Paul Jackson draws from experience to build Residential Capital Partners.

Paul Jackson recognized the appeal of real estate from an early age.

“Everybody in my family was in the real estate business,” he said. “It’s in my blood.”

Jackson, president and CEO of Residential Capital Partners (ResCap), grew up in Dallas, where he saw his father, uncle, and friends’ parents find success in the booming market. His father was an attorney who became a developer and started a brokerage. Jackson worked there during the summers as he studied at Baylor University to earn a business degree with a finance focus.

He intended to get into the finance side of real estate, and his first job at JPMorgan Chase & Co. taught him the ropes.

“It helped me understand what being a lender was like,” he said. “Here I am, 27 years later still in the lending business.”

Lending Lessons

Jackson started his career in Austin, but he soon followed his wife to Washington, D.C., where she pursued her dream job working for first lady Laura Bush. In D.C., Jackson found a job working for his childhood idol, Dallas Cowboys quarterback Roger Staubach, at The Staubach Co.

Each of his jobs taught Jackson various aspects of business. At JPMorgan Chase, he learned how to be a good partner to the businesses that borrowed money. At The Staubach Co., the focus was “one team, one dream,” he said. Growing up, he learned to appreciate the entrepreneurial spirit of the real estate business.

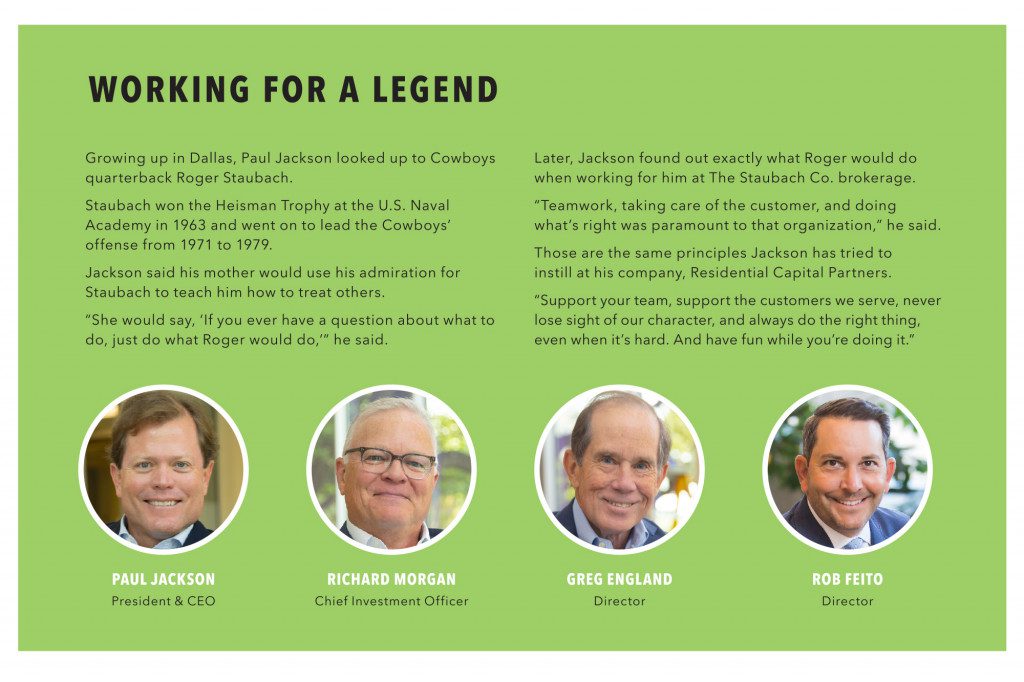

All those tenets helped form the foundation for Residential Capital Partners, which Jackson founded in 2009 with partners Richard Morgan, Greg England, and Rob Feito.

Initially, Jackson said, they intended to buy distressed mortgage pools that came available during the Great Recession. However, through their research into the single-family rental market, the drive of single-family investors impressed them.

“We really liked the entrepreneurial spirit and the integrity of the single-family investor that was working to improve communities across the country to provide affordable housing to Americans,” Jackson said. “So, what we thought was going to be an opportunity to buy distressed assets during the global financial crisis actually ended up being a decision to loan money into the space.”

Seeing a void in credit at the time, the partners decided to put together capital to invest in the industry as a lender rather than as an owner. That decision has proven successful, with Residential Capital Partners becoming a nationwide lender with a staff of about 25 people. Recent growth—including during the pandemic—has been exciting to watch, Jackson said.

“We have a lot of team members who have been with us since the very beginning that are our tried-and-true foundation,” he said. “During this period of growth, we hired a lot of young talent. It’s just been an exciting part of what we’re building because it represents the opportunity available in this industry.”

Residential Capital Partners bills itself as a balance sheet lender, which Jackson said gives them flexibility and the ability to adapt loans to each borrower.

“We named ourselves Residential Capital Partners because we really did want to come alongside the single-family rental investor as a partner in the transaction, not just a lender,” Jackson said. “As a balance sheet lender, we can look at the relationship as a whole sometimes. … It truly is one of our competitive advantages—it’s just part of who we are as an organization. We look at our borrowers as part of our team.”

To provide what borrowers really need, ResCap keeps its focus on its customers, Jackson said.

“Before we were lenders, we were real estate investors. And so we built our business through the lens of the paradigm of what matters most to the real estate investor,” he said. “If we can take our background experience in real estate investments and apply it to the success of the single-family rental borrower, we can create value in financial solutions that will serve a single-family rental investor and this industry for many years to come.”

“Before we were lenders, we were real estate investors. And so we built our business through the lens of the paradigm of what matters most to the real estate investor,” he said. “If we can take our background experience in real estate investments and apply it to the success of the single-family rental borrower, we can create value in financial solutions that will serve a single-family rental investor and this industry for many years to come.”

ResCap focuses on fix-and-flip or rehab loans but also offers bridge and long-term rental loans. Jackson said they also provide some ground-up construction loans. The company developed an in-house digital loan approval process to facilitate the speed and efficiency investor borrowers need.

To provide what borrowers really need, ResCap keeps its focus on its customers, Jackson said.

“Before we were lenders, we were real estate investors. And so we built our business through the lens of the paradigm of what matters most to the real estate investor,” he said. “If we can take our background experience in real estate investments and apply it to the success of the single-family rental borrower, we can create value in financial solutions that will serve a single-family rental investor and this industry for many years to come.”

Rick Morgan, chief investment officer at Residential Capital Partners, said Jackson is uniquely suited to be the face of the company. Although Jackson understands the financial aspects that are critical to lending, Morgan said, “crunching numbers is not his passion.” Jackson is a people person who is skilled at communicating the company’s message and mission to employees and clients alike, Morgan said.

“Paul can derive that top line in a great way but respect the necessity to write good paper and communicate that priority,” Morgan said.

That aptitude for keeping everyone working toward the same goal propelled Jackson into his leadership role at ResCap, Morgan said. Leveraging that skill set has been crucial as the company has grown. In their line of work, Morgan said it’s crucial to “embrace the grind” of getting every small detail right—Jackson does, and everyone follows his example.

“He’s in that prime part of his life and career with the knowledge and proven ability that instills confidence in people inside and outside the company,” Morgan said. “I’d like to keep him a well-kept secret.”

Overcoming Challenges

The real estate market is constantly changing, but the big challenges that presented themselves in the past two years were the pandemic and, now, inflation.

Jackson said inflation has been a part of every conversation he’s had with borrowers in the past several months, but he doesn’t see it slowing down single-family rental investors any time soon. Demand is still strong for affordable rental housing, he said. What’s more, he said, demographic changes may support additional rental opportunities. Some millennials are deciding that owning a home is not their American dream and will continue to rent.

Despite the outside pressures on the housing market, Jackson sees demand for lending remaining strong.

“We built the foundation of our business around the resiliency of the single-family rental investor, and we started the business at the bottom of the global financial crisis,” Jackson said. “Something we’ve learned as we walked into the covid-19 crisis—it was confirmation for us as an organization that the investment we made in the resiliency of the single-family rental investor was confirmed through how the industry performed during the pandemic.”

The growth ResCap experienced during the height of the pandemic continues, Jackson said, which he sees as confirmation of the strength of the rental investment market.

Sharing Knowledge

Jackson and his team value their membership in the American Association of Private Lenders. The access to industry leaders and sharing of knowledge and best practices are the top benefits, he noted.

“Especially during times like a pandemic, we saw our industry come together and share information so we could all ride out the pandemic successfully,” he said.

Just as AAPL shares knowledge among industry players, Jackson offered advice for new or potential real estate investors:

- Know and understand your market.

- Pull your own comps and don’t rely on appraisers.

- Protect your cash balances and don’t overextend yourself just to make a deal.

- Make sure you’re investing your dollars in projects that can sustain you through the ups and downs of market cycles.

Leave A Comment