Business process automation (BPA) can help businesses streamline their operations, enhance efficiency, and reduce human intervention in repetitive tasks. But which parts of your business should you automate—and how?

rivate lenders deal with complex processes ranging from loan origination, underwriting, risk assessment, and document management to compliance and security.

Despite the complexities of the industry, most small private lenders aim to start out with little to no overhead. They defer the selection of systems and creation of processes because they can be costly and there may be no immediate need for them. However, because most lenders scale quickly without much marketing, growth is inevitable.

If you determine your growth goals are beyond two to five loans a month, then you should be focusing on business process automation (BPA) immediately. It’s much easier to establish these processes before you need them. By the time you do need them, it’s almost too late because you are overwhelmed with volume and inefficiencies—and you have little time to stop and carefully select the right vendors and focus on the business requirements necessary to make the proper decisions.

Should I Be Focusing on BPA?

Here’s a quick checklist to determine whether BPA should be on your radar:

- Your loan application form is not connected to your loan origination system (LOS).

- Your prospective borrowers send their forms and attachments via email.

- You store your borrower data in more than one data source.

- You need to hire more people to allow you to process twice as many loans.

- Your departments have their own independent systems that aren’t feeding from the same current central database and have their own subset of information.

- It regularly takes you more than one week to fund a deal.

- Your team has made costly data entry errors in the past.

- You don’t have a set of latest documentation readily available for auditors to aid compliance and auditability.

If one or more of these situations applies to you, read on.

Why Is BPA Important?

Without automation, executing loan processes involves input from multiple people. This approach is prone to mistakes, resource intensive, and time-consuming. Automation guarantees compliance with standards and regulations and offers scalability. Accidentally add an extra zero and you turn a $100,000 loan into a $1,000,000 loan.

As their loan operations grow more complex, private lenders need solutions that increase efficiency, improve accuracy, and maintain compliance. We’re talking about being able to handle not only greater volume but also wide fluctuations in volume without needing to add to headcount.

What Should You Automate?

As you begin to consider automating your processes, anything you do once a day should be automated, if it hasn’t been already. Save yourself, your staff, and your bottom line the burden of repetitive motions and build automations around them. You’ll spend a great deal of time automating a task, but once it’s automated, you’ll save an infinite amount of time going forward.

Understand Your Current Workflows

The first step in automating is understanding your current workflows and processes. You’ll need to document every step and the parties involved in completing tasks and activities.

Creating a mind map of your current workflows not only helps you visualize the processes but also makes it easier to identify bottlenecks, redundancies, or opportunities for automation.

Here is how to do this:

Capture All Steps. Start with capturing every step in the process, no matter how minor it appears.

Identify Dependencies. Highlight how one task affects another and how they are dependent on each other. For example, construction draw requests can’t be processed before pictures and proof have been provided.

Highlight Key Players. Identify all stakeholders involved in each step and note their roles (e.g., accounting, loan processing team, borrower, legal).

Identify Decision Points. Mark the places where the decisions made will impact the direction or outcome of the process (e.g., size of the project, credit score of the applicant, financial potential).

Pinpoint Bottlenecks. Highlight potential bottlenecks or areas where flow often gets blocked (e.g., where the decision of the CEO is needed, repetitive and duplicate data entry, communication with external parties such as lawyers and escrow).

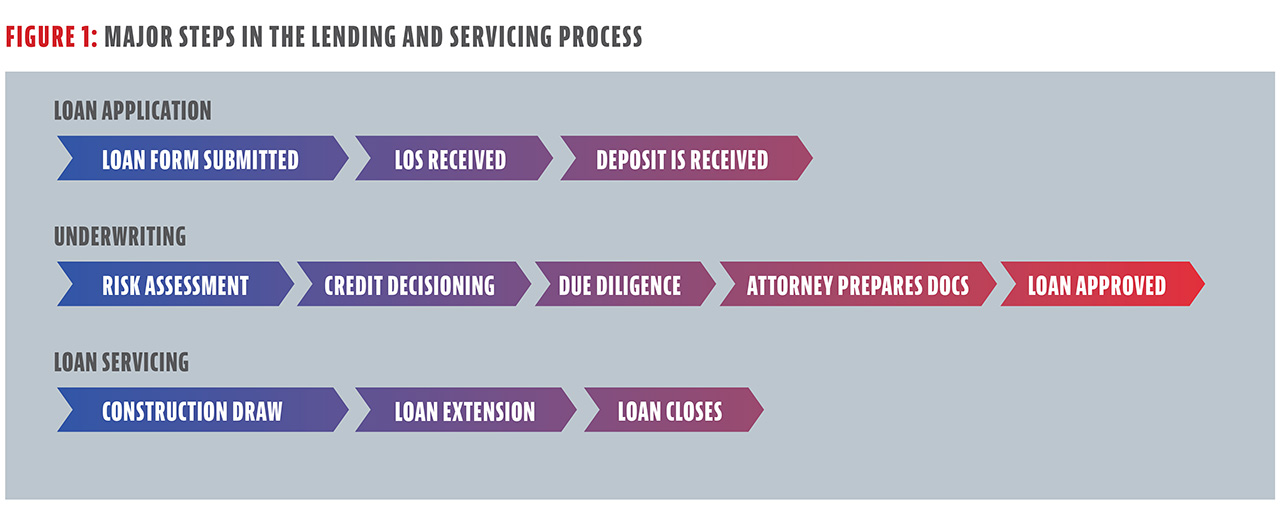

Figure 1 is a map highlighting a few major steps most lenders take. Your map, however, should contain every little step your team works through.

Identify What Works and What Doesn’t

Once you have a clear idea of your current workflows, evaluate those processes. Determine which aspects work well and which ones do not. Some of the factors to consider are the time taken for task completion, rate of errors, and interdependencies. Understanding the strengths and shortcomings of your current business processes is an essential foundation for BPA, because it helps you set clear expectations and define your automation objectives.

Next, identify which aspects of these processes are functioning well and which parts are problematic. Here’s how:

Analyze Performance Indicators. Review key performance metrics to identify areas of success versus those that consistently underperform (e.g., the number of loans one agent can process per month).

Gather Employee Feedback. Employees involved in the processes you identify may be aware of glitches and inefficiencies that aren’t visible at the managerial level. They can also share what’s working well and should be retained.

Customer Feedback. Customer can provide insights about the processes that impact them directly (e.g., when borrowers say they aren’t willing to learn a new complex system to apply for a loan).

Compare with Industry Standards. Comparing the efficiency of your business processes with industry standards can shed light on the areas where you are excelling and where you lag.

If you’re wondering how you stack against other private lenders, here are two of OpsDog’s KPI benchmarks that may help:

- An average employee can process eight loans per month.

- The top 5% most efficient employees can process 15 loans per month.

In our experience, lenders that implemented end-to-end business process automation can process 30+ loans per employee per month.

Identify Automation Opportunities: The First 20%

The next step is to identify opportunities for automation. Highlight tasks that are repetitive, time-consuming, prone to errors, or consume a significant proportion of employees’ time. This part of the process helps you find “better paths” to achieve the desired outcomes, including re-engineering the process, removing unnecessary steps, or even developing more efficient and effective workflows.

Opportunities for improvement and automation include:

Opportunities for Streamlining. Identify areas where you can combine tasks or eliminate irrelevant steps to streamline the process.

Automation Possibilities. Look for repetitive, time-consuming tasks that do not require human judgment. These are prime candidates for automation.

Technology Update. Check whether any processes can be improved with software.

Although you probably won’t be able to identify all automation opportunities yourself, you should be able to find some you can easily implement internally without outside help. They are your lowest hanging fruit—your first and easiest 20%. Implement these changes first.

Identify Who Can Help You Tackle Your Next 60%

Identifying the next set of lowest hanging fruit/high ROI opportunities may require the eye of a specialist. A specialist can help determine those that are indeed low-hanging opportunities versus those that will take months of work.

Specialists who can help you with this step include:

- Your current LOS support team (start here)

- Business process consultants

- IT consultants

- Automation experts

- Data analysts

- Project management consultants

Here’s a list of loan process automation opportunities we see most often:

Loan origination. The loan origination process, which includes everything from application intake to credit decisioning to loan disbursement, is time-consuming and complex. Automating the loan origination process can streamline the entire journey, making it faster and less prone to errors.

Most private lending software solutions can offer an online loan application that is embedded within your website. It can help you reduce the amount of time you spend on pre-qualification calls with prospective borrowers. Being able to review a loan request before getting on a call with a prospect makes the phone call more productive and less time consuming.

In terms of application input, an online application form can automatically pull information into the loan origination system, eliminating manual data entry. As for documentation, borrowers using an online solution know exactly what documents they need to provide Plus, you always have the latest and correct version of documents because each document is accessible from a central location. Documents can be approved/disapproved or commented on.

Underwriting. Automating the underwriting process in private lending can lessen the time and resources needed, effectively increasing both efficiency and profitability. Automating this aspect involves:

- Automated Data Analysis. Every lender has their “special sauce” or set of guiding principles. When those principles are input to a software program, it can follow a predefined logic and provide a suggested outcome to automate decisioning.

- Risk Assessment. Automated tools can evaluate the risk associated with a loan based on predefined parameters, successfully helping you make informed underwriting decisions (e.g., preapproves a recurring borrower or assesses the validity of the project based on the input parameters for new borrowers).

- Credit Decisioning. A credit score can be automatically pulled in as soon as the application is submitted, helping you make quick credit decisions.

Loan Servicing and Payment Processing. Loan servicing encompasses tasks such as billing, collection, and reporting of loan payments.

- Billing Automation. Generate and send bills to borrowers on auto pilot.

- Payment Processing. Allow borrowers to make payments online.

- Payment Tracking. With automation, payments are tracked in real-time, ensuring accurate records.

- Payment Portal. Providing borrowers with easy access to loan information and payment history will decrease the number of questions you have to answer.

- Scheduled Payments. Set up a scheduled payment plan, ensuring payments are made promptly.

Reporting and Analytics. Monitoring performance, identifying trends, and informing decision-making can be achieved by:

- Automated Report Generation. Automatically generate reports and dashboards on various metrics such as loan performance, default rates, and collection efficiency.

- Trend Identification. Software can identify patterns and trends in data that might be overlooked manually (e.g., whether the value of houses is going up or down in a given city/state/region).

- Predictive Analytics: Use historical data to predict future trends and potential issues, helping mitigate risks before they manifest. For example, identify project profitability potential.

- Regulatory compliance: Automate the preparation and submission of required regulatory reports to governing bodies. Having all the latest documentation readily available for auditors alone will be huge.

Identify Automation Tools

For lenders just getting started, an LOS type of software will be of great help. Then consider getting a Document Management System. Lenders with more than 50 investors should evaluate getting an investor portal system.

If an out-of-the-box loan software doesn’t suit your unique processes and you’ve thought about building your own custom solution, then look into a no-code database builder platform. It will serve as your single source of truth, empowering your team to create custom internal systems without developer assistance.

In conclusion, workflow automation for private lenders is not just a luxury; it’s a necessity. The ability to adapt swiftly to unforeseen circumstances while efficiently handling routine tasks is crucial. Investing in BPA not only prepares your organization for scale but also equips you with the resilience to tackle any challenge. By automating workflows, private lenders can reduce operational costs, enhance customer experiences, and ensure compliance. It’s a strategic move that ensures your business remains agile and competitive, ready to thrive in any environment.

Leave A Comment