Working with a trusted borrower, balance sheet lender We Lend chose an alternative to foreclosure when construction on the property did not progress as the loan reached maturity.

The Situation

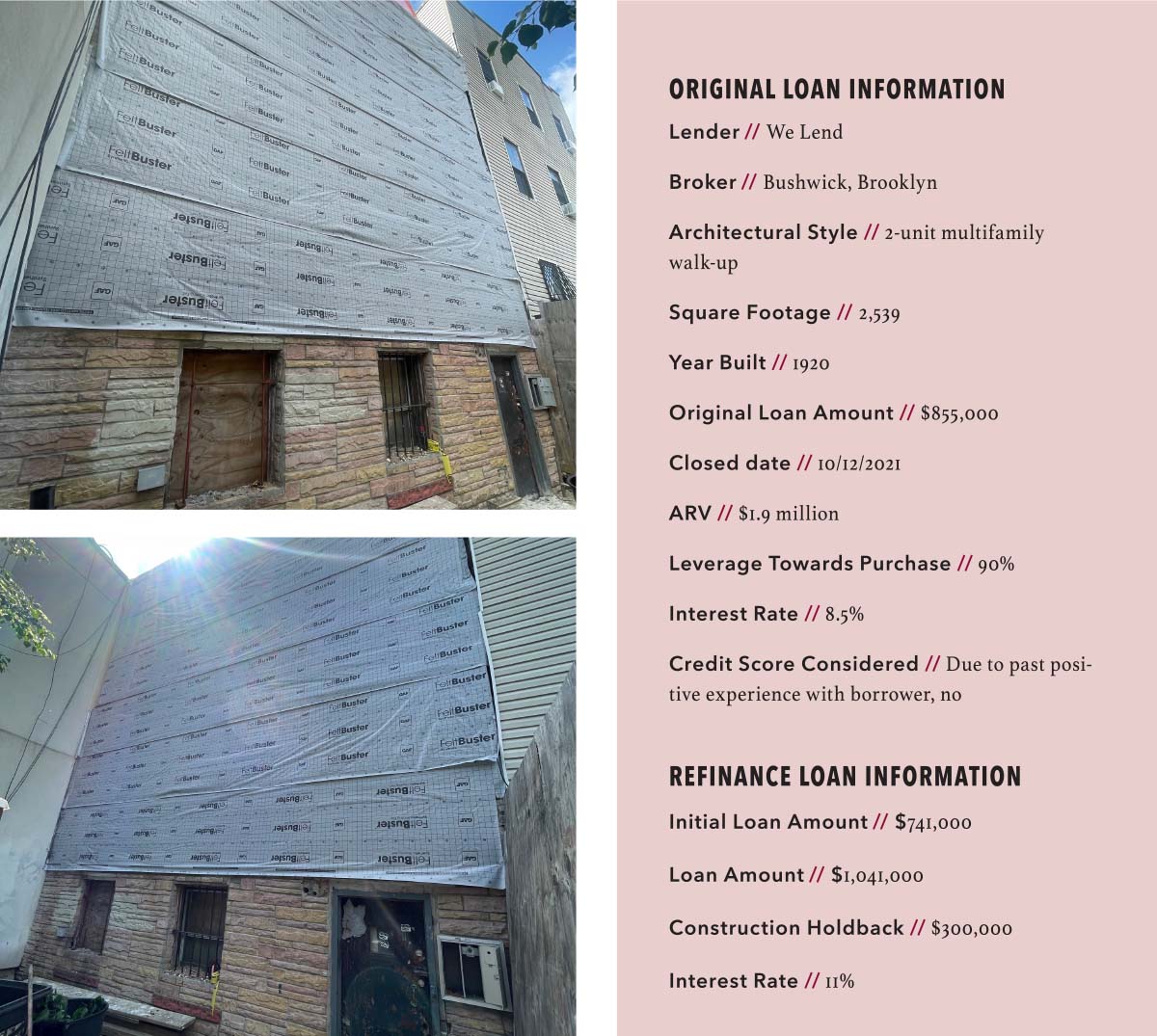

Just over a year ago, We Lend funded a loan for a borrower for whom we’ve completed 25 loans. In this particular deal, the borrower had purchased a home already burdened with a stop-work order and various city violations prior to their purchase. Because The Department of Buildings had issued a stop-work order, the project was essentially mid-construction at the time of the property’s purchase. Since their purchase of the property, the borrower has dealt with persistent preexisting violations and the slow bureaucracy of the Department of Buildings. Still, the borrower has demonstrated a good faith effort to resolve these issues and move the renovation forward as much as possible.

The Solution

As a balance sheet lender, We Lend was able to demonstrate flexibility and offer a loan extension as the loan reached its maturity date with little movement on the renovation and a partial stop work order still in effect. We were able to do this in spite of these circumstances because of our knowledge of the property’s status prior to closing, extensive history with the borrower, and the borrower’s transparency with their progress.

As of this publication date, there is still a partial stop work order in effect that is expected to be lifted any day. As the expiration of the extension draws near, We Lend is structuring a bridge refinance with the borrower to allow completion of the extensive renovation project, rental of the property, and an exit into a term loan within the next 12 months.

Default Isn’t Always the Answer

In today’s environment, many institutional lenders are inclined to default a borrower if their loan matures without any noticeable progress. This often leads to the unfortunate result of foreclosure. However, as a balance sheet lender that retains loans on our own books, we’re fortunate to be able to prioritize our clients’ interests and align ourselves with their goals. We are committed to supporting our borrowers’ success.

Leave A Comment