By financing an office, commercial warehouse, and land deal in Renton, Washington, 1892 Capital Partners changed a business’s trajectory.

The Opportunity

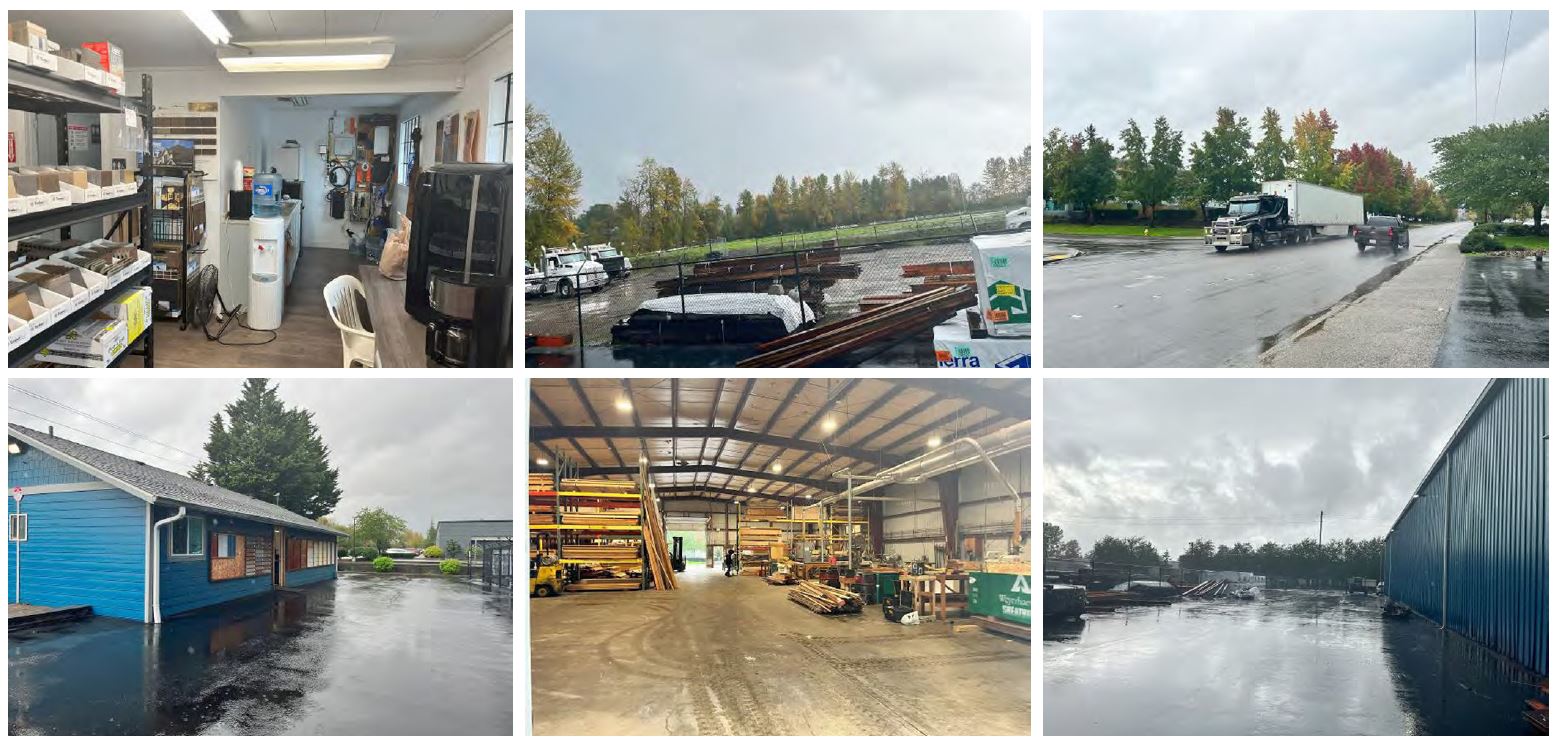

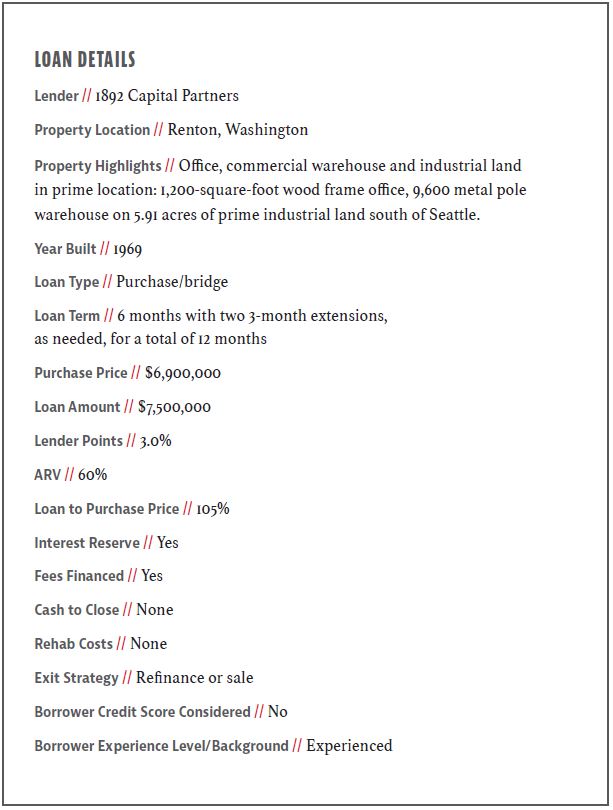

The borrower, a savvy entrepreneur in the construction supply business, sought to purchase a 1,200-square-foot wood frame office, 9,600 metal pole commercial warehouse and 5.91 acres of prime industrial land in Renton, Washington, south of Seattle.

Initially leasing the property with a purchase option, the borrower faced a critical regulatory hurdle: obtaining a No Further Action (NFA) letter from the relevant regulatory agencies due to possible contamination that occurred prior to the borrower’s lease. Although the purchase option did not have to be exercised until the NFA was received, the moment this clearance was secured, the clock started ticking—with just six months to finalize the purchase.

In the face of unpredictable interest rates, traditional financing options were hard to come by, leaving our client with just 30 days to to find an alternative.

Capitalizing on Property Appreciation

During the past five years while our client worked toward NFA status, yet experiencing numerous delays due to the pandemic, the property’s value soared to $12.5 million. The seller, likely banking on our client missing the six-month purchase window, stood to benefit significantly. Meeting the deadline was a must.

The team at 1892 Capital Partners worked hard to fast-track appraisals, scrutinized the NFA documentation to ensure no further unforeseen cost of clean-up, and stepped in with an acquisition loan that covered the full option price. Our comprehensive solution also financed associated fees and established an interest reserve, ensuring the borrower could comfortably manage the debt while exploring refinancing or sale options.

Innovative Financing Solutions

Our borrower is now finalizing a refinance, having unlocked the property’s equity by exercising the purchase option. Because 1892 Capital Partners is not constrained by traditional bank financing or stringent underwriting, the borrower was able to get 105% of the purchase price financed, enabling the transaction to close without any cash upfront from the borrower.

Empowering Entrepreneurs with Flexible Financing

This case showcases the importance of adaptability, speed, and the ability to deliver creative financial solutions to face modern real estate challenges. By understanding the nuances of the market and the needs of borrowers, private lenders can empower businesses to seize opportunities and achieve their goals.

Success hinges on more than just properties—it’s about partnerships. Innovative and flexible approaches make all the difference.

Leave A Comment