Sixty-eight percent of renovated foreclosure resales during the pandemic went to owner-occupants.

Foreclosure properties renovated and resold by real estate investors supplied an estimated 118,000 affordably priced homes to owner-occupants in the last two years, according to an analysis of proprietary data from Auction.com and public record data from ATTOM Data Solutions.

The 118,000 renovated foreclosures resold to owner-occupants represented 68% of all renovated foreclosures resold in the last two years, according to the analysis, which matched public record sales data to properties previously sold on the Auction.com platform at foreclosure auction or bank-owned (REO) auction. The total market number was extrapolated based on Auction.com’s estimated market share of all distressed property sales.

Renovating Right

The average resale price of the renovated homes sold to owner-occupants was $235,312, and the monthly payment to buy the renovated homes, including property taxes and insurance, represented just 20% of the median family income in the census tracts surrounding the homes, on average. The renovated homes were resold an average of 173 days, or less than six months, after the foreclosure auction.

“When we buy a property and we renovate it, we’re going to do it the right way,” said Tony Tritt, owner and broker at Tritt Realty, a real estate company that buys and renovates distressed properties in the Atlanta area. “We’re still a business. Making a profit is important to us. But nowadays, delivering a product. Something that we feel proud of. I mean we live, work and play here.”

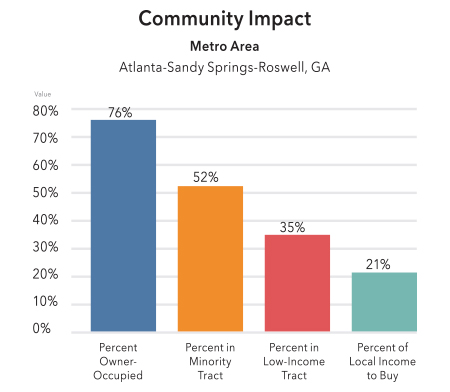

Among 23 Atlanta-area properties that Tritt Realty has renovated and resold after purchasing on the Auction.com platform since 2016, 91% are owner-occupied. Tritt’s renovated foreclosures have sold at an average resale price of $152,196, representing 17% of the median family income in the surrounding neighborhood, on average. Nearly half (48%) of Tritt’s renovated foreclosures are in low-income neighborhoods, with more than half (52%) in minority neighborhoods, according to an overlay of census tract-level data from the Federal Housing Finance Agency (FHFA).

Affordable for Local Families

Nationwide, one-third of renovated foreclosure resales over the last two years were in minority census tracts, while about 30% were in low-income census tracts. Homeownership rates for renovated foreclosure resales were above 60% in both low-income tracts (64%) and minority tracts (67%).

Real estate renovators like Tritt added an average of 33 percentage points in market value to the distressed properties they resold in all census tracts nationwide, and the value added through renovation was even greater in minority tracts (35%) and low-income tracts (38%).

Despite the added value, renovated foreclosures still sold at affordable price points for local families. Overall, buying a renovated foreclosure in 2020 and 2021 required 20% of the median family income in the surrounding census tract. Renovated foreclosures required 23% of the median family income to buy in low-income tracts and 24% to buy in minority tracts.

Restricted Inventory

The estimated 118,000 renovated foreclosures sold to owner-occupants between 2020 and 2022 was down from an estimated 153,000 in the previous two years (2018 and 2019). A pandemic-triggered foreclosure moratorium on government-backed mortgages that started in April 2020 and ended in July 2021 restricted the number of distressed properties available to real estate renovators like Tritt.

“It’s not that we don’t like foreclosure sales. We do,” said Tritt, explaining his shift to buying about 50% of his properties at foreclosure sale compared to nearly 100% in previous years. “The ones we pick up on the courthouse steps are the ones the institutional investors steer clear of.”

A temporary rule the Consumer Financial Protection Bureau (CFPB) put in place between August 2021 and December 2021 effectively kept the nationwide foreclosure moratorium in place through the end of 2021. Volume of properties going to foreclosure auction has gradually increased since then, hitting a new pandemic high in the second quarter, according to Auction.com data. But even with that increase, foreclosure auction volume was still more than 50% below the pre-pandemic level in second quarter 2019.

Richmond, Virginia-area estate investor Rick Starnes said he’s noticed a recent uptick in bank-owned (REO) properties available to buy via online auction. The part-time investor started buying and renovating homes in 2018 and has purchased a total of seven properties, five of them on Auction.com.

“It’s been a pretty active little while here. I see a lot more foreclosure activity,” said Starnes, who has sold all of his renovated homes to owner-occupants and takes pride in the quality of renovations he performs. “When I walk away from (the renovated homes), I want (the buyers) to think they are buying a new house. I’m an engineer, and I don’t want to do it halfway.”

Neighborhood Impact by Market

Starnes is not alone in the Richmond market when it comes to selling most of his renovated foreclosures to owner-occupants: 87% of renovated foreclosures that resold in the Richmond market in the last two years went to owner-occupants, according to the Auction.com analysis. The average resale price of renovated foreclosures in the Richmond area was $243,402, requiring just 20% of the local median family income to buy on average.

Among 104 metropolitan statistical areas included in the Auction.com analysis, Richmond posted the fifth highest owner-occupancy rate for renovated foreclosure resales. Ahead of Richmond were Worcester, Massachusetts (96% owner-occupancy rate); Boston (91%); Virginia Beach, Virginia (88%); and Hartford, Connecticut (88%).

Markets with the highest number of renovated foreclosures sold to owner-occupants were led by Chicago, with an estimated 5,102; followed by Atlanta (4,307); New York (4,072); Philadelphia (3,669); and Washington, D.C. (2,946).

Markets with the lowest average price for renovated foreclosures were Peoria, Illinois ($97,181); Youngstown, Ohio ($111,127); Toledo, Ohio ($121,180); Rockford, Illinois ($123,516); and Flint, Michigan ($126,743).

Returning Inventory

Returning Inventory

Despite a slowdown in the retail housing market, many investors are still hungry for more distressed inventory to renovate.

“I’m in aggressive acquisition mode,” said Starnes, the Richmond, Virginia-area investor. “I’m just trying to lock in three more houses as inventory.”

The Virginia market is poised for a return to pre-pandemic levels of foreclosure inventory in the second half of 2022, according to Auction.com data. The number of properties scheduled for foreclosure auction in Virginia in the third quarter of 2022 was 18% above the pre-pandemic level in third quarter 2019. That was the sixth highest among all states, behind Wyoming (52% above pre-pandemic levels), Colorado (47% above), West Virginia (45% above), Nebraska (40% above), and Minnesota (35% above).

States where third-quarter 2022 scheduled foreclosure auctions were furthest below pre-pandemic levels were New Jersey (91% below), North Dakota (89% below), Florida (82% below), Massachusetts (78% below), and California (78% below).

Leave A Comment