Eliminate overly-subjective and intentionally misrepresented influence to safeguard every loan you originate.

Whether your lending business has been affected or not—and whether you’ve been aware of recent issues that have impacted many reputable lenders in our space or not—one simple truth exists: The possibility of fraud in valuation exists. When left unchecked, it can cause material financial consequences for lenders of any size.

At its core, risk in valuation lies in one thing: subjectivity. In most cases, an appraisal relies on just three comparable sales, or “comps,” to establish value. Because the appraiser chooses which comps to include, how to adjust them, and which sales to leave out, a large degree of discretion is at play. That subjectivity opens the door to another vulnerability: borrowers who try to influence, sway, or even bribe appraisers during the site inspection to ensure favorable comps are used.

This discretionary selection of comps, with additional discretionary adjustments, is the entire basis for establishing a property’s value. The loan, its LTV, and its risk parameters are materially based on this property value, whether it be for as-is value or after-repair value. And therein lies the real risk.

The two biggest risks in valuation, then, are:

Three Comps. Value is determined based on the discretionary selection of only three comparables, with no transparency into other sales in the area.

Borrower Interaction/Influence. As the industry has seen recently, bad actors can systematically exploit this weakness by influencing and even bribing appraisers during site inspections. The result? A predetermined set of comps and a manipulated property value.

In private lending, value is everything, and beating the valuation risk is easier than you might think. Let’s look at two approaches in detail.

Approach #1: Primary Valuations

If you’re a lender with flexibility to design and adjust your valuation policies, then this option is available to you—ordering valuation products that minimize risk.

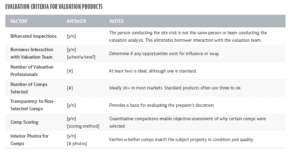

Ordering third-party valuation reports establishes value in a more comprehensive way. The accompanying figure offers a set of criteria that can be valuable in your search for the best valuation products to protect your capital.

Valuation reports with bifurcated inspections reduce borrower interaction and the risk of influence or bribes. Reports that use a larger set of comparable properties instead of three discretionary comps provide a more objective analysis—one that is less vulnerable to subjectivity and manipulation.

As we’ve seen with Kiavi, even the largest lenders active in the securitization markets can design their own approach to valuations.

Approach #2: Secondary Checks

Sometimes standard appraisals are required, either because lenders lack flexibility in their capital stack or because certain portfolio segments face outside requirements (e.g., RTL vs. DSCR loans, in-house warehouse line vs. outside loan sales).

For these lenders , valuation risk remains key, because lenders can be subject to repurchase risk, and/or losses on balance sheet loans, which end up with collateral that is worth materially less than what the appraisal stated.

In this situation, the best approach is to find a scalable, cost-effective way to run diligence on each appraisal, either by ordering a third-party review or by conducting an internal review.

In either case, lenders should seek partners or adopt an approach that will provide an objective, independent, and wider look at the market. Options for appraisal review can include a third-party assessment, a software platform to facilitate internal review, or just a simple “by-hand” checklist for internal review.

When developing an internal review checklist or when selecting a third-party product for appraisal review, be sure to include factors that help you identify and mitigate the most risk. At a minimum, consider the following:

Evaluate the comps they selected.

Evaluate the comps they excluded.

Apply common assessment factors (e.g., sale date, location, property characteristics, condition, and final valuation conclusions).

Whether your lending shop has the flexibility to use enhanced valuation products as the primary valuation, or you must meet stricter outside requirements that require an appraisal, there are practical, cost-effective steps you can take to better mitigate valuation risk.

Rodney, 1000x yes! We are a direct RTL and DSCR lender and rely upon internal valuations for our RTL loans. 18 months ago, we started using the same internal staff to do a second appraisal on the DSCR originations. We flag appraisals that are 10%+ higher than our internal appraisal. On retail originated loans where we’re ordering the appraisal through an AMC, 10% of loans get flagged! It was higher than I expected. On TPO originated loans where we’re taking in a transfer appraisal, that figure was also 10%. I expected a difference, but didn’t see one – UNTIL, 120 days ago, when TPO originated loans went from 10% to 15% to 20% to 25% in just 4 months. Something is up with broker originated DSCR loans. I think borrowers are working with brokers to find proceeds, not the best rate. A canary in the coal mine for an uptick in TPO delinquency, I think.