Roc Capital demonstrates how private lending supports an ecosystem of affordable single-family workforce housing.

In today’s rising interest rate environment, single-family rental homes have become an attractive alternative for prospective homebuyers seeking an affordable and flexible solution to their housing needs. As demand shifts from owning to renting, private lending fills an important void by providing quick funding for the rehab of non-owner-occupied investments (1-4 units) and debt service coverage ratio (DSCR) loans for landlords.

In today’s rising interest rate environment, single-family rental homes have become an attractive alternative for prospective homebuyers seeking an affordable and flexible solution to their housing needs. As demand shifts from owning to renting, private lending fills an important void by providing quick funding for the rehab of non-owner-occupied investments (1-4 units) and debt service coverage ratio (DSCR) loans for landlords.

Private lenders are an essential component within the larger ecosystem by priming additional housing stock to be used either as single-family rentals or homes for first-time homebuyer within a workforce community. They provide the needed capital to build, update, and stabilize single-family properties; convert office and retail units to residential workforce housing; and convert single-family properties to 1-4 unit multifamily properties (including adding ADUs).

Fix-and-flippers that acquire, rehab, and stabilize affordable properties usually live within close proximity to their investments and provide vital support to their communities by hiring locally. However, as capital becomes scarcer in today’s market, maintaining adequate liquidity for these types of workforce housing and Section 8 projects can be challenging. Private lenders can bridge the gap but have fewer options for capital sources as well.

Roc Capital Teams with Riparian Capital Partners

Roc Capital’s white-label table funding model provides reliable institutional capital that is balance-sheet-lite and operationally efficient. It is a less risky capital option for private lenders looking to diversify their product offerings and better align with the needs of entrepreneurial fix-and-flip and landlord investors. Most important, with Roc’s programs, the spigot of liquidity remains open to private lenders focused on lending into affordable housing communities, even as capital markets have been dislocating.

The use cases for deploying private institutional capital to workforce communities extends beyond serving as a fast and efficient funding source for private lenders working with entrepreneurial investors on a smaller local level. Roc Capital also works with commercial brokers who facilitate the funding of larger turnkey SFR portfolios within workforce neighborhoods. Many middle-market owner/operators are looking for turnkey, renovated workforce housing units they can stabilize with a bridge loan or longer-term financing if they plan to add the units to their portfolios.

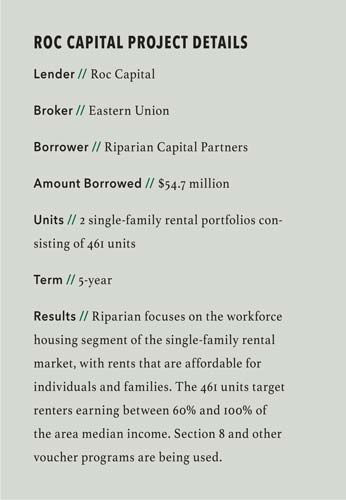

Riparian Capital Partners, which has one of the largest single-family rental portfolios in the mid-Atlantic area, focuses on the workforce housing segment of the SFR market, with rents that are affordable for individuals and families.

The company, which owns more than $125 million in assets under management, secured $54.7 million in financing to incorporate two newly acquired single-family rental portfolios into their existing managed portfolio. Eastern Union arranged the financing, which was provided by Roc Capital. Both the acquisition loan for the former and refinancing for the latter carry five-year terms.

“The 461 units target renters earning between 60% and 100% of the area median income.”

The portfolios, acquired by Riparian Capital Partners in October 2020 and December 2021, are comprised of 461 units, all located in workforce communities within Baltimore, Maryland. The units target renters earning between 60% and 100% of the area median income. Section 8 and other voucher programs are being used.

Working with Institutional Capital

Institutional capital is also being put to work on other new construction projects to meet the growing demand for rentals. Recently, JP Morgan and Haven Realty announced a joint venture to develop and acquire $1 billion in build-to-rent communities throughout the U.S. These types of ventures will help address the shortage of housing; however, demand for housing continues to grow faster than supply.

The lack of housing supply as well as rental stock is putting a major strain on affordable housing. A Freddie Mac report released in 2020 cited the nation was short some 3.8 million units, up from 2.5 million in 2018. According to Census Bureau data, owner-occupied housing levels have increased by 11% during the past five years, yet the number of rental housing units has grown by less than 1.5%. In fact, the share of rental housing today (30.9%) is less than it was five years ago (31.8%).

Yet, the demand for single-family rentals appears to be growing at a fast pace. This is partly due to the rising costs of home ownership. A June 2022 New York Time’s article, “Cost of Owning a Home Surges Above Cost of Renting One,” cites a new report from John Burns Real Estate Consulting that reveals having a mortgage is far more expensive than having a lease. This could explain why a sizable share of current homeowners have an interest in single-family rentals. According to a July consumer survey of nearly 1,350 owners and renters, John Burns Real Estate Consulting discovered that “one in four owners would live in a rental house if they could find a place that meets their exact needs.”

Yet, the demand for single-family rentals appears to be growing at a fast pace. This is partly due to the rising costs of home ownership. A June 2022 New York Time’s article, “Cost of Owning a Home Surges Above Cost of Renting One,” cites a new report from John Burns Real Estate Consulting that reveals having a mortgage is far more expensive than having a lease. This could explain why a sizable share of current homeowners have an interest in single-family rentals. According to a July consumer survey of nearly 1,350 owners and renters, John Burns Real Estate Consulting discovered that “one in four owners would live in a rental house if they could find a place that meets their exact needs.”

The goal of creating more affordable housing requires not only the construction of additional housing but also a harmonious balance of both homeowners and renters. According to a 2021 report by Harvard’s Joint Center for Housing Studies and AARP, “the most livable neighborhoods offer the most diverse set of housing options, including multifamily and rental opportunities as well as single-family and owner-occupied homes.”

Private lending has played a key role and will remain an essential component to connecting institutional capital sources with both small- and large-scale affordable housing projects across the U.S.

Leave A Comment