Investors will likely gain a bigger advantage in acquiring properties on the retail market but may see more competition from retail buyers on alternative purchase platforms and chilling demand for resales.

A landmark court settlement roiling the real estate industry this year will likely give real estate investors an even bigger advantage when acquiring properties in the traditional retail market. It could also result in more competition from retail buyers on the alternative, often commission-free real estate platforms investors typically favor.

“I think the only ones winning here are the sellers and investors, to be honest,” said James Perez, a real estate broker who runs Own it Now Realty with his brother Eric in Southern California. The Perez brothers list all types of properties on the traditional retail market, from high-end luxury near the coast to distressed, bank-owned (REO) properties that are often more affordable for lower-income buyers.

“A lot of these buyers are entry-level or first-time buyers with limited funds,” said Perez, referring to the buyers of the more affordable properties in his market. “They may just have enough to make the down payment.”

Some of those lower-income, often first-time, homebuyers who are stretching just to make a down payment could be left out in the cold by the settlement, which was agreed to by the National Association of Realtors (NAR) and is scheduled to take effect August 17. The settlement prohibits listing agents from advertising on the Multiple Listing Service (MLS)—which most agents have historically used to list properties—that the seller will pay a commission to the buyer’s real estate agent.

Retail Acquisition Advantage

Designed to deter collusive behavior between listing agents and buyers’ agents, the prohibition could result in more buyers paying their agent’s commission out of their own pocket. That extra cost could knock some marginal prospective buyers out of the running to buy a home in the traditional retail market.

“If buyers begin paying their agent, the funds will have to come directly from the buyer, which means the buyer is now responsible for their down payment, closing costs, and now agent commission,” said Jermain Morgan, a real estate agent and investor who owns Divine Investment in Columbus, Georgia.

“Down payment assistance programs are in place to help buyers of modest income,” continued Morgan, who often sells renovated properties originally purchased at foreclosure auction at affordable prices to lower-income buyers. “In Georgia, the buyer is only expected to (put down) $1,000 in a Georgia Dreamtransaction. These buyers don’t have funds to complete a normal purchase. How can they now be expected to come up with thousands more to pay their agent?”

In the short term, this possible scenario the settlement has created could give real estate investors like Morgan an even bigger advantage in the retail market. That’s because investors are typically either agents who can represent themselves on the buy side or are experienced enough to be comfortable writing offers on their own without the help of a buyer’s agent.

“My expectation would be that there is minimal impact (from the settlement) to the real estate investment community on the acquisition side,” said Tony Tritt, a real estate broker and investor who owns Tritt Realty, operating in communities northwest of Atlanta, Georgia. “Our experience is that most investors don’t really feel as if they need an agent on the buy side; moreover, they’d rather get a couple of percentage points off the price versus having representation.”

Some investors press this advantage even further by allowing the listing agent to represent them. That allows the listing agent to “double-end” the transaction; that is, they receive both the listing agent and the buyer’s agent commission.

“When I write offers, I always ask the listing agent if they would represent me,” said Josh Krom, a real estate broker and investor in Los Angeles, California, who owns Krom Brokerage. “If they say no, then I just write it up myself. If I can sweeten the pot, I do.”

“With the new rules (under the settlement), perhaps I will offer to pay the listing agent’s commission,” Krom added.

Chilling Demand for Resales

Although the settlement could give real estate investors like Krom, Tritt, and Morgan an additional advantage in acquiring properties off the retail market in the short term, it could also chill demand for the renovated properties they sell back into the retail market in the longer term.

“I think the real estate market will eventually slow down a bit for investors and everyday sellers,” said Morgan, summarizing his belief that the settlement will suppress demand from many first-time buyers who purchase renovated homes from him and other investors.

Krom and Tritt both expressed concern about the ramifications of less quality representation for buyers, particularly newer buyers with less experience.

“If buyers are not represented by an agent, I don’t know how they will be able to submit an offer (for properties I list),” said Krom, noting that he does not double-end his listings due to potential liability issues down the road. “The ‘normal’ buyers will have less and less quality representation. For something as costly and complex as a home transaction, you cannot treat it like booking a vacation online.

“An experienced and intelligent broker is necessary to guide people through those challenges,” Krom continued. “People will then have to hire a lawyer to solve those problems, which may make the process more expensive in the end.”

Tritt took this train of thought in a similar direction, speculating that litigation from unrepresented buyers could end up creating a less efficient and more expensive process.

“As we experience on the new construction side of the world, more paperwork, greater education, more people, etc. all equal greater expense to attempt to bring housing to market—making it increasingly difficult to create quality housing at an affordable price-point,” he said.

Emerging Marketplace Alternatives

Some real estate brokers and investors were optimistic the disruption the settlement caused could result in the emergence of more transparent real estate platforms that would benefit both investors and owner-occupant buyers.

“I have long been a proponent of a national MLS system or really preferably to list on Amazon.com and get rid of realtors altogether,” said Paul Lizell, a Florida-based real estate investor who became a real estate agent to help better navigate what he saw as an inefficient system.

Lizell buys many of his properties via online auction on sites like Auction.com and trains other investors to purchase homes via auction through his REO Auction Academy.

“Buying from Auction.com, we don’t need a buyer’s agent,” he said.

But investors like Lizell are facing more competition from first-time homebuyers and other owner-occupant buyers when buying on alternative platforms like Auction.com, and the settlement could accelerate that trend for bargain-hunting buyers who want to avoid paying a buyer’s agent commission.

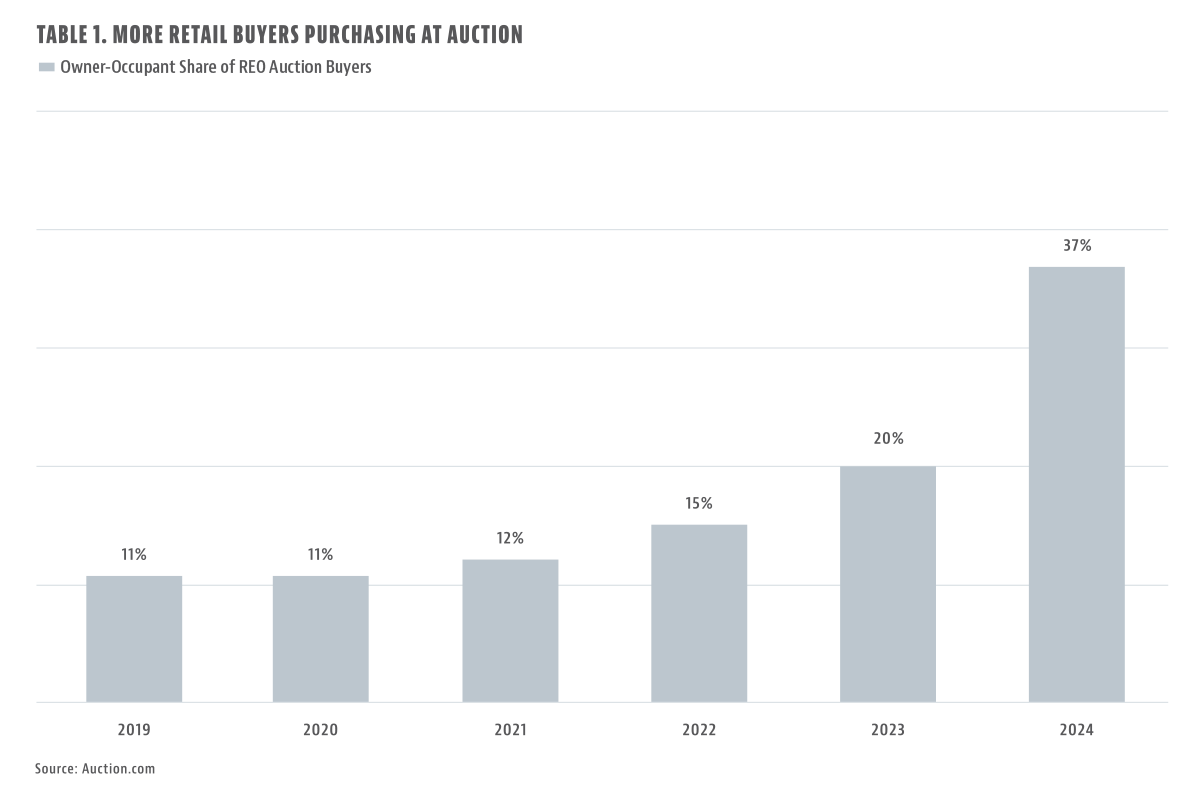

One in five buyers (20%) who purchased REO properties at online auction in 2023 were owner-occupants, according to sales data from Auction.com. That was up from 15% in 2022 and 12% in 2021. In 2019 and 2020, the share of owner-occupant buyers was 11% (see Table 1).

Thinking Outside the Box in Birmingham

Karina Barone, a real estate agent and investor in Birmingham, Alabama, has been helping owner-occupants purchase properties on Auction.com for several years. Many of those are lower-income buyers who can’t afford prices on the retail market.

“I like the idea of people that do not have a house and cannot afford one, can buy one,” she said, recounting the story of one client who purchased an affordable property on Auction.com and has since added value through renovations. “You have to see what she did what did with that house… When she bought it, it was a $35,000 house. Now it’s worth about $180,000.”

Barone’s experience with that same client provides a prime example of why she’s willing to sacrifice her commission on the buy side in exchange for future commissions that stem from referrals from happy buyers.

“Out of this very sweet girl I have 10 other transactions,” said Barone, explaining that the client referred several family members to her. “Everything was started because I didn’t mind not to make money in one of my first transactions with her.”

Leave A Comment