Make sure you understand the laws and tax consequences surrounding UBTIs.

Unrelated Business Taxable Income (UBTI) is income that is regularly generated by a tax-exempt entity by means of taxable activities. This income is not related to the main function of the entity, and it prevents or limits tax-exempt entities from engaging in businesses that are unrelated to their primary purposes.

UBTI greater than $1,000 is subject to taxation. For 2019, the highest tax rate was 37%.

Most forms of passive income (e.g., dividends, interest income, and capital gains from the sale of capital assets) are not treated as UBTI.

Many investors use their IRAs to invest in Mortgage Debt Funds (MDF). Many MDFs like to attract retirement accounts because of the passive income that is derived—MDFs lend money similar to a bank in that they take a deed of trust as collateral for the loans they make to borrowers. Typically, income derived from an MDF is not subject to UBTI, even though the income derived at the MDF level is not passive in and of itself. The IRA investor, however, is a passive investor. Consequently, the IRA is not usually subject to UBTI. There are times, however, when this is not so.

What Can Trigger UBTI?

From the MDF sponsor’s standpoint, there are ways the UBTI can be triggered for the investor in a MDF. One is if the MDF borrows within itself to generate income (called a leveraged MDF), according to the exclusion for passive income rules under IRS Section 512(b)(4). Another is if the MDF ends up foreclosing on too many assets, and the IRS treats the MDF as a dealer in real estate. This second risk is relatively small. Under normal circumstances, the IRS would not treat most MDFs as being in the business of buying and selling real estate.

Ordinarily, interest is considered a passive investment and would not have UBTI issues associated with it. However, an MDF is “in the business” of making loans that derive its income from interest and is considered an active business. As such, UBTI has to be a consideration for both the investor and the promoter. According to IRS Section 514(b)(1), this means any property (or property loans, in the case of an MDF) held to produce income with respect to which there is an acquisition indebtedness at any time during the taxable year may have UBTI issues.

In the case of losses, UBTI may not be offset against other activities that are substantially unrelated. However, related activities may use losses to offset UBTI as well as be carried over from one year to the next for offsetting purposes. For example, if, in year one, an MDF (that uses leverage) suffers a loss of $5,000 (on the investor’s K-1), there is no UBTI issue in that year. If, in year two, the K-1 shows a profit of $4,000, the carry-over of year one’s loss would wipe out year two’s UBTI potential [of $3,000 (after subtracting the allowable first $1,000 of UBTI)].

Whether an activity is substantially related is based on the facts and circumstances according to Treasury Regulations 1.513-1(d)(1).

Most MDFs that use leverage usually center on attempting to enhance its yield to investors. If the MDF can borrow from a bank at 5% and lend it out at 8%, there is a 3% arbitrage in favor of the MDF. This may possibly put undue risk in its portfolio, however, depending on how much leverage is used and the bank covenants required to obtain this leverage. In addition, for those investors in the MDF who use their IRAs (or 401(k)s, pensions, or profit-sharing plans), this leverage may subject the income derived to create UBTI.

Certain key factors for the investor’s IRA that the MDF sponsor should be aware of include:

- How much the IRA has invested in the MDF because the first $1,000 of UBTI is not taxable to the IRA

- The income derived by the MDF

- How much leverage was used to produce that income. In addition, it is important to consider the length of time that leverage was used, as the UBTI will be calculated using a pro-rated formula.

IRS Section 514(a)(1) would require the IRA to include in UBTI a percentage of income derived from “debt-financed property” equal to the “average acquisition indebtedness” for the taxable year.

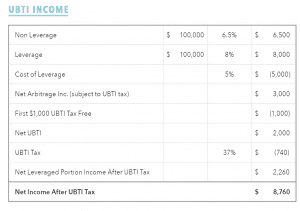

For example, the accompanying chart shows an IRA investor with $100,000 in an MDF generating a rate of return of 6.5% (without leverage) not having the $6,500 income subject to UBTI since no leverage was used. However, if the MDF chooses to leverage the fund 50% (50% investor funds and 50% bank funds) for the entire year and can borrow (from the bank) at 5% and invest that portion at 8%, the net income to the IRA (after subtracting the bank interest expense and UBTI tax) would be $8,760.

Many IRA investors may not feel the extra $2,260 earned in this example is worth the risk. When a real estate syndication goes bad, it is usually only for one reason—leverage. If no leverage is used, usually the only way for a real estate investor to lose substantially most or all of his or her investment in these types of investments (i.e., REITS, limited partnerships, limited liability companies, etc.) is if the real estate taxes associated with the underlying real estate are not paid. When leverage is used, the banks have first priority over the assets. Simply, the more leverage that is used, the riskier the investment; thus, it is important for the MDF sponsor to consider how much and for how long leverage is to be used.

Investors using their retirement savings to invest in assets that potentially produce UBTI should ask the manager how much debt/leverage is used in the investment. A small amount of leverage is not usually taking on undue risk, especially if that leverage is used sparingly.

One strategy in this case is to use a small amount of leverage, and on a very short-term basis, for an MDF for specific reasons—mostly, to help fund short-term loans in a fund when expecting payoffs on other loans or anticipated investor money flowing in. As soon as payoffs or investor money comes in, the line of credit (leverage) can be paid down immediately. This provides the ability to close deals that otherwise might not have been able to close.

The short-term nature of this leverage does not usually create enough UBTI income to concern the retirement investor. In addition, the short duration of the leverage puts the fund at minimal risk; however, since the rate of interest to obtain the leverage is less than the income derived from it, the fund still benefits from a small amount of positive arbitrage.

Blocker Corporations

One strategy that has been instituted in recent years to help avoid UBTI is a “blocker corporation.”

(In a 2008 handout regarding a seminar on UBTI, Suzanne McDowell, senior counsel at Steptoe and recognized as a top lawyer in the tax-exempt organization field (according to Legal 500), wrote: “Exempt organizations can avoid the debt-financed property rules by investing in a foreign corporation in a country that does not impose an income tax. According to an IRS private letter ruling, an exempt organization held 100% of the stock in a foreign corporation that invested in a U.S. Partnership holding debt-financed securities. The agency held that the dividends the foreign corporation paid to the exempt organization were excluded from UBTI as dividends under IRS Section 512(b)(2) and were not debt-financed income because the exempt organization had not incurred debt to acquire its interest in the foreign corporation.”

Although private letter rulings are not law in and of themselves, one can believe that the IRS position on similar matters would remain the same. Thus, an MDF may choose to explore setting up a blocker corporation to avoid UBTI becoming an issue. However, the MDF must consider the costs of setting up and the continual operation of the foreign corporation to determine whether it is worth the time and expense just to avoid the potential of UBTI.

Because the laws surrounding UBTI are numerous and complex, both investors and promoters should carefully study the UBTI rules and consult tax professionals to determine whether UBTI is a factor for their investment decisions.

Leave A Comment