As Q4 2020 wraps, we are in the midst of an absolute housing boom. This is undeniable and beyond that, it’s happening in the middle of a recession. Existing home prices are surging. New home building is up. Sales are way up! Many construction company stock prices are at record highs. The fed has taken interest rates basically back to zero and the personal savings rate has jumped to over 25%! Behind all that, the stock market has somehow raised the net worth of America’s households to an all-time high. All of these facts would be incredible and exciting on their own, but what is truly exceptional is that this is all happening in the midst of a recession, during a pandemic.

During the great recession in 2008, homeowners lost over $3 trillion in home equity in a single year. This year, we’re seeing the complete opposite. Driving this year’s resilience and growth, we have the two forces that ultimately impact the real estate market more than anything else: demographics and mortgage rates.

The Housing Market

Let’s dive into the housing market. First off, let’s talk about that scary word being thrown around a lot lately: bubble. The question people ask is “With rates this low and so many houses flying off the market and higher and higher prices, are we setting ourselves up to repeat the 2008 crash?”

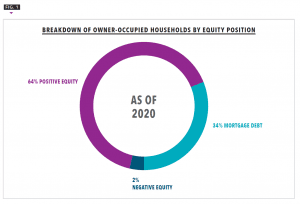

The last bubble was really built from 2002 to 2006 and behind it we had real home price growth in the double digits every single year. Purchase application numbers went through the roof during that period too. That’s simply not the case today. Existing home sales are still negative from 2019 and real home prices are only adjusting to inflation. Furthermore, with HELOCs dropping by about 50% in the last decade, owners have significantly more skin the game than 2008.

Some have asked if these equity positions are phantom value, with prices propped by each buyer hoping someone else will pay more in a year and playing a “greater fool” game. It’s simply not the case. From 1985 to 2007, the average tenure in a home was 5 years. Since then, it’s basically doubled to almost 10 years. We have been building bigger and bigger homes and so people are not moving as much, and that means the number of homes on the market has further limited supply and the equity in those homes has been supported by years of market price appreciation. It also means good news for the private lending industry, as those homes often need more work from our borrowers to really turn over and sell to the next long-term owner.

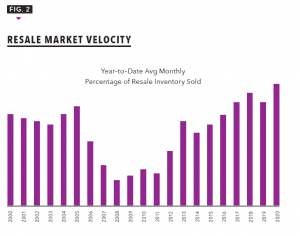

Existing home sales have bene particularly interesting, as we have seen velocity increase ahead of 2018 level.

Given the pandemic, that’s pretty remarkable. New builds are doing well, but we should level set. We often find ourselves talking about existing home sales and new homes sales in the same sentence like they are the same thing, but let’s remember, existing home sales are almost 10 times the number of new homes sales. In any given year, we are looking at a number around 6 million total, and only about 700 to 800 thousand of those are new builds.

If you are a higher end buyer, you may have the luxury of thinking about a new home. It is often custom built for you and your needs and everything is brand new, but it’s expensive. Dollar for dollar, you simply almost always get more for an existing home. The biggest single growth number was in the $1+ million homes, but that’s a small portion of the market and so for our industry, which has a foundation in rehabbing existing homes, we do not face a danger from new home builds.

Overbuilding of new homes is also not a real danger to rehabbers of existing homes, as many in our industry have speculated recently. We have been talking for 10 years about being behind on total homes and how we should be building more homes. How we need more homes. That’s all true, but the home builders are not irrational. They are not going to overbuild and push down their own margins. Specifically, they understand the demand in their home markets and understand their competition against cheaper existing homes, and they are going to follow that demand without killing their margins. For our industry, that means a proliferation of new homes should not pose any danger to the borrowers who come to private lenders to rehab and sell existing homes.

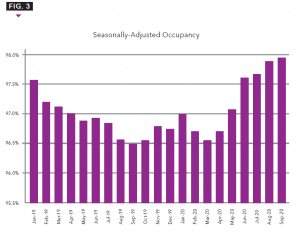

Finally, let’s talk about a growing piece of many of lenders’ and institutional buyers’ business: rental. While multifamily rental took a big hit early in the pandemic when basically 5% of occupants moved back home with their parents, that has not hit as strongly in the single family home rental space. Occupancy is very high in houses, especially as people look for more space.

Stepping back, a huge number of these homes being bought for rental are being grabbed up by cash buyers. In a low interest rate environment, rents are a great way to get yield on cash and so that is going to create a great additional layer of demand for these homes, and so, for our industry’s borrowers who are turning over homes.

Stepping back, a huge number of these homes being bought for rental are being grabbed up by cash buyers. In a low interest rate environment, rents are a great way to get yield on cash and so that is going to create a great additional layer of demand for these homes, and so, for our industry’s borrowers who are turning over homes.

Coming out of the last downturn, these type of buyers were typically buying at auction and then quickly flipping. This time, they’re holding on and at a time when we don’t see rates moving up any time in the foreseeable future, and you have about one third of the population as permanent renters, this is an asset class that’s going to be very attractive for a very long time.

Demographics & Mortgage Rates

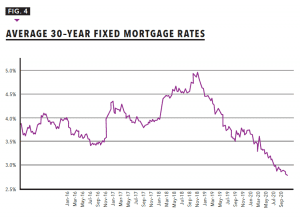

Behind all of this growth and resilience are our two main factors: demographics and mortgage rates. What we have is a millennial generation coming into their family formation years, which is when people tend to buy homes for the first time. We have only about 1.25 million houses sitting in the market, which is roughly equivalent to 3 and a half months of supply nationwide after hitting a 40 year low this summer. And they’re hitting their prime buying age with the average 30 year mortgage rate at 2.78% and the 15 year mortgage at about 2.3%.

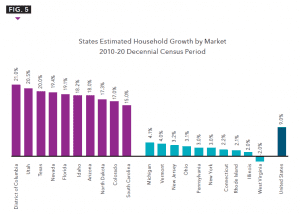

Demographics are shifting around the country though, and while COVID has spurred growth to certain states, the truth is that movement has already been happening for some time. Places with more space and cheaper taxes like Colorado, Utah, and Texas have become fashionable destinations for families leaving cities in 2020, but they have also been growing areas since 2010.

While the pandemic was clearly a huge challenge to our industry and the economy, the housing market was resilient. New home builds are growing, and the existing home sale market is on fire. Behind these, we have great fundamentals in demographics and low mortgage rates that should not change any time soon. The result is that the need for our industry, where lenders like those who make up the foundation of AAPL and are the lifeblood of the real estate investment world, is greater than ever.

Leave A Comment