Turn Broker Relationships into a Competitive Edge

Smart lenders know brokers are critical partners, not just conduits for deal flow. The current lending landscape is as competitive as ever. Combined with growing concerns over a potential recession and what seems like a [...]

The Hardest Deal You’ll Ever Close Might Be Your Own

Whether you’re selling, scaling, or handing off the reins, a smart transition starts with brutal honesty about where your business stands today. Here’s the deal. You’ve built your lending business from the ground up. You’ve [...]

Make Title an Advantage, Not a Bottleneck

A strategic title partner can accelerate closings, safeguard reputation, and support long-term portfolio growth. Not all title companies are created equal, especially when it comes to business-purpose loans. The right title partner understands the urgency, [...]

Transactional Funding Fraud Nearly Killed Us

Our private lending startup almost lost more than half a million dollars to fraud. Here’s what you can learn from our experience. Ternus is a young private lending company that prides itself on operating differently. [...]

The Contractor Vanished (But the Deal Didn’t)

When a flip in Texas started to fall apart, smart structure brought it back from the brink. Jet Lending funded a flip of a single-family home in Ingleside, Texas. It was appraised at $216,000, with [...]

Doubt Is My Edge

I found success when I rewrote my inner voice and stopped playing small. There was a time—not long ago—when the phrase “women don’t raise capital like men do” echoed a little too loudly at lending [...]

Member Spotlight | Samonae Carter

Our September Member Spotlight shines on Samonae Carter How long has Micro Monies been an AAPL member? We just joined! What benefit are you most looking forward to from membership/why did you join the association? [...]

Pay Now or Pay Later

Investing in the right people is often less expensive than the hidden costs of hiring mistakes. Success is powered by people. Every loan funded, process streamlined, and relationship managed ties back to the talent working [...]

Appraised to Fail

From comps to construction costs, lenders who question everything stand the best chance of protecting themselves from fraud. Private lenders face a material risk of fraud, and the cases have become increasingly more sophisticated. Mix [...]

Federal Bill Needs Your Support: Accredited Investor Expansion

Private lenders may soon have expanded access to capital via a bipartisan bill that opens a path for more investors to seek accredited status. If passed, H.R.3339, also called the Equal Opportunity for All Investors [...]

Proposed Law Adds Hurdles for Collecting Default Interest

The State of Florida already requires that, at minimum, lenders provide borrowers with an annual statement of the payments they’ve made. SB 392 “Requirements of Lenders of Money” sought to clarify the contents of the [...]

Mid-Construction Loans: A Different Due Diligence

Assess key elements across legal, financial, and market risk to prevent costly disruptions on this high-demand but challenging product. Jill Duke and Keith Tibbles, Level Capital LLC Mid-construction financing presents significant risks and opportunities for [...]

Multifamily Is Winning the RTL Recovery

Underwriting corrections and stronger sponsor quality have fueled a sharp rebound in multifamily residential transition loans while other segments remain volatile. By Sam Kaddah, Liquid Logics, and Aleksandra Simanovsky, Adige Advisory In the historically opaque [...]

Member Spotlight | Crossroads Investment Lending

Our August Member Spotlight shines on Crossroads Investment Lending! How long has your company been an AAPL member? Less than 1 year. What should we know about Crossroads Investment Lending? Established in 2014, Crossroads Investment [...]

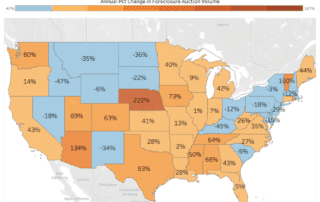

Foreclosure Auction Volume Increases 19 Percent To Two-year High As Demand From Buyers Drops To Mulit-Year Lows

Foreclosure Auction Volume Increases 19 Percent To Two-year High As Demand From Buyers Drops To Mulit-Year Lows · REO auction volume up 20 percent from a year ago to a more than two-year high, with [...]

Mindset Fuels Resilience

Navigating deployment and a pandemic reinforced the power of optimism, consistency, and community. After my husband transitioned out of active duty, we decided to invest in real estate. In 2016, we purchased our first rental [...]

Private Lender Master Class: Day 1 Terminology

Build your business with foundational lessons on deal sourcing and structure, risk mitigation, and insider knowledge. Private lending refers to nonbank loans provided by individuals, private equity funds, or lending companies to borrowers that need [...]

Junior Mortgages Doomed After AB 130?

Republished with permission from Doss Law. Original article published 7/1/2025 on dosslaw.com, "Junior Mortgages Doomed After AB 130?" On July 1, 2025 California AB 130 became operative law in California. Intended to remedy “zombie loans¹,” it goes further. [...]

Toorak Capital Partners Reaches $15 Billion Milestone

Pioneering Real Estate Lending Platform Has Funded 35,000+ Mortgage Loans Since Inception TAMPA, FL – July 9, 2025 – Toorak Capital Partners, Inc. (“Toorak”), a tech-enabled investment manager of business purpose mortgage loans, announced it [...]

Spot (and Stop!) Real Estate Fraud

From subtle name alterations to false ownership claims, train (and re-train ... then train again) your team on the biggest bottom-line-busting misrepresentations. In the labyrinthine world of investment real estate, the complexities of transactions provide [...]