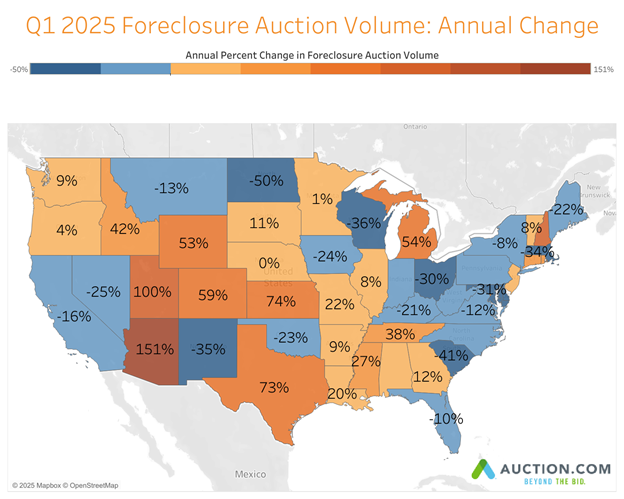

- Foreclosure auction volume up from a year ago in 26 states

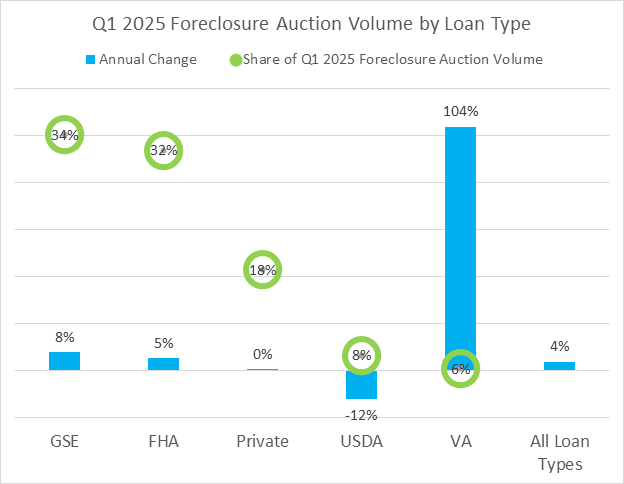

- VA foreclosure auction volume spikes 104% as VA foreclosure moratorium expires

- Auction buyers pull back on price they are willing to pay as economic volatility ramps up

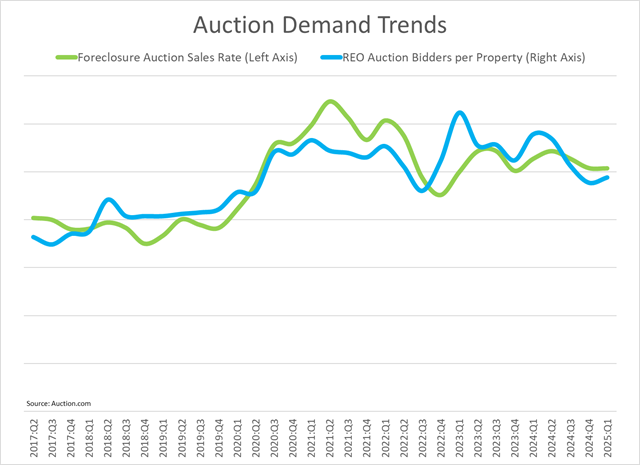

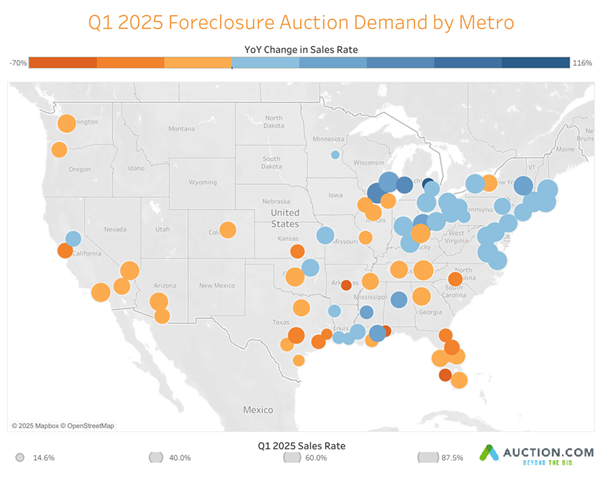

- Foreclosure auction demand down from a year ago nationally and in 50% of markets

- Bid-ask spread narrows for REO auctions, holds firm for foreclosure auctions

- Full report here

Irvine, Calif. — April 29, 2025 — Auction.com, the nation’s leading distressed real estate marketplace, today released its Q1 2025 Auction Market Dispatch, which shows that completed foreclosure auctions jumped 20 percent from the prior quarter and 4 percent year-over-year to reach a six-quarter high, propelled in part by a January spike to a 21-month high. While volume dipped in February, March closed strong with a 5 percent annual gain.

The Auction Market Dispatch is a quarterly report based on proprietary inventory, bidding, pricing and survey data from Auction.com, the nation’s largest distressed property marketplace that accounts for nearly half of all properties sold at foreclosure auction nationwide.

Foreclosure auction volume was up across all loan types except for loans insured by the U.S. Department of Agriculture (USDA). Loans insured by the U.S. Department of Veterans Affairs (VA) led the way with a 104 percent annual increase. The VA foreclosure auction spike came after a nationwide foreclosure moratorium on VA loans expired at the end of 2024.

Scheduled foreclosure auctions rose 14 percent from the previous quarter to a five-quarter high — a potential harbinger of continued elevated completions into Q2. Despite the gains, total completed auction volume remains at just 49 percent of its pre-pandemic level.

Demand signals were less decisive. Although activity started strong in January, it softened notably in February and March, keeping the overall Q1 sales rate essentially flat quarter-over-quarter and down from a year earlier. Meanwhile, buyer pricing behavior weakened — a trend more pronounced as the quarter progressed, especially among foreclosure auction participants.

Auction Demand Mixed as Buyers Pulled Back Mid-Quarter

The foreclosure auction sales rates— the share of properties available at auction that sold to third-party buyers — began Q1 on an upswing, reaching an eight-month high in January, up 1 percent year-over-year. However, February saw demand drop to a 26-month low, with rates falling 7 percent annually. March showed a partial recovery but remained 7 percent below prior-year levels.

REO (Real Estate Owned) auction activity was modestly up from the previous quarter, with bidders per asset increasing 2%. But year-over-year comparisons remained negative across all three months, culminating in a 16% annual decline.

Half of 76 major metro areas analyzed posted year-over-year declines in foreclosure auction demand (sales rate), including Chicago (down 16 percent), Houston (down 42 percent), Dallas-Fort Worth (down 19 percent), St. Louis (down 17 percent), and Atlanta (down 14 percent).

On the other end of the spectrum, 37 markets posted annual gains. Notable increases included New York (up 19 percent), Philadelphia (up 10 percent), Detroit (up 3 percent), Washington, D.C. (up 8 percent), and Minneapolis-St. Paul (up 4 percent).

Among top-performing metros in Q1 2025 in terms of foreclosure auction sales rate were Richmond, Virginia; Milwaukee; Hartford, Connecticut; Rockford, Illinois; and Providence, Rhode Island. The weakest markets included Minneapolis-St. Paul; Little Rock, Arkansas; Beaumont and Corpus Christi in Texas; and Mobile, Alabama.

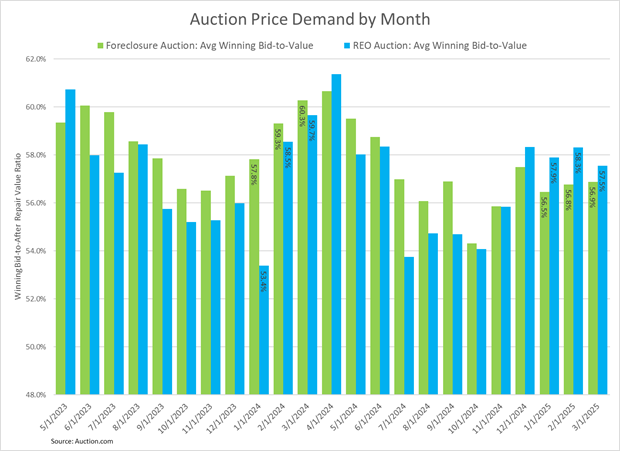

Buyer Caution Evident as Price Demand Slips Across Most Markets

Price demand — the amount buyers at auction are willing to pay relative to estimated after-repair value — flattened in Q1 2025 and trailed prior-year benchmarks. Foreclosure auction price demand held steady sequentially at 56.7 percent, up slightly from 55.9 percent in Q4 2024 but down from 59.0 percent a year earlier.

Monthly performance told a clearer story of decline in foreclosure auction price demand. The metric fell 2 percent year-over-year in January, 4 percent in February, and 6 percent in March.

REO price demand followed a similar arc — rising 3 percent quarterly and 1 percent annually to 57.9 percent — but with monthly softening. After starting strong with an 8 percent YoY jump in January, gains flattened in February and turned to a 4 percent decline in March.

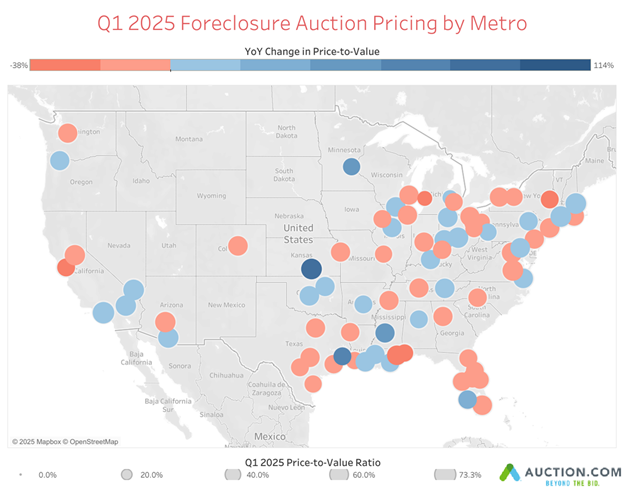

Of the 76 markets analyzed, 59 percent saw annual declines in foreclosure auction price demand in Q1 2025. Those included Chicago (down 4 percent), New York (down 1 percent), Houston (down 14 percent), Philadelphia (down 7 percent), and Dallas (down 8 percent).

Some bright spots emerged: 41 percent of markets posted year-over-year increases in foreclosure auction price demand, led by Minneapolis-St. Paul (up 57 percent), New Orleans (up 7 percent), Baton Rouge (up 5 percent), Baltimore (up 2 percent), and Pittsburgh (up 2 percent).

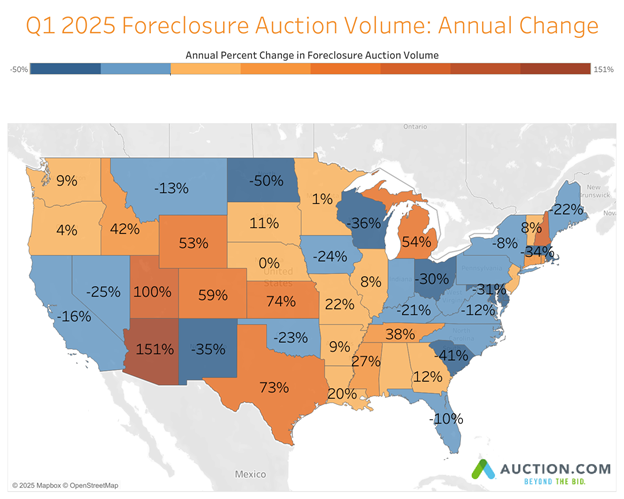

Foreclosure Volume Recovers from Lows; State-Level Variation Remains Wide

Foreclosure auction completions surged 20 percent quarter-over-quarter to their highest level since Q3 2023. The total volume recovered to 49 percent of pre-pandemic (Q1 2020) levels, up from 41 percent in Q4 2024. States seeing the most pronounced annual increases were Arizona (up 151 percent), Utah (up 100 percent), New Hampshire (up 80 percent), Kansas (up 74 percent), and Texas (up 73 percent).

Trends among top-volume states were uneven, with Texas, Illinois and Michigan posting an annual increase, and New York and Ohio posting an annual decrease.

Among states with above-100 percent foreclosure auction volume recovery relative to pre-pandemic norms were Connecticut, Colorado, Wyoming, Alaska, Louisiana, South Dakota, Minnesota, Kentucky and Utah.

Scheduled foreclosure auctions — a leading indicator of future volume — climbed 14 percent quarterly to 60 percent of pre-pandemic levels, the highest since Q4 2023.

REO supply also rose — up 2 percent quarterly and 3 percent annually — reaching a six-quarter high, though still just 39 percent of pre-pandemic levels.

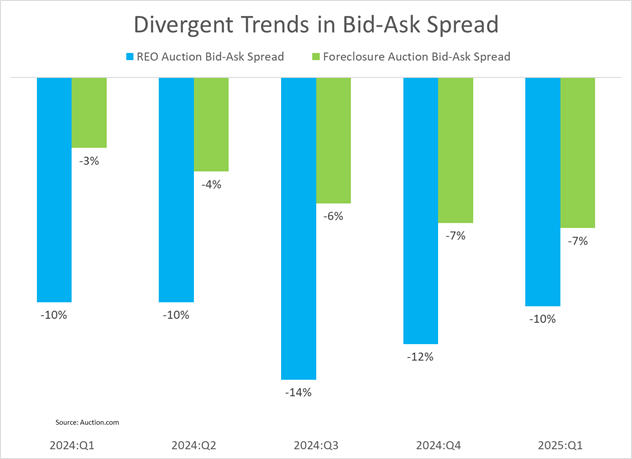

Bid-Ask Spread Signals Buyer-Seller Gap Persists

The gap between what buyers are willing to pay and what sellers are willing to accept — known as the bid-ask spread — showed diverging patterns between auction types in Q1 2025.

- Foreclosure Auctions: The spread held steady at 7 percentage points in Q1 2025, the same as Q4 2024 but more than double the 3-point spread a year earlier. The spread widened month-by-month, from 6 points in January to 7 in February and March, driven in part by an uptick in seller pricing (up 100 basis points compared to the previous quarter).

- REO Auctions: The spread narrowed to 10 percentage points in Q1 2025 from 12 points in the previous quarter, thanks to stronger buyer pricing and only minimal upward movement in seller expectations (up 10 bps compared to the previous quarter). The spread remained flat compared to a year ago.

About Auction.com

Auction.com is the nation’s leading online marketplace for the disposition of distressed residential properties. The company goes beyond traditional disposition programs, offering tools and services that stabilize neighborhoods, expand homeownership, maximize sales, shorten the sales cycle, yield higher returns, mitigate risks and elevate results. Our seller strategy includes customized and flexible programs, data intelligence and buyer insights, and pioneering technology. This includes Remote Bid®, which expands the buyer base nationwide by letting buyers bid on and win select foreclosure sales from anywhere, and Portfolio Interact™, featuring Bid Interact™. The national footprint for online and in-person auctions includes all 50 states, as well as Washington, DC, and Puerto Rico. Auction.com is headquartered in Irvine, CA, with offices in key markets nationwide.

Leave A Comment