In “An Insider’s View of Fund Management,” an article in the Winter 2021 issue of Private Lender, we intentionally left readers hanging about why Nexus Private Capital didn’t follow conventional wisdom when it came to choosing a structure for its fund.

This article picks up where the prior one left off. It explains why you can argue that the traditional approach falls short of adequately aligning the respective interests of manager and investor. Although it sheds light on why we chose a different approach, it is not intended to be a promotional piece. Instead, we hope you will accept that it is nothing more than a critical look at alternative fund structures.

Conventional Fund Structure

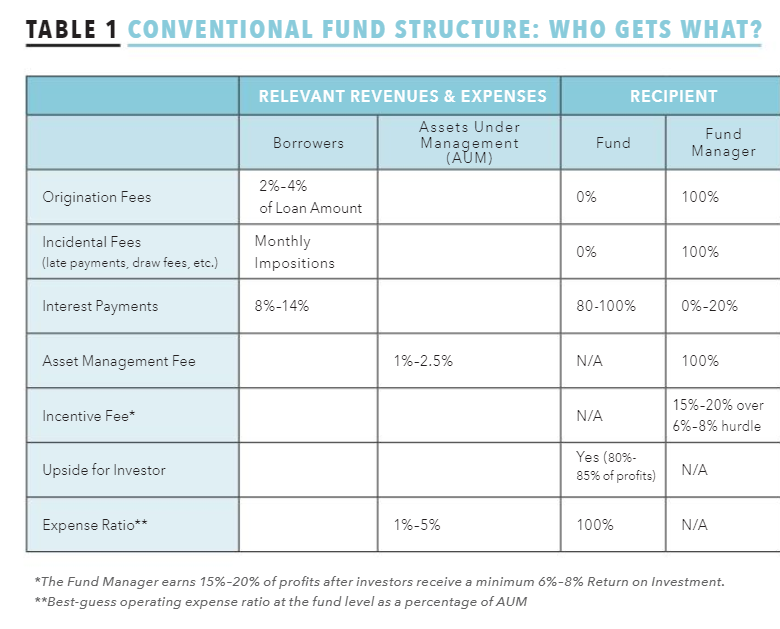

Table 1 provides a quick review of the typical fund structure so we have a baseline to compare alternatives to. Variations do exist, but this table generally captures the default setup among private lending funds.

Note that there are other impositions on the fund that are not reflected in Table 1 and are often collected by the manager. Loan servicing, fund servicing, and construction management fees are good examples. However, these are simply services that are brought in-house for any number of reasons rather than being performed by a third party. Nexus, for example, outsources loan servicing and construction management, but its management entity performs fund servicing in-house and charges the same amount to the fund that a third-party imposed prior to being replaced.

Nexus Fund Structure

Now, let’s take a look at the Nexus model:

An astute observer may notice that under this alternative structure, 100% of all revenue from all sources goes to the fund, and the fund manager charges no fees. The manager’s sole compensation is a profits distribution after everyone else is paid first—in our view, the epitome of the manager “putting its money where its mouth is”!

An astute observer may notice that under this alternative structure, 100% of all revenue from all sources goes to the fund, and the fund manager charges no fees. The manager’s sole compensation is a profits distribution after everyone else is paid first—in our view, the epitome of the manager “putting its money where its mouth is”!

By comparison, under the conventional approach, the fund manager is “in the money” the moment a loan is originated, which means they are motivated to make that loan whether it’s a good or bad one. Similarly, they are incentivized to grow the pot as big as possible to earn more incidental income and asset management fees, all of which are priority distributions to the manager ahead of payments to investors.

There are finer but more powerful points as well. Under GAAP accounting protocols, the alternative structure must amortize origination fee income over the number of months of the respective loan term. Under the conventional format, however, the manager earns 100% of the fee at the time of closing.

For example, a $300,000 loan with a 12-month term and a 2% origination fee would pay the conventional manager $6,000 immediately, whereas the alternative fund recognizes only $500 of income for each of 12 months. So that “pop” for the conventional manager is a motivator to do a loan in a way that the watered-down version for Nexus is not.

For the same reason, the alternative structure smooths out what could otherwise be large gyrations in manager income from high and low origination months while adding a stabilizing source of income to the fund. This is because deferred origination fee income from prior originations is evenly recognized across many months. This latter point is one of the reasons why Nexus weathered the pandemic storm so well. We enjoyed origination fee income even though we pulled back dramatically on new originations.

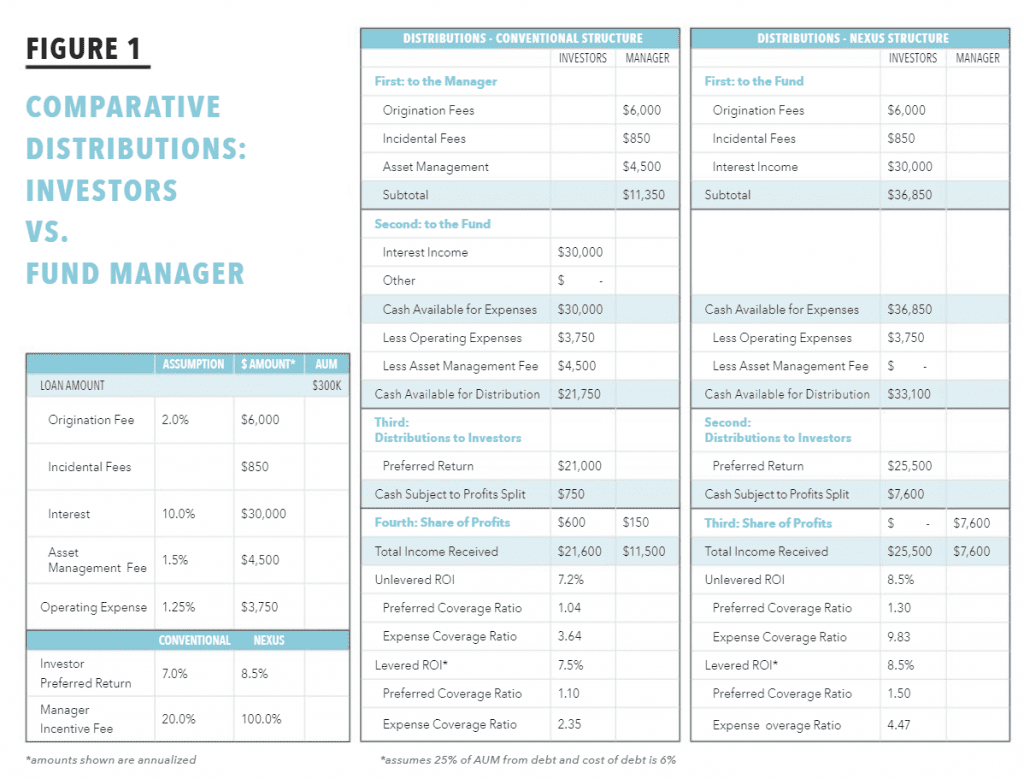

Next, I’ll make the argument that other than the asset management fee conventional funds customarily charge, the Nexus alternative makes more money for the manager but at considerably less risk to the investor. Figure 1 compares distributions under the two approaches to investors and the manager, respectively, using our hypothetical $300,000 loan amount.

This comparison is for illustrative purposes only. In reality, the conventional approach typically uses debt to equity in a 1:1–2:1 ratio and/or sells loans while retaining a strip (portion of the coupon). Both these actions juice returns for the fund but add risk.

Nexus, on the other hand, caps the use of debt at 25% of loan value and rarely sells its loans. These are strategic choices driven by a dual focus on safety and client service. They do not influence the values in Figure 1.

The major takeaways from the comparison in Figure 1 are:

Under the conventional model, the manager is “in the money” before investors; with the alternative approach, investors are given priority.

Expense and preferred return coverage ratios are considerably higher under the alternative approach. This translates into greater safety for investors (and explains why they get no “upside” in the Nexus model).

Other than the asset management fee, compensation the manager earns in the alternative model is greater than in the conventional model. In addition, the alternative fund manager can communicate that “they put their money where their mouth is,” whereas the conventional fund manager cannot.

There is another critically important point that is not apparent from looking at Figure 1. It has to do with REO (Real Estate Owned) scenarios. REOs are properties owned directly by the fund, typically as a result of foreclosure.

Regardless of structure, in a foreclosure, the fund temporarily loses interest and ancillary fee income on the principal amount of the loan. In this case, the conventional fund manager loses ancillary fee income, and its incentive fee income is reduced. The lion’s share of the pain is felt at the investor level as profits and coverage ratios decline. In this case, the wrong party got punished for making a bad loan.

By contrast, under the alternative structure, the manager absorbs 100% of the hit to profits from an REO, because its only compensation is whatever profit remains after everyone else gets paid first. In this case, the right party got punished for making a bad loan. However, the flip side is that REOs are typically resold at a profit. Consequently, the alternative fund manager usually makes up for his temporary losses by enjoying 100% of the gain on sale. In that event, the right party got rewarded!

Leave A Comment