While private lenders are the oldest form of financing, the banking industry gained prestige and influence year over year. Ask anyone where they can get financing for projects and most will say a bank. Bank are large, organized and visible.

Their branches litter streets across the country – across the World. Why? Because they are what people know.

Still, banking scandals and failures continue to fill the news. People are still losing trust in banks. Consumers trust and confidence levels eroded significantly following the 2008 financial collapse, when the role of the megabanks was revealed.

Earl Warren, former Supreme Court Justice, said, “I hate banks. They do nothing positive for anybody except take care of themselves. They’re first in with their fees and first out when there’s trouble.”

The truth is that ethical issues in banking are the same issues that private lending professionals have been fighting for generations. The same issues affect everyone. Even if you don’t work in the financial filed, you’re a consumer of the services.

The public seems to have the perception that those in the financial sector are more unethical than any other business. The misconception persists for several reasons. First, the industry itself is vast. It includes securities firms, insurance companies, fund management organizations, credit agencies, capital management, private mortgage lenders – any company doing business in the arena of finance. Due to the size alone, the industry tends to reap headlines, many of which peddle its ethical lapses.

Think about $50 trillion in assets growing at 8 percent a year – that’s more than twice as fast as any gross domestic product. Even with the amount of regulation on banks – and the lack of realistic framework for private lenders – theoretically, there are a higher percentage of bad transactions happening every day that identified and reported, conceivably more so than in other less regulated industries.

Nevertheless, consumers don’t care about the excuses of how large of an industry it is when ethical lapses occur. Those ethical lapses are personal and we all have a responsibility to represent the industry the best we can.

Be the new breed of lender dedicated to providing funding for local communities and individual borrowers by using modified sets of criteria that would be unacceptable to banks or other traditional sources of capital. Consumers are looking for organizations and products that are compatible with what they believe.

Help change the perception of private lending by fighting the predatory lenders that demand up-front fees and damage consumers’ credit scores. Be genuinely committed to getting your borrower our of debt instead of profiting from it.

Markkula Center for Applied Ethics discussed five reasons why offenses happen:

Self-interest sometimes morphs into greed and selfishness. This sort of greed becomes a kind of accumulation fever. “If you accumulate for the sake of accumulation, accumulation becomes the end, and if accumulation is the end, there’s no place to stop,” said Ronald Duska, Markkula Center Chair of Ethics. The focus shifts from the long-term to the short-term, with big emphasis on profit maximization.

Some people suffer from stunted moral development. This happens in three areas: failure to be taught, failure to look beyond their own perspective, and the lack of proper mentoring. So, what if you went to business school? Most often they tend to reduce everything to an economic entity: the fundamental purpose of business is to make money, maximize profit and increase shareholder value. How many students ever questioned the fundamental purpose of something? It’s the ultimate ethical questions: What’s your purpose?

Some people liken moral behavior with legal behavior. People content that the only requirement is to obey the law. They tend to ignore the spirit of the law in only following the letter of law, disregarding the fact that even though an action not be illegal, it still may not be moral.

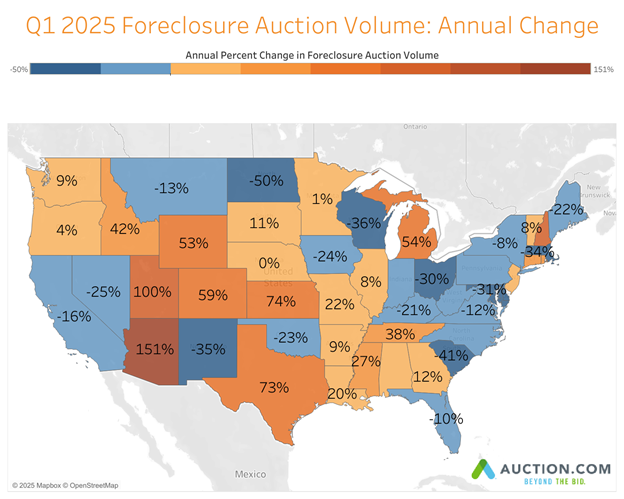

For example: When an investor has to move a home into foreclosure it’s often because the owner is suffering the “3 D’s: death, divorce or disease.” Just when a person is struck by tragedy and needs all the comfort of home, a failure to make a payment (or two) leads to endless phone calls and letters from lenders (or collectors for lenders.)

Legally, could a lender follow through with a foreclosure if an agreement is broken? Of course.

To avoid looking unethical – as if you didn’t originate a loan based solely on the desire to see the recipient fail so you could obtain the title – consider loan modifications, forbearance agreements, and repayment plans so foreclosure can be avoided.

Professional duty can conflict with company demands. A faulty reward system could induce unethical behavior. A purely self-interested agent would choose that course of action which contains the highest return to him or herself.

Individual responsibility can wither under the demands of the client. Sometimes the push to act unethically comes from the client. How many people expect their accountants to pad their expenses where possible? How many clients expect their insurance agents to falsify their applications or claims? It’s a temptation once you have a relationship with the client, you really want to help you client out. That’s just another conflicting loyalty.

Who’s responsibility is financial security?

Let’s start by saying that consumers need to be better informed. It doesn’t necessarily mean that they need to know everything about the service you are offering, but they should know enough to ask the right questions.

With the financial world in a constant state of change, you need to be educated enough to answer those questions accurately. Strategies that worked a few years ago don’t always apply today. There are plenty of opportunities you can take advantage of to generate positive results instead of practicing “accidental ignorance” and putting yourself and/or your company in jeopardy of acting unethically.

Being socially responsible or practicing responsible lending has been making an imprint on the financial marketplace around the globe. Solid rates of return and sustained level of success have posted through turbulent markets and are attracting institutional investors. A corresponding grassroots movement in the mortgage and personal loan market may signal the beginning of a much larger trend. A trend that fights back against fraudulent transactions by scam artists and works on repairing the unethical reputation that private lending has been plagued with.

This article was originally published in Private Matters Today, Issue 07, Winter 2017.

Leave A Comment