Lenders can use this approach to save borrowers money as interest rates rise.

The commercial real estate market stumbled in 2022 as the Federal Reserve sought to combat high inflation with a series of jumbo hikes in the benchmark federal funds rate. These moves elevated interest rates to the highest levels in more than a decade. The ripple effects have included a double-digit year-over-year decline in commercial mortgage originations during the third quarter of last year, a sizable pull back in CRE property sales volume in the same period, and a deceleration in growth—if not absolute decline—in asset prices.

Amid this market turmoil, many traditional lenders began to narrow their risk appetite, tightened underwriting, and increased credit spreads last year. Further, in the event of a recession, more than 80% of commercial banks that responded to the Federal Reserve’s third quarter 2022 survey of senior bank loan officers indicated they would “somewhat” or “substantially” tighten lending standards on CRE. In the wake of the market’s uncertainty and these credit adjustments, a significant percentage of these banks also reported demand for CRE loans had softened.

As a result, borrowers now find less liquidity in the debt market and have had to adjust to a much higher cost of capital. Further, with cap rates still hovering well below prevailing interest rate levels, the appearance of negative leverage is a telltale sign of today’s more challenging times for CRE.

Clues to Streamline the Lending Process

Private lenders can still find ways to originate loans without necessarily taking on riskier deals. Lenders who simplify their lending processes and reduce origination costs can gain a competitive edge with and thumbs-up from many frustrated borrowers whose deals no longer pencil out—or simply cratered—because of lower-than-expected estimates of loan proceeds due to higher interest rates.

To compensate for the market’s turbulence, to reduce costs, and keep deals flowing, private lenders are deepening their commitment to streamlined and borrower-friendly processes. Put simply, they are optimizing due diligence operations with third-party service providers.

One solution involves using abbreviated reports by environmental risk assessment firms. For smaller, plain-vanilla-type projects devoid of environmentally sensitive uses, a fast option is an environmental “screening” report derived from governmental records that includes a green-yellow-red summary indication of any on-site environmental risks or hazards, accompanied by an environmental professional’s review. This option also won’t hurt the wallet.

Another solution—and the biggest lift to shorten cycle times and increase certainty of execution—is to focus on trusted vendor partnerships that can deliver consistent and reliable commercial property valuation products. Because appraisals are frequently the most expensive and time-consuming of these third-party services, lenders should make them a top priority as they seek a competitive edge.

A key to quick underwriting is trusting the property-related information a broker or origination partner submits. So, procuring a simplified, easy-to-understand valuation report especially for small-balance multifamily properties (e.g., loan amounts less than $1,000,000), can lead to a faster loan decisioning and funding process.

More cost-effective property valuations will resonate with your investors. Private lenders are always looking for ways to expand their investor base. Over the last few years, large institutional investors that securitize or sell loans on the secondary markets have required expensive appraisals compliant with FIRREA (Federal Institutions, Reform, Recovery and Enforcement Act) and USPAP (Uniform Standards of Professional Appraisal Practice. But by using private sources of investor capital (e.g., crowdsourcing with accredited investors; in other words, investors that meet specific net worth and income criteria), private lenders are keenly focused on finding a trustworthy and reliable bottom-line valuation and are less interested in having their investor clients pay a premium for regulated appraisal reports that typically do not directly impact their investment decision.

Property Valuation Tools Engineered for Small-Balance Loans

Appraisals dominate the industry—and for good reason. They assure participants that property valuations are conducted with a high level of professional practice based on high-quality reports and principle-based standards.

However, when it comes to small-balance commercial loans—the proverbial sweet spot for many private lenders, appraisals aren’t necessarily the best tool for the job at hand. After all, the small-cap CRE market is massive, with an estimated equity dollar value of $3.7 trillion, according to research from Boxwood Means LLC. So, the size of this market incentivizes lenders to use resources in the most efficient and calibrated ways possible.

For many small-balance commercial loans, an appraisal is akin to swatting a fly with a sledgehammer. Plus, the report’s cost is disproportionately high relative to the value of the loan.

Of course, for a lender or investor needing a property valuation, the cost of the appraisal should not be the primary factor considered. The valuation report’s thoroughness, reliability, and reasonableness of its conclusions will always be paramount. But as noted, private lenders have reliable and certainly more cost-effective alternatives for property valuations on small-balance loans.

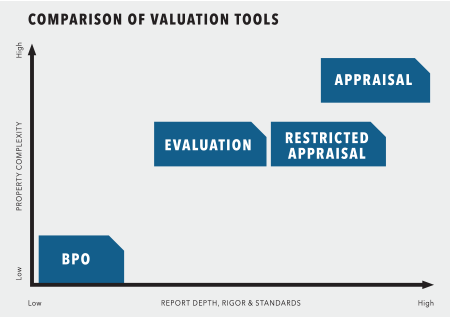

Let’s take a look at some additional valuation tools of the trade. Refer to the accompanying chart for a visual comparison of these resources.

-

-

- Commercial evaluations. The Interagency Appraisal and Evaluation Guidelines (IAEG) were initially adopted in 1994 and updated in 2010 and 2018. The IAEG differentiates between the policies and procedures, contents, and applicable uses—among other considerations— of appraisals and evaluations for federally regulated institutions involved with commercial and residential real estate lending activities. Although the IAEG may be outside of common parlance among most private lenders, commercial evaluations are a conventional tool the vast majority of commercial banks selectively and prudently use on small-balance loan originations and non-financial transactions (e.g., loan renewals, extensions, credit reviews, and portfolio monitoring). Here are some other details private lenders should know about commercial evaluations or “evals”:

- The reports are frequently performed by CRE valuation analysts and appraisers. Some eval shops with a national footprint rely on a network of contract brokers to prepare the valuations, while other firms employ full-time in-house staff. The latter tends to be more trustworthy, producing more consistent, high-quality, and timely reports. They also tend to offer better client communications and support. Much like appraisals, evaluations may use the sales comparison approach or combined sales and income approach. On the latter, the valuation of an income-producing property is typically calculated with the direct capitalization (direct cap) method.

- Evaluations are not Broker Price Opinions (BPOs). Though evals tend to be abbreviated reports (i.e., usually less than 20 pages), their content is in a different league than BPOs. They are more comprehensive and reflect more rigor in data collection, verification, and analysis of the subject property, comps, and market. Also, BPOs are prepared by brokers who usually aren’t trained in valuation techniques. Moreover, evals incorporate the results of an exterior or interior inspection of the subject property, whereas BPOs do not.

- Evaluation reports come at a substantial discount to appraisals and typically can be delivered in a much faster timeframe.

Despite their attractive attributes, evals should not be used indiscriminately. Although they are perfectly suitable for valuing a single-tenant retail store, office/industrial condo, strip center, and mixed-use property, among other types of buildings, evals are not recommended for the following:

- Complex assets (e.g., properties subject to a ground lease with multiple streams of income, or large commercial buildings with dozens of leases, etc.);

- Many special-use facilities (e.g., assisted living, nursing homes, marinas and other recreation-related properties, parking garages, etc.). For these types of collateral, appraisals are your best bet.

- Commercial evaluations. The Interagency Appraisal and Evaluation Guidelines (IAEG) were initially adopted in 1994 and updated in 2010 and 2018. The IAEG differentiates between the policies and procedures, contents, and applicable uses—among other considerations— of appraisals and evaluations for federally regulated institutions involved with commercial and residential real estate lending activities. Although the IAEG may be outside of common parlance among most private lenders, commercial evaluations are a conventional tool the vast majority of commercial banks selectively and prudently use on small-balance loan originations and non-financial transactions (e.g., loan renewals, extensions, credit reviews, and portfolio monitoring). Here are some other details private lenders should know about commercial evaluations or “evals”:

- Restricted Appraisal. Previously referred to in the industry as a limited scope or restricted use appraisal, the restricted appraisal is a second and slimmed-down version of an appraisal. In its abbreviated format, the restricted appraisal is closer to an evaluation with regard to scope, content, and detail than an appraisal. Perhaps its biggest distinction is the restricted appraisal’s compliance with USPAP and its inclusion of the appraiser’s state license and certifications. The latter offer credence to lenders that the appraiser’s report and conduct are consistent with the ethical and performance standards of the appraisal profession.Some other key features of the restricted appraisal lenders should know about include the following:

- Unlike an appraisal that summarizes the appraisal process and data compiled and analyzed, a restricted appraisal may simply state much of the information. This distinction is actually material in nature; that is, appraisals describe the data sources, assignment scope, and methods used to the lender-user in far more detail than a restricted appraisal does. For example, an appraisal will define the appraisal methods and techniques employed; provide the reasoning behind the data collections, analyses, opinions, and valuation conclusions; and, if appropriate, explain the rationale for excluding the sales comparison approach, income approach, or cost approach.

- In fact, a restricted appraisal must explicitly caution the report’s intended user(s) that the basis under which the appraiser reached his or her opinions and conclusions may not be fully understood without additional information (which the appraiser must retain in his or her work file). So, it’s important that lenders understand the limitations of a restricted appraisal in order that it adequately support its intended use.

- Restricted appraisals are increasingly performed by licensed appraisers as a substitute for, and in response to, greater demand for evaluations by lenders. It’s a bit confusing because of differing state laws, but lenders should know that when you procure an evaluation from a licensed appraiser in your state of interest, you’re more likely than not to receive a restricted appraisal because of USPAP’s requirements.

- Like evaluations, restricted appraisals are also more cost-effective than appraisals.

-

Commercial evaluations and restricted appraisals thus offer private lenders viable alternatives to appraisals, depending on the scope and intended use of the assignment and the complexity of the loan collateral. It’s best to fully discuss your needs and options with a trusted valuation partner before you pull the trigger.

Navigating into Uncharted Waters

As of this writing, there is little transparency when it comes to the direction of the CRE debt market and the economy at large. Amid the market’s uncertainty, private and small-balance lenders that redouble their efforts to simplify operations, choose their service providers wisely, and wring out third-party due diligence costs will please clients and investors and win more business in 2023.

Leave A Comment