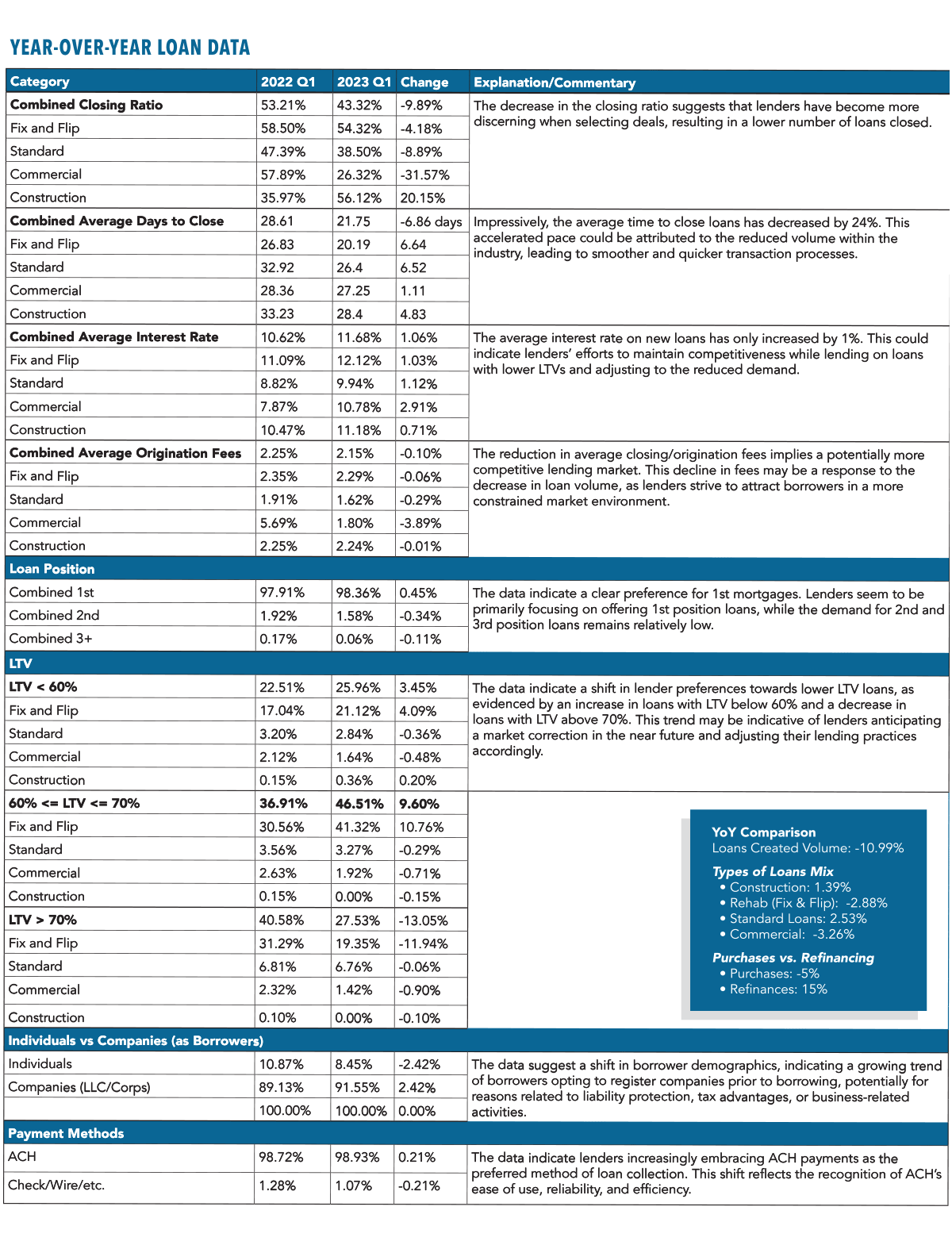

Analysis of the first quarter year-over-year changes reveals that market conditions have exerted pressure on both private lenders and borrowers.

Despite a decrease in volume, lenders have displayed a heightened risk aversion by opting for first mortgages, lower loan-to-value ratios, reduced involvement in commercial and rehab deals, and a preference for ACH as the primary payment method. On the other hand, borrowers have demonstrated a tendency to establish companies before seeking loans, accepting higher interest rates but lower fees. Further, their inclination toward refinancing existing properties suggests they are facing additional financial pressures.

Despite a decrease in volume, lenders have displayed a heightened risk aversion by opting for first mortgages, lower loan-to-value ratios, reduced involvement in commercial and rehab deals, and a preference for ACH as the primary payment method. On the other hand, borrowers have demonstrated a tendency to establish companies before seeking loans, accepting higher interest rates but lower fees. Further, their inclination toward refinancing existing properties suggests they are facing additional financial pressures.

Overall, the data suggests a mixed trend in deal volumes across different loan types. Construction and standard loans experienced an increase in deal volume, but rehab and commercial loans decreased. Economic pressures are likely playing a significant role in shaping these changes, particularly impacting the commercial and rehab markets. For more detailed data and analysis, check out the table on the facing page.

Note: The analysis is based on data exclusively from lenders who have undergone complete onboarding and actively utilized the system during both first quarter 2022 and first quarter 2023. The dataset encompasses nearly 10,000 loans in first quarter 2022, ensuring a comprehensive representation of the market dynamics during the specified period. Keep in mind that while the following loan product definitions may serve as a guide for readers, lenders self-select the loan type for each transaction they enter into the platform.

Leave A Comment