Inflation is affecting real estate investor insurance rates—and will hurt returns.

Insurance premiums across the board are increasing at a fever pitch due to rising inflation and the increase in catastrophic weather events. Although there are a few practical ways to keep insurance costs from rising, inflation, labor trends, supply chain issues, and weather events are all out of the control of investors—and their wallets are likely to bear the burden.

Let’s take a look at how inflation is directly impacting real estate investors, from an insurance perspective, as well as a few of the options for avoiding unnecessary increases in premium price.

Calculating Insurance Premium Pricing

When calculating premium pricing, insurance companies look at a variety of factors to determine the policy cost. These factors include, but are not limited to:

- Number of claims

- Type of claims

- Age of the home

- Age of the roof

For example, about 70% of a policy is priced on the value of the property’s replacement costs, known as “coverage A.” If materials and labor have risen an estimated 20% since last year, you can typically expect your policy to go up 14% based on the replacement cost alone.

Here’s what that math ends up looking like:

70% of premium x 20% = 14% increase in premium costs

Let’s assume we have a three-bedroom, two-bathroom, single-family rental located near Cleveland, Ohio, with an annual premium of $1,500. The premium may now be closer to $1,710 a year.

Here’s what that math looks like:

$1,050 (70% of Premium) x 20% = $210 increase in premium costs

Why Insurance Likely Increased This Year

Housing material and labor costs have increased. Material and labor directly affect insurance premiums due to the replacement cost. Replacement cost, based on how it is calculated, makes up a majority of the cost of your insurance premium.

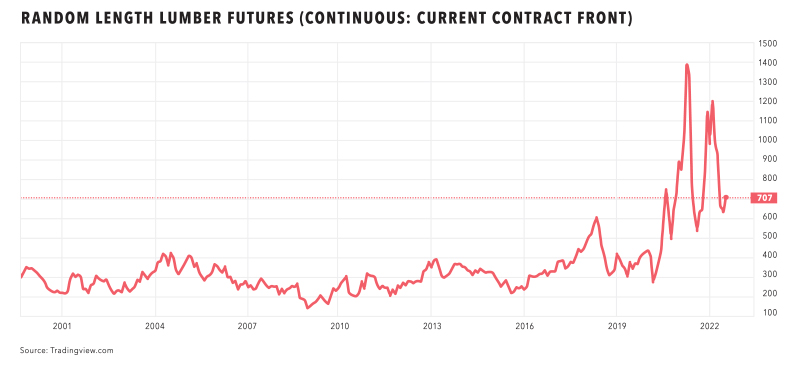

Rising costs of materials. We have all seen the price of lumber rising along with other commodities associated with rebuilding a home. Because overall buying power has been reduced, the price for materials alone has gone up exponentially.

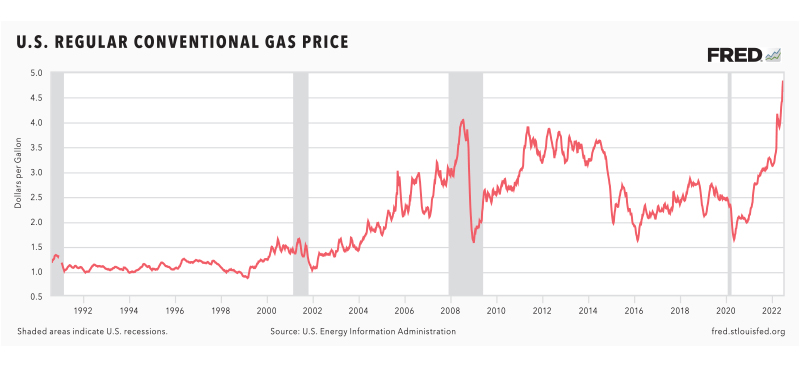

Price per gallon of gas. The price of gas by the gallon directly affects the cost of the transportation of all goods,including the importing and transporting of building materials. As gas prices continue to rise, suppliers, service providers, and retailers across the country need to adjust their prices. This leads to an increase for nearly all goods and services, including those required to repair and replace homes. Insurance providers also must account for the increase in prices, which is reflected in their insurance premiums.

Rising cost of lumber. Lumber futures, although down from earlier in the year, are still up tremendously from pre-pandemic levels. The dramatic increase strains all industries requiring lumber, including those involved in replacing dwellings. The extremely high demand for new housing also factors into the increasing replacement costs for existing dwellings.

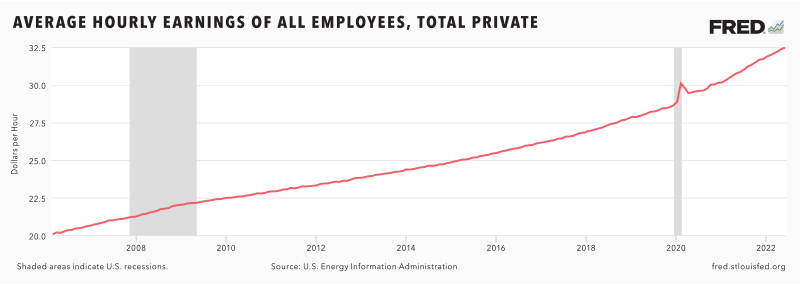

Labor shortages. Wage increases impact the rebuild cost of a property. Supply and demand also increased the cost of skilled labor. Supply of labor has been limited due to a national shortage of trade workers. As of April 2022, the construction industry is down by about half a million skilled workers. When you combine those two factors, the results are wage increases of more than 10% year over year. The trend is not expected to slow during the next 12-18 months.

With roughly 20% of the replacement cost of an investment property being labor cost and commodity cost, the price to replace a property has increased significantly due to no fault of the insurance company. When those costs increase, the price of insurance premiums will likely increase as well—upward of 20%-30% year over year in some areas.

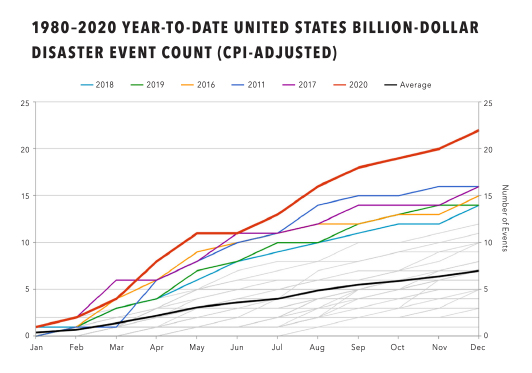

Severe weather. Catastrophic storms have increased in severity and frequency. 2020 produced 22 billion-dollar storms—smashing the previous record of 16. Many have predicted that 2022 is likely to be a particularly bad year in terms of weather.

Increasing rents. A small, but significant percentage of a policy cost pays for a displaced tenant and the lost revenue on a property (Coverage D with most carriers). As rental income climbs, so does the premium. This is important to note: Between 5%-10% of premium costs land in this section. Rents in many areas have gone up as much as 20%-25% in the last 18 months. With increases like this, you can expect a policy premium to adjust in kind.

Here’s what this looks like:

20% (rent increases) x 5% (premium costs) = 1% gross premium increase

This also serves as a reminder to continually update a property’s income and to ensure investors make these policy adjustments annually.

Options for Reducing Premiums

Despite the rising costs of goods and services, increased severity of catastrophic weather events, and other factors linked to the rise in insurance premiums, real estate investors have options.

Here are several things investors can do to avoid unnecessary increases in insurance premiums:

- Remaining claims-free for five or more years

- Consistently maintaining property to avoid deferred maintenance issues and claims

- Exploring payment options like automatic payments or paying for the year in full

- Increasing the deductible

- Replacing roofs that are 20+ years old

- Considering new or different building materials that help reduce risk when building new

The cost of insurance is rising, and debt service coverage is the name of the game. Increases in expenses may make underwriting and getting a loan more challenging. It also creates risk for lenders when the borrower tries to obtain a policy that is as cheap as possible to make sure they can close. Borrowers facing cash crunches will likely forgo coverages or may even default on the insurance in an effort to pay for the debt service. Be prepared to see higher-than-average deductibles, lower liability limits, and borrowers attempting to game the premium cost by calculating replacement cost at a level that may turn out to be unacceptable.

As an investor, be sure to ask your insurance companies how they can help borrowers avoid high-cost insurance.

Leave A Comment