Borrower rehabs a single-family home in Miami, Florida, in a neighborhood dedicated to maintaining affordable housing.

Borrower rehabs a single-family home in Miami, Florida, in a neighborhood dedicated to maintaining affordable housing.

As climate change and rising ocean levels affect the more flood-prone areas of Miami, higher-elevation neighborhoods like Liberty City have become more attractive to investors. In response, the Liberty City Trust was established to maintain affordable housing in the area and protect the community.

Opportunity

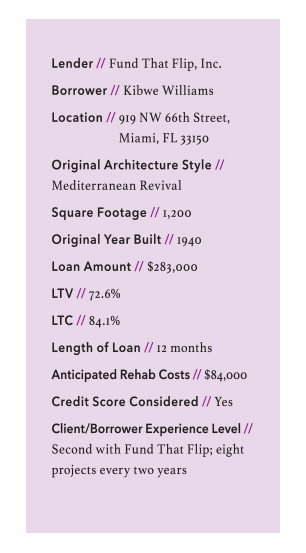

Borrower Kibwe Williams saw an opportunity to create more value and transform a single-family home in this historic, tight-knit community. He purchased the two-bedroom, one-bathroom, 1,200-square-foot single-family home for $230,000 and planned to update it to current codes and modern aesthetics designed to fit in with the rest of the neighborhood.

The mid-level updates included adding a bedroom and a bathroom, resulting in a three-bedroom, two-bathroom home. In addition, updates included creating an open floor-plan kitchen with stainless steel appliances and quartz countertops, updated bathrooms, windows, drywall and interior paint, interior doors, PVC plumbing, HVAC ducts, exterior stucco, shingles and fascia for the roof, and the addition of an enclosed carport, simple landscaping, and a primary bedroom closet.

Exit Strategy

The exit strategy is to sell the single-family home at the estimated ARV of $390,000, which Williams is currently doing. Comparable properties in the area recently sold between $325,000 and $405,000.

Williams has a track record of successful residential fix-and-flip projects in this area. He and his team have financed several projects with Fund That Flip, allowing them to easily meet their goals of eight projects every two years.

Leave A Comment