26

Credit Score // Yes

Borrower Experience // Experienced

Interest Rate // 10.88%

Length of Loan // 12 months

Rehab Costs // $675,000

Summary of Opportunity // The property had a $680,000 original value. After rehabilitation,

it was anticipated to be $1,100,000.

With only eight units in the renovation scenario, the property achieved stabilization during

the renovation process. Stabilization near the date of completion was well-supported by absorptions within the local market. Renovations were completed June 8, 2019.

Leave A Comment