Borrower’s first RV park endeavor integrates luxury with nature in Port Angeles.

Firm Ridge Real Estate Partners, an experienced developer but new to transient RV parks, faced significant difficulty locating capital to fund their newest project in Port Angeles, Washington.

They found 1892 Capital Partners, a Seattle-based boutique direct private money lending firm, through a combination of word of mouth and social media marketing. 1892 has carved out a niche by positioning itself as the go-to lender for deals others might shy away from (especially in unique and unconventional asset classes). They saw opportunity in the location and RV@Olympic concept; it was poised to become a premier destination for outdoor enthusiasts seeking to explore the stunning Olympic National Park.

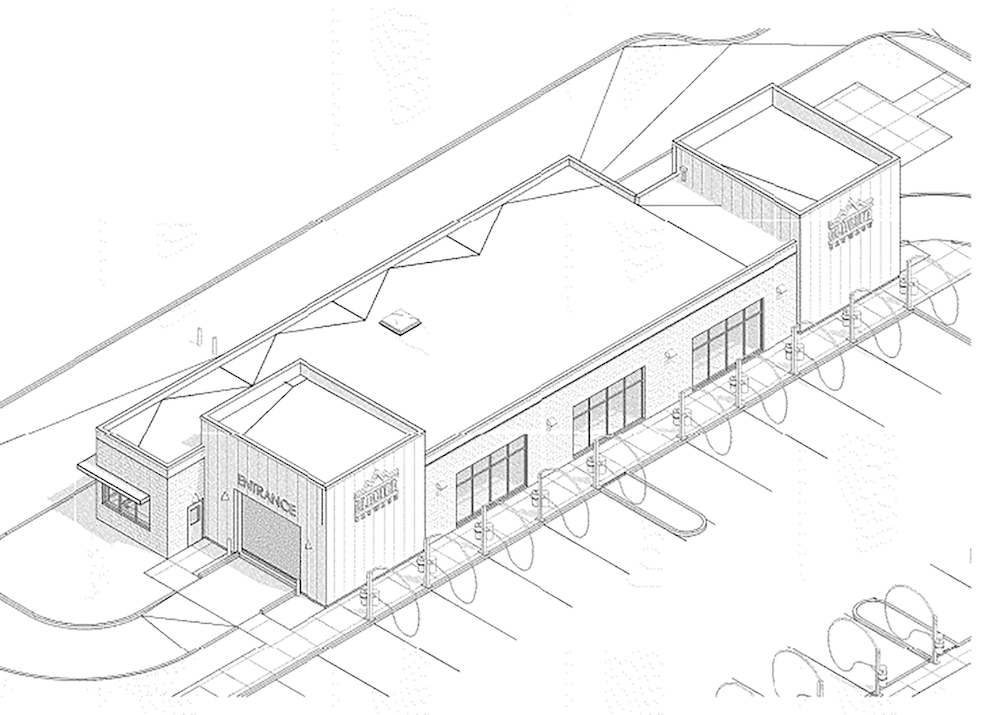

RV@Olympic will offer the ultimate RVing experience, combining modern conveniences with the beauty of nature. The development will feature 98 RV sites, a 24-hour cashierless store, a main building with check-in, laundry, bathrooms, an indoor community center, a dog park, a dog wash station, a community shower/bathhouse building with private showers and bathrooms, a hot tub area, a kids’ playground, a large outdoor community space with firepits and outdoor games, and fiber optic and 5G internet.

Nearby outdoor recreational attractions include Olympic National Park, which offers hiking trails, wildlife viewing, and diverse landscapes; Lake Crescent, known for boating, fishing, and swimming; and the Elwha River Valley, recognized for its restored river ecosystem and activities such as kayaking and fishing.

The project is expected to open in mid-to-late April 2025.

Opportunity

The project offered a strategic lending opportunity toward alternative assets with intelligent and able operators. The loan had a low Loan-to-Value (LTV) and Loan-to-Cost (LTC) ratios, and the clients offered strong intelligence, market research focus, and solid experience in underwriting and risk assessment. Despite this being Firm Ridge’s first real estate project in a unique asset class, 1892 saw an opportunity to mitigate the risks and support them in successfully launching the project with a $4.195 million development loan at a loan-to-value of 50% and a loan-to-cost of 65%.

Exit Strategy

The strategy is to refinance and hold.

Solutions & Outcomes/Results of Loan

The loan closed in December 2024. The client has been a stellar performer, with the first draw going smoothly and the project progressing exactly as planned. To manage draw requests and project milestones, 1892 uses an online draw system integrated with inspectors experienced in RV development. Additionally, 1892 conducts site inspections themselves since this is their first project with the client. To mitigate risk and manage potential overages, 1892 required sizeable front-loaded draws upfront.

Leave A Comment