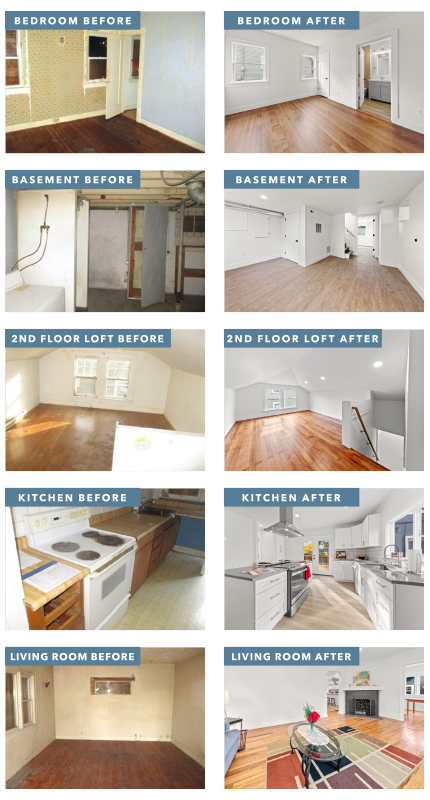

Renovations to an untended home in a desirable neighborhood of Portland, Oregon, yielded significant ROI.

Renovations to an untended home in a desirable neighborhood of Portland, Oregon, yielded significant ROI.

A single-family home in a desirable neighborhood of Portland, Oregon, was priced far below market value because it sorely needed rehabbing. The home matched the average age of other homes in the area.

An experienced borrower saw the 1,200-square-foot, 2-bedroom, 2-bathroom home near schools and shopping centers as a fix-and-flip opportunity that would yield a 60% return on investment. With renovations, the investor expected to add about $300,000 to the home’s value, and the sale price was anticipated to be significantly above the neighborhood average.

The rehab project has been completed, and the property is currently listed for sale. The renovations completely transformed the home, and the borrower anticipates a solid return on investment.

Lender: RCN Capital

Loan Officer: Peter Rusconi

Loan Officer

NMLS ID # 1975612

(860) 432-9764

Client/Borrower: #1 Firm Foundation LLC

Location: Portland, Oregon

Architecture Style: Single Family

Year Built: 1925

Square Feet: 1,854

Loan Amount: $363,600

LTV: 72% ARV

LTC: 92%

Client Borrower Experience Level: 5

Loan Term: 12 months

Anticipated Renovation Cost: $90,000

Credit Score Considered:: Yes

Exit Strategy: The borrower intends to sell the property after completing renovations and is expecting a 60% return on investment.

Leave A Comment