Financing helps flippers overcome market challenges.

Flipping houses is becoming more challenging as profits get squeezed by higher home prices and increased competition. Home flippers can still be successful in these market dynamics if they flip with smarts and discipline, and private lenders still have plenty of opportunity to tap this market too.

Home flipping has grown exponentially in popularity in recent years. Certainly, many were attracted by bargain home prices in the wake of the housing crisis. More recent entrants may be enthralled by television shows that make the process appear quick, easy and full of fat profits.

As a testament to the increasing competition in the fix and flip space, ATTOM Data’s Daren Blomquist, who crunches home flipping statistics on a quarterly basis for the real estate research firm, notes that the number of entities flipping single-family homes reached a 10-year high of 43,694 in the second quarter of 2017, the highest number since the second quarter of 2007.

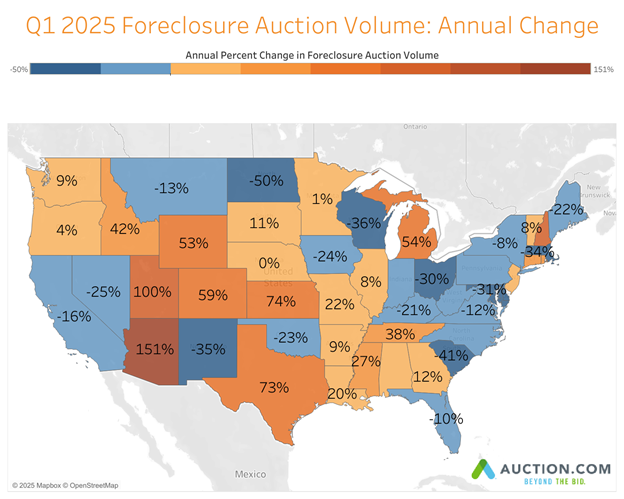

As the competition increases and prices rise, the inventory of affordable homes for purchase is dwindling. The nation’s foreclosure crisis peaked nationwide in September 2010, with approximately 120,000 completed foreclosures occurring during that single month, according to CoreLogic data. There have been approximately 7.8 million completed foreclosures nationally since the beginning of 2007. Last year, serious delinquency and foreclosure rates reached their lowest levels in more than a decade, signaling that the housing recovery is on solid ground.

Distressed properties remain a major acquisition target for home flippers, with about 39 percent of flipped homes purchased either in the foreclosure process or as REO—far lower than the peak in 2010 when the percentage was as high as 70 percent, according to ATTOM Data. Flippers look for these pockets of distressed housing because these areas also tend to be locations with strong rental markets, giving flippers a consistent pipeline of demand from buy-and-hold real estate investors seeking turnkey rentals.

Dwindling Discounts

Discounts have completely disappeared in some major markets such as Kansas City, where investors are typically paying a premium on the purchase price. Discounts are nearly gone in other major metros such as Dallas-Fort Worth-Arlington, where flippers are getting a negligible discount of -0.8 percent, according to ATTOM Data. Purchase discounts are also soft in places that include Austin-Round Rock, Texas (-1.6%); Salt Lake City (-5%); and San Jose-Sunnyvale-Santa Clara, California (-8.2%).

Conversely, large discounts are still possible in cities that still have a foreclosure overhang such as Pittsburgh; the Philadelphia-Camden-Wilmington metro; Akron, Ohio; York-Hanover, Pennsylvania; Cleveland; New Orleans; Flint, Michigan; and many others.

Even with the lack of discounts, the nation’s recovered housing market offers good news for flippers: Home prices have continued to rise rapidly in many markets, providing a hedge by helping flippers on the back-end when they get ready to sell. Nevertheless, rising homes prices can also price flippers out of some markets on the front end.

Some of these challenges may dampen interest in flipping this year, but that remains to be seen as the numbers start to come in after the first quarter. Preliminary numbers gathered by ATTOM Data at press time for full-year 2017 indicate that 2017 will likely mark an 11-year high in home flipping. Blomquist wonders, though, whether that trend will continue into 2018. The headwinds of acquisition prices, competition and rising interest rates could dampen interest.

Using Loans as Leverage

Those using all cash for their purchases will be limited by rising home prices, but flippers using financing will have the opportunity to use leverage to expand their flipping portfolio at a faster rate. `

New lenders entered the marketplace about five years ago to provide some creative spins on the traditional hard money loans that have been the mainstay for flippers. These products have included bridge loans, refinances and crowd funding. The increased competition among lenders going after real estate investors, coupled with the use of sophisticated technology and algorithms used in online lending platforms, has also brought down the cost of borrowing.

It’s a good news story for today’s real estate investor who has more financing options at a lower cost. These additional loan products have served to re-energize the home flipping market over the past five years while widening access to capital. The introduction of online lending platforms has allowed flippers to access a new source of financing regardless of where they live or where they plan to flip a home.

More than a third of flippers used financing on their flips in 2016 and 2017. That percentage rose to 36.3 percent in the second quarter of 2017, the highest since the third quarter of 2008, according to ATTOM Data.

This is far different from how flipping used to be financed. As few as 10 years ago, the typical hard money loan would have cost a flipper 15 percent interest (or more), and financing would have typically come from a local lender. Now, investors can find short-term rehab loans with single-digit interest rates and get them over the internet in as little as seven days (sometimes even faster).

This year’s expected modest rise in interest rates likely won’t affect real estate investors’ willingness to consider financing options. However, investors who hope to sell their homes to first-time home-buyers in the affordable housing sector via Federal Housing Administration (FHA) products may see demand wane from these buyers. Often first-time buyers are very sensitive to interest rate hikes that may price them out of the market.

There is a silver lining in the recent jobs and wage gain news that could temper that interest rate risk on the affordable end. Average hourly wages rose 2.9 percent in January, the highest level since 2009, while unemployment remained unchanged at 4.1. percent. The number of workers filing for unemployment claims also dropped to a 45-year low in February. Together, these economic indicators bolster the prospects of further wage growth this year, which should help soften the blow of rising interest rates.

Looking to Tertiary Markets

Still, home flippers and the private lenders who serve them, will need to look for strategies to keep profits up and expenses down to find success in today’s more challenging market.

One strategy is to consider flipping in tertiary markets that have outperformed large metros.

“Tertiary markets are receiving a lot of interest, and some of the biggest increases in the home flipping rates that we saw in the third quarter were in tertiary markets,” Blomquist said.

The three markets that saw the biggest year-over-year increases in home flipping over a year ago were all in tertiary markets. Baton Rouge, Louisiana, had the biggest year-over-year percentage change, up 140, percent, followed by Winston-Salem, North Carolina (up 58%) and Salem, Oregon (up 51%). Other tertiary markets that saw significant interest included Buffalo, New York; Tulsa, Oklahoma; Greenville, South Carolina; and Chattanooga, Tennessee.

“Flippers are migrating to those markets because they have some combination of more distressed inventory that they find at a discount or just lower price points,” Blomquist said.

He believes the momentum behind the tertiary trend is likely to continue into 2018 as the capital chasing returns will be interested even if it’s in tertiary markets. Financing and lending technology likely will help “grease the skids” of this phenomenon.

Flippers will have the option of using a locally based hard money lender, but they will have many other lending options as well. Today’s national, sophisticated online lenders are willing to lend in these smaller markets and don’t require a bricks-and-mortar presence to lend in a particular city.

These many financing options should continue to energize the flipping market as it moves further from a distressed, all-cash marketplace into one that focuses more on at-market homes purchased with financing that allows leverage and faster portfolio growth.

Leave A Comment