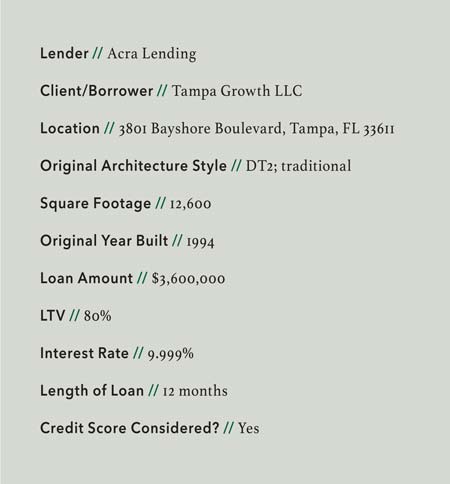

The lender provided a jumbo bridge loan that closed in 10 days and structured the deal in a way that allowed the borrower to purchase at below-market price, flip the property, and turn a profit.

An Opportunity—and a Challenge

What if a borrower approached you about purchasing an expensive and exclusive property on the water in one of the hottest markets in the nation? They’ve done their research and feel confident they can make a great profit if they can purchase this property below fair market value and line up a buyer. And they believe the lender on the deal will benefit greatly too. Would you be prepared to be that lender?

What if a borrower approached you about purchasing an expensive and exclusive property on the water in one of the hottest markets in the nation? They’ve done their research and feel confident they can make a great profit if they can purchase this property below fair market value and line up a buyer. And they believe the lender on the deal will benefit greatly too. Would you be prepared to be that lender?

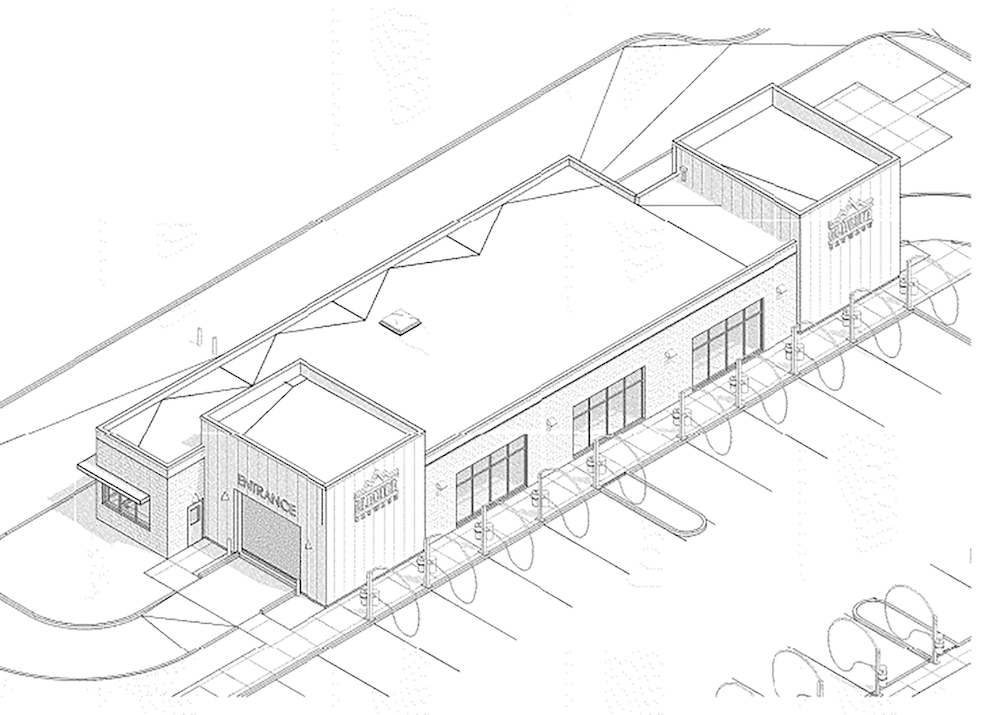

Tampa Growth LLC experienced such an opportunity when they found a 12,000-square-foot home in Tampa on famous Bayshore Boulevard for $5 million, which was under market value.

The challenge? They needed to close quickly to make the deal happen.

Solution

Tampa Growth pulled it off by finding a partner in Acra Lending. Acra not only could fund the transaction but also could structure the deal favorably and get the funds to Tampa Growth in time to meet close of escrow (COE).

Tampa Growth knew that locking the property down quickly in a rapidly changing market was critical to making the purchase at under fair market value, doing a quick flip to the buyer they had lined up, and turning a great profit. Tampa Growth just needed a few months after purchase to close with the new potential buyer, earning great potential in profit, and assisting the new buyer with the purchase.

With Acra Lending as their partner, Tampa Growth was able to obtain a 12-month jumbo bridge loan that closed in 10 business days from appraisal to loan submission. No PPP was involved, and terms included a minimum of four months interest only.

With Acra Lending as their partner, Tampa Growth was able to obtain a 12-month jumbo bridge loan that closed in 10 business days from appraisal to loan submission. No PPP was involved, and terms included a minimum of four months interest only.

Acra Lending was able to educate Tampa Growth about their guidelines and how to structure the deal. In this syndicated transaction, multiple LLCs were set up to assist as grantors, with one entity holding the closing funds, assets, and liquidity.

The LLC established to hold the funds to close requested there be limited liability to the grantors due to millions in assets, their experience in the business, and the millions in liquidity offsetting the layered risk. The request was granted with certain clauses.

Outcome

All parties achieved their goals in profit and fees, and the transaction was a success.

Leave A Comment