Don’t overlook these five common examples of budget omissions.

As the saying goes, a picture speaks a thousand words. The problem in real estate? There aren’t enough photos!

Let’s be honest. How do often do you receive more than just a few basic photos of a subject property when ordering an appraisal or BPO? It’s probably not as often as you’d like. The truth is you should want to obtain that level of transparency on 100% of your loans under consideration. There are many reasons why pushing for comprehensive photos of the subject property is critical, including the following:

- Comprehensive photos are critical to determining whether the subject property is perhaps inferior in architectural style and quality versus the market comparables.

- Comprehensive photos are critical to understanding current property condition.

- As-is-value can be inaccurate and overstated if actual condition is worse than assumed.

- With respect to RTL loans, without comprehensive photos, there is no way to evaluate whether the budget is sufficient to renovate the subject property or whether it has omitted critical items that require repair.

This article will delve into the last point to highlight the importance of obtaining comprehensive interior photos of each of your subject properties. These photos are critical for properly evaluating each deal, its feasibility, its budget, and the target ARV associated with the specific budget for the property.

Our firm commonly flags lenders regarding insufficient budgets on roughly 8%-12% of projects we review. These flags generally indicate the investor/borrower/contractor is either trying to cut corners or they’ve provided a generic budget, possibly before conducting their own walkthroughs. In either case, it represents risk to the lender and the possibility of facing incomplete projects months down the road—perhaps even default or REO situations. These situations can be avoided altogether by flagging this risk upfront. The key is knowing what to look for.

Here are five considerations that might be worthwhile to look for as you conduct diligence on your prospective lending opportunities.

Ceiling and Drywall Damage

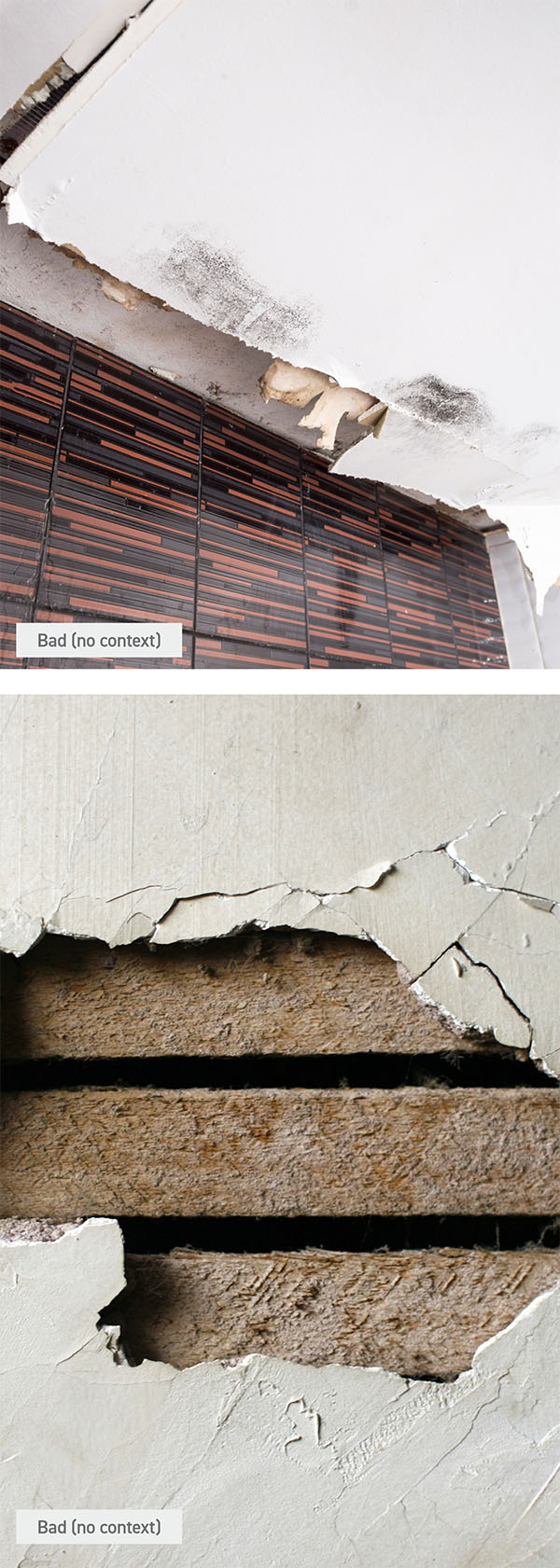

For some reason, failing to address known ceiling and drywall damage is one of the biggest budget omissions we encounter. Quite often, these issues are only discovered with a full set of property photos.

A full set of property photos should include one to three photos of every room, and they should be taken from a wide enough view to capture the floor, ceiling, and walls/windows/doors.

Proper inspection photos should capture any and all visible damage the inspector encounters. Further, photos of damaged items should not simply zoom in on a damaged element. They need to capture enough of the room or exterior to allow someone assessing the damage from the photographs to properly place things in proper context. Photos that zoom in on damaged items are often not useful because they can make it difficult for a viewer to understand what they are looking at, making it difficult to assess the magnitude of the damage.

The commonality of ceiling and drywall damage is not surprising to us, particularly in colder/wetter climates and involving properties 50-100 years old or more. What’s surprising is the frequency of omitting these repairs from the budget.

The commonality of ceiling and drywall damage is not surprising to us, particularly in colder/wetter climates and involving properties 50-100 years old or more. What’s surprising is the frequency of omitting these repairs from the budget.

If you have a full set of proper photos, then identifying ceiling damage will be easy, because you should have a clear view of the ceilings in each room. If your reports, however, do not provide the proper quality of photos, then some important clues to look for include debris and/or piles of debris, drywall, or insulation in certain spots or corners of a room.

When you encounter full ceiling or drywall damage in your photos, the next step is simple. Check the borrower’s budget to make sure it includes line items with sufficient costs allocated toward ceiling repair, insulation, drywall repair, and paint based on your assessment of the damage.

Inoperable Kitchen or Bathrooms

As surprising as it sounds, we have definitely seen situations where a property has an inoperable kitchen or bathroom, and the budget fails to properly address the issue, either because the line items are missing entirely or they do not include the full budget needed to address the issues. Accurately allowing for kitchen and bathroom situations is critical to avoiding difficulties, change orders, or budget shortfalls later in the project. Perhaps it was an omission, or perhaps the budget was produced with generic information, before/without the investor or contractor having conducted a site visit. In either case, this one is critical to catch!

Exterior Siding and Disrepair

Scenarios in which investors or their contractors focus on the interior items and really neglect to perform a thorough inspection of the exterior is fairly common. The rest of the budget might look great, but a finished project that has rust, deterioration, or full disrepair will face difficulty in the market, requiring seller concessions that typically outweigh the cost to address them in the first place. Make sure you have a complete photo set of the entire exterior, and review it to determine whether necessary exterior repairs or upgrades are missing from the scope.

Significantly Inferior Appliances, Bathrooms, or Finishes

In many instances, properties are furnished with some very outdated and/or inferior elements, including bathrooms, appliances, and other finishes. This is often why the seller is willing to sell at a price that makes sense for the investor. Be sure to identify whether budgets account for keeping the existing elements in place, particularly if doing so could have a detrimental effect on resale value. Sometimes bathroom upgrades will include a new toilet or vanity, but inferior mirrors, lighting fixtures, and tub/surround are omitted. Another common situation is for the investor to upgrade kitchen counters and/or cabinets without replacing appliances that appear to be 40 years old. These are warning signs that are worth questioning!

Material-Deferred Maintenance

Thoroughly scan the full set of inspection photos to identify material issues of deferred maintenance. Items in this category can include missing or deteriorated HVAC units, systems, pool equipment or pools in disrepair, doors/window damage, bowed flooring indicating issues with subflooring, and more. If you spot anything, review the budget to determine whether the key line items are included. If they are included, then determine if the costs allocated appear sufficient to fully address and resolve the issue.

In all these cases as well as others not mentioned, the central theme is the same. Investors are moving quickly, and so are their contractors. As a lender, it’s important to take the steps to protect your capital and conduct the proper level of diligence to ensure the budget being proposed is fully reflective of a comprehensive, thorough property inspection. Make sure you have full photographic evidence of the subject property, and try to avoid relying on straight appraisals or other reports that provide you with only three to five property photos with a big “trust me” emoji. Your capital deserves better!

Leave A Comment