Current home flippers infuse the housing market with quality, affordable inventory.

Proposed legislation in New York could make it harder for real estate investors to finance real estate renovation projects, which could further limit the supply of affordable housing inventory in the state, according to an analysis of home flipping data from the last two decades.

New York State Assembly Bill A1420 and its corresponding Senate Bill S10610 would require private lenders to obtain licensing if they offer financing products of $500,000 or less, according to the American Association of Private Lenders (AAPL).

Paul Alexander, legislative director for State Sen. James Sanders Jr., who is sponsoring the legislation in the state senate, said by email that the legislation was written to “prevent unfair business practices” from happening, due to the fact that “currently, non-traditional commercial lenders are allowed to operate without being licensed in New York State.”

Kevin Carmody, legislative director for Assemblywoman Kimberly Jean-Pierre, the state house sponsor, provided some more detail on the bill’s intent.

“The bill intends to license alternative/non-traditional lenders who have popped up as an alternative way for businesses to receive a loan,” Carmody wrote in an email response to questions about the legislation, noting that it has received support from the fintech industry. “These types of lenders mostly originated from the internet age because many of their loans are given out quickly over the internet. They are not a traditional ‘financial institution,’ so they can get around being regulated now. These lenders mostly provide their services to small businesses who may not realize what they are getting themselves into.”

Many in the non-traditional lending space don’t see it that way.

“The government does not need to come in and solve for a problem that does not exist. We’re not talking about payday loans. We’re talking about two commercial entities engaged in a business transaction,” said Jeffrey Tesch, CEO at RCN Capital, a Connecticut-based commercial lender focusing on both single-family and multi-family loans for real estate investors.

Tesch said RCN would likely continue to lend to real estate investors in New York, even if the new licensing regulations were signed into law—albeit with the hiring of new employees needed to monitor compliance. He thinks smaller lenders with less capital would likely exit the New York market.

“Those smaller lenders wouldn’t be able to afford to do it, and you’re just going to squeeze capital out of the marketplace,” Tesch said. “That capital is going to rehabilitating property that’s often not just distressed but actually uninhabitable.”

Investors Cast as Villains

Previously proposed New York legislation more directly targeted real estate investors rehabbing and reselling homes in New York City. In 2019, Assembly Bill A5375A and its Senate counterpart S3060E proposed a new tax on the transfer of property that occurred within two years of the prior transfer. According to RealtyTimes, this new “flip tax” would amount to 20% for properties resold with 12 months of the prior sale and 15% for properties resold within 24 months of the prior sale.

Both the “flip tax” legislation and the more recent private lender licensing legislation are in committee and may never end up as law. Still, both provide evidence that some politicians consider real estate investors as the villains of the housing market, particularly investors who rehab and resell homes in relatively short timeframes for a profit.

Data supporting the investors-as-villains narrative is certainly more readily available when looking at the years leading up to the 2006 housing bubble and 2008-2009 Great Recession. Many new rookie real estate investors were lured into speculative home flipping—often without adding much value to the home between purchase and resale—by loose lending standards and the skyrocketing home prices those loose standards enabled.

A total of 374,107 homes were flipped in 2005, and another 333,155 homes were flipped in 2006, according to data from ATTOM Data Solutions. ATTOM defines a home flip as a second sale of a property within a 12-month period. Those were the two highest years for home flipping volume going back to 2000, the earliest that data is available. Home flips in both years represented 8% of all home sales.

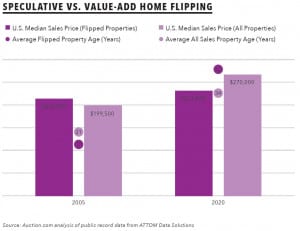

A deeper dive into the 2005 data reveals many properties being flipped were newer properties likely to be in good condition and in not much need of rehab before a resale. The average age of properties flipped in 2005 was 17 years, the lowest as far back as data is available—and an average of four years newer than the average 21 years of age for all homes sold during the year.

A deeper dive into the 2005 data reveals many properties being flipped were newer properties likely to be in good condition and in not much need of rehab before a resale. The average age of properties flipped in 2005 was 17 years, the lowest as far back as data is available—and an average of four years newer than the average 21 years of age for all homes sold during the year.

Second, the median price of flipped properties in 2005 was $213,000, or 7% above the $199,500 median price of all home sales for the year. This indicates many of the flippers from this era were simply riding the coattails of a hot market rather than adding value to the market through the renovation of distressed properties that still represented affordable inventory even after the rehab.

The 2005 and 2006 home flipping data, along with ample anecdotes documented in pop culture (see The Big Short), point to real estate investors as being part of the problem leading to the housing crash in 2008. The speculative buying and reselling with little value added contributed to the home price bubble. The low- or no-doc loans supporting this speculation were the tip of the spear that eventually burst the home price bubble.

Value-Add Home Flipping

But that narrative of real estate investors as villains doesn’t hold up in more recent years with the tighter lending standards and aging housing stock that is often in need of extensive rehab.

The ATTOM data show 233,602 home flips in 2020, representing 6% of all home sales for the year. The average age of properties flipped in 2020 was 42 years, the oldest average age on record and nearly 2.5 times the average age of properties flipped in 2005. Unlike in 2005, when flipped properties were four years newer on average than all homes sold, flipped properties in 2020 were an average of eight years older than all homes sold during the year. These older properties are more likely to have deferred maintenance and need extensive rehab.

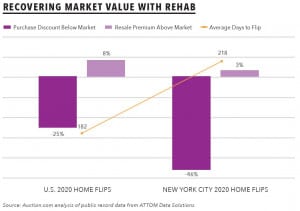

Because they are purchasing distressed homes in need of extensive repairs, home flippers in 2020 purchased at a discount, 25% below estimated “after-repair” market value on average. But they resold at a premium—8% above market value on average—a result of the significant value added with rehab. This is according to the deeper dive into the ATTOM data.

This value-add home flipping also shows up in the New York City market. In the five boroughs of New York City along with Long Island, homes flipped in 2020 were originally purchased by the real estate investor for an average 46% discount below “after-repair” market value. The bigger discount in New York City compared to nationwide was likely because of more deferred maintenance and rehab needed for the much older properties in New York City (95 years old on average compared to 42 years old nationwide). But the flipped New York City properties still resold at a premium of 3% above estimated “after-repair” market value, indicating substantial renovation on the part of the real estate investor.

It’s important to note these are not quick home flips. The extensive rehab requires more than just a few weeks, contrary to what might appear to be the case on HGTV. Nationwide, the average home flip in 2020 took more than six months (182 days). In New York City, the average home flip took more than seven months (218 days).

That’s certainly true for Michael Hallman, a Chicago-area real estate investor who renovates and resells between 12 and 20 properties a year, after purchasing many of them as distressed properties on platforms like Auction.com.

That’s certainly true for Michael Hallman, a Chicago-area real estate investor who renovates and resells between 12 and 20 properties a year, after purchasing many of them as distressed properties on platforms like Auction.com.

“I buy and sell properties like I was going to go ahead and live in them. Or a family member was going to live in them. So, we don’t really cut any corners. We go ahead and we make sure everything is done,” said Hallman, adding that neighbors are appreciative of the work he does on his investment properties. “People just love that for their block and for their community, and you’re going to increase the value of their neighborhood and their house as well.”

Affordable Owner-Occupied Housing

Hallman resells most of his properties to owner-occupants, helping to improve homeownership rates in the neighborhoods where he invests. This holds true for most investors purchasing on the Auction.com platform, according to an analysis of more than 28,000 properties sold to third-party buyers at the foreclosure auction via Auction.com in the four quarters ending in first quarter 2020.

The analysis used public record data and data from the multiple listing service (MLS) to identify which properties had subsequently resold as well as tax assessor data to identify which properties were owner-occupied after that subsequent resale. More than 70% of the subsequent resales were owner-occupied as of the first quarter of 2021.

Hallman and investors like him are also a source of much-needed affordable housing inventory. The median sales price of homes flipped in 2020 was $233,000, which is 14% below the median sales price of all homes sold during the year. That stands in stark contrast to the 7% above the overall market that home flippers were selling for back in 2005.

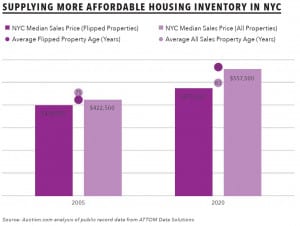

This pattern plays out in New York City as well. The median sales price for homes flipped in the five boroughs and Long Island in 2020 was $475,000, or 15 % below the overall median price for all homes sold for the year. Additionally, homes flipped in New York City in 2020 were 95 years old on average, 12 years older than the average age of all homes sold in the city during the year.

Leave A Comment