Mortgage Automator’s partners rely on each other’s strengths to move the company forward.

Some say it’s not advisable to go into business with your friends, but the founders of Mortgage Automator wouldn’t have it any other way.

The Toronto, Ontario, tech company has evolved from a proprietary software project to an award-winning business with 50 employees and 275 clients across the globe. Partners Pavel Tchourliaev, Lawrence Schwartz, and Joe Fooks see more growth ahead.

‘We’re Going to Sell This Software’

‘We’re Going to Sell This Software’

Each of the founders came to the business with a different background, lending a variety of perspectives to the company.

Fooks has worked in mortgages and private lending for nearly two decades. He learned early lessons about bad business partners, having to rebuild from scratch twice in 10 years. Schwartz had a variety of jobs, selling everything from artwork to insurance. Tchourliaev, despite his background in accounting, built a web development agency that he grew and sold.

After a business disappointment, Fooks reached out to Schwartz, a former roommate, about joining forces in private lending. Finding success, they reached out to Tchourliaev, a longtime friend of Fooks, to build software that would make workflows run more smoothly.

“We had Pavel build up little things here and there to help us with our business, with no intention of ever commercializing the product,” Fooks said. “It was strictly like an ace up our sleeves for ourselves. Then, at some point, we realized the market was definitely missing something.”

Fooks said he and Schwartz were at a golf tournament chatting with colleagues when someone saw his phone screen showing the proprietary software Tchourliaev had built.

“She’s like, ‘I’ve been looking for something like this my entire life. Would you lease it to me?’” Fooks recalled. “I looked at Lawrence — he said, ‘Don’t get any bright ideas.’”

But that conversation set the wheels in motion. Fooks brought it up again later with Schwartz.

“I looked at him and said, ‘I’m going to tell you something right now: We’re going to sell this software,’” Fooks said. “He smiles at me and he knew I was crazy enough to actually push it.”

They continued discussing the opportunity and agreed it made sense to share their software with the industry. By that time, Tchourliaev had exited his previous business, so they asked him to join them as a partner in building Mortgage Automator. They enhanced the software, beta tested with key clients in 2018, and officially launched in 2019. That year, they earned the Innovator of the Year Award, one of the Mortgage Awards of Excellence, and have continued racking up accolades.

Continuous Improvement

The trio hasn’t built a one-size-fits-all solution—it’s been a learning curve for all three partners to understand how differently each company uses its platform. With Tchourliaev’s input, they have made a product that’s flexible and can adapt to various use cases.

“What we learned is quite literally every private lender does something different,” Tchourliaev said.

The product has grown far beyond their expectations, allowing them to meet the needs of lenders in Canada, the U.S., Australia, and New Zealand.

“What Joe and I were building for our company was extremely basic,” Schwartz said. “If there was a pie, it was 1.5% of what we have now.”

Although they have built out many modules for the platform, Tchourliaev said they constantly have new requests from clients for additional functionality.

“We want to continue evolving it to make it better, stronger,” Fooks said. “I think when you stop evolving, it actually hurts you. So, we’re always putting pressure on ourselves internally to say, how can we improve this process? How can we improve this module? How can we make it better in any way, shape, or form?”

As they’ve grown Mortgage Automator, the founders have recognized it’s important to hire local developers rather than outsourcing talent. Tchourliaev said that practice keeps overhead lower and allows them to move more quickly while making fewer mistakes. Fooks said Toronto’s status as a tech hub has benefited the company as it seeks out high-quality programmers.

As they’ve grown Mortgage Automator, the founders have recognized it’s important to hire local developers rather than outsourcing talent. Tchourliaev said that practice keeps overhead lower and allows them to move more quickly while making fewer mistakes. Fooks said Toronto’s status as a tech hub has benefited the company as it seeks out high-quality programmers.

“That decision was initially a more costly expense to the business but probably one of the best things we’ve ever done, and I thank (Tchourliaev) for that,” Fooks said.

A selling point has been Fooks’ and Schwartz’s deep industry knowledge and the fact they actually use the software in a private lending company they still run—though initially they weren’t sure whether to highlight that nugget.

“It was something we learned over time was actually a great asset,” Schwartz said. “We learned quickly that people wanted our expertise. They knew that we are experts in the field.”

Fooks said they help clients by providing a roadmap on how to overcome the struggle with day-to-day operations and other pain points, which they can do because they’ve experienced it all. Schwartz said he enjoys watching the trajectory of the businesses that have embraced Mortgage Automator.

“Seeing where clients are when they start with the software to where they are years down the road and their growth as a company—I find that the most rewarding,” he said.

Tchourliaev said their product has made the industry better by introducing new ways of working that makes life easier for clients. But even more satisfying and humbling, he said, is how Mortgage Automator has benefited employees.

“So many people on our team have been able to buy houses in the last several years, start families, et cetera, and so on,” he said. “It’s a huge responsibility, but at the same time, it’s a very rewarding responsibility, in my opinion. I think it’s great that we are able to really take care of our team and our clients.”

Meshing Personalities

Meshing Personalities

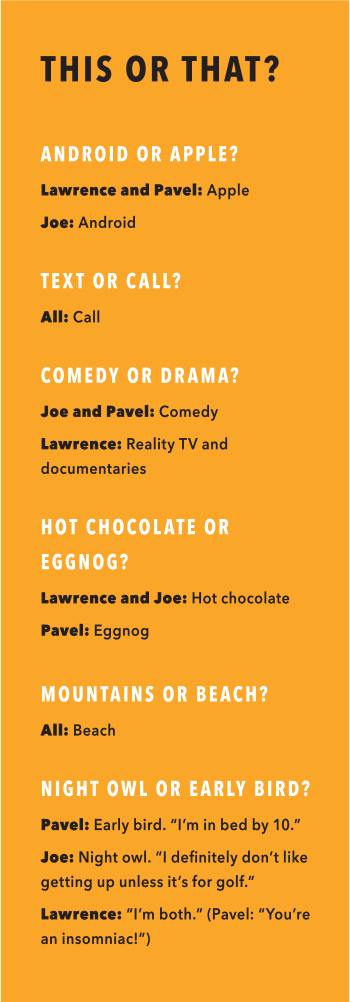

The three co-founders have learned to rely on each other’s strengths to make the business the best it can be. As they describe each other, they mix admiration and respect with good-natured ribbing.

Fooks is a motivator and a closer, they said.

“Joe is a maniac,” Tchourliaev joked. “Hands down, he’s one of the most hardworking people I’ve ever met. Whether justified or not, he always creates artificial pressure, and he is just moving as fast as he can at all times.”

“Joe will run through a brick wall if he has to,” Schwartz said.

Schwartz brings a different energy to the group with a level-headed and objective perspective.

“He’s one of the most calm, collected, analytical thinkers you’re ever going to meet,” Fooks said. “He’s well-spoken. But the guy just knows how to read the room, understand how people are thinking, understand where their perspective is coming from. … He picks up on things that Pavel and I don’t pick up on—smaller things that are less obvious to us.”

Though Tchourliaev didn’t come from a lending background, his partners admire how much time and effort he put into learning the industry in order to make a better product.

“When we’re talking to potential clients, we just know that Pavel will understand what you’re talking about and take care of it,” Schwartz said. “If Pavel wanted to leave tomorrow and start his own lending firm, he’d be able to do it right. He just knows everything.”

“I think both my partners are really smart people,” Fooks said. “Pavel brings a really different approach—just a grinder. The guy knows how to put his head down and just figure it out.”

The shared respect makes it easier to come to decisions, Tchourliaev said.

“We really take our time to develop our opinions and we defend our opinions to each other, but we don’t mind switching and changing our views if somebody is more correct than we are in our mind,” he said. “We don’t mind changing our perspective. We all care very, very much for this business. We all have our own perspectives and ideas, and we’re all extremely respectful of having different opinions from time to time.”

The co-founders say they’ve allowed their personalities to shape their roles within the company. They don’t put much stock in hierarchy, but Tchourliaev said he is CEO because someone needed to have that title.

“We don’t meddle in each other’s business,” Fooks said. “Nobody has to really feel like they have to get involved in each other’s day-to-day stuff. Everyone has different roles with this company, and we use our strengths to help the business get better.”

“Everything is of the utmost importance—every aspect, no matter what it is,” Schwartz said. “I think the team here sees that we’re willing to step in. No matter what their job is that they need help with, we’re happy to step in and help always.”

They have managed to maintain the careful balance of remaining friends while running a business together.

“I think working with friends is great. You have to be careful,” Fooks said. “We’ve done a really good job of making sure that we all understand what’s on the line, and everyone has the best intentions because this is really special here. Nobody wants to ruin it.”

Leave A Comment