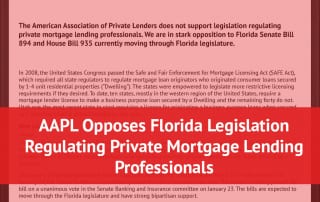

New Florida Law Raises Concerns for Florida Private Lenders

Law restricts certain foreign persons from acquiring real property in Florida. A new Florida law is raising concerns for private lenders. Although its greatest impact is on transactions that finance Florida real property purchased by certain foreign persons associated with the People’s Republic of China, it also affects transactions that finance the property purchases of [...]