Renovate-and-resell profits have soared during the pandemic, but does that make it a good time to flip?

When the COVID-19 pandemic was declared in March, Chicago-based investor Michael Hallman scrambled to mitigate any home flipping losses that might result from the shock to the economy and housing market.

“I’ve got about 10 properties right now for sale. … I’ve taken lower prices than normal. …I’ve had people pulling out of them because of the coronavirus,” he said in a late March interview. “I can’t wait six months for it to clear up. I’ve just got to cut my losses and move on.”

Like Hallman, investors who renovate and resell distressed properties (flippers) across the country pulled back following the declaration of the pandemic, according to an Auction.com analysis of public record data from ATTOM Data Solutions.

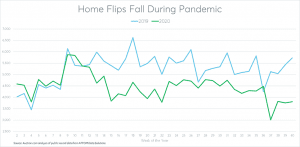

In the first 10 weeks of 2020, before the pandemic, the number of completed home flips—properties sold a second time in an “arms-length” transaction within a 12-month period—increased an average of 5% compared to the same weeks in 2019.

But starting the week of March 22, less than two weeks after the pandemic declaration, completed home flips decreased from a year ago by double-digit percentages for 14 consecutive weeks, through the week of June 21. The number of home flips has continued to stay below year-ago levels since then, although not at the consistent double-digit percentages seen in the first three months following the pandemic.

Flipping Profits Boosted

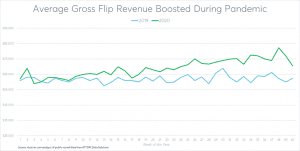

Fears that the renovate-and-resell market would flounder because of a home price downturn triggered by the pandemic turned out to be, somewhat surprisingly, unfounded. Although home price appreciation initially slowed following the pandemic declaration, it quickly recovered in heroic V-shaped fashion.

This quick recovery in home price appreciation, coupled with a scarcity of homes for sale, has helped to boost home flipping profits during the pandemic.

According to the Auction.com analysis, average gross flipping revenue (the difference between the flipper’s purchase price and sale price) in the first full 10 weeks of the year was averaging 2% above the same weeks in 2019. But since the week of March 22 and through the end of September (the most recent data available), average gross flipping revenue increased an average of 15% compared to a year ago.

A similar pattern shows up in gross flipping return on investment (gross flipping revenue as a percentage of the flipper’s purchase price, not including any repair, holding or closing costs). Gross flipping ROI was declining an average of 6% from a year ago in the first 10 weeks of the year, before the pandemic declaration. But starting the week of March 22, gross flipping ROI increased an average of 7% compared to a year ago.

Among 98 metropolitan statistical areas with at least 200 home flips during the pandemic (second and third quarters of 2020 combined), those with the highest gross home flipping ROI were Pittsburgh, Pennsylvania (128.7%), Cleveland, Ohio (105.7%), Philadelphia, Pennsylvania (104.5%), Buffalo, New York (96.2%), and Akron, Ohio (93.1%). Nationwide, the average gross flipping ROI during the same period was 42.4%.

Rising Demand for Distress

Rising home flipping returns have helped drive more demand for distressed properties, which are often good candidates for the renovate-and-resell strategy. Bank-owned (REO) homes sold on the Auction.com platform in September received an average of 12 bids per property, up from 11.1 in the

previous month and up from 8.3 a year ago to a new all-time high as far back as data is available, September 2012. The average number of bidders per REO sold in September increased to an eight-year high.

The heightened competition for REO properties helped push the average price per square foot for those homes to a new all-time high of $87.30 per square foot in July, still 61% below the average price per square foot of $225.30 for all existing home sales in July, according to ATTOM data.

Despite the rapidly rising potential profits available on home flips, growing competition and rising prices for distressed properties have helped keep Hallman, the Chicago-based investor, cautious.

“I’ll have my limit, and I’ll go above my limit a little bit sometimes,” he said, referring to his bidding for auction properties. “A lot of people are first-time investors. They’ll do them once and they’ll get killed on them, and they won’t be back.”

Rising Eviction Risk

Hallman, who has been flipping between 12 and 20 properties a year since 2012, said staying conservative has been a key to his long-term success as real estate investor.

“I’m a pretty conservative investor, and I’ll stay conservative,” he said, noting that’s particularly important during the pandemic because of moratoria on evictions.

Even before the pandemic, Hallman planned for a flip to take twice as long if it required an eviction. He planned six to eight months for flips with no eviction and 12 to 18 months when an eviction was required. Now that evictions are on hold in the Chicago-area counties where he buys, purchasing an occupied property to flip becomes even more of a risk.

“The occupied property is always the wild card. The courts are biased toward the tenant. If you’re an investor, they don’t care about you,” he said, adding the backlog of eviction cases now building will slow down the process even when eviction moratoria are lifted.

No-Eviction Flip Opportunities

Foreclosure auctions represent a less eviction-heavy acquisition channel for home flippers like Hallman during the pandemic. Virtually all properties being sold at foreclosure auction during the pandemic are vacant or abandoned and, therefore, require no eviction. That’s because vacant or abandoned properties are exempt from a nationwide foreclosure moratorium on government-backed mortgages that has been extended through the end of 2020.

Although the foreclosure moratoria mean less inventory overall at the foreclosure auction, the available inventory has slowly rebounded as banks and mortgage servicers have been able to identify more properties in the foreclosure process that are vacant or abandoned. The number of homes brought to foreclosure auction nationwide via the Auction.com platform increased to a six-month high in September.

Foreclosure auction volume in September was still 78% below year-ago levels, but the inventory was much closer to year-ago levels in some states, including Colorado, Oklahoma, Kentucky, and Arkansas. Foreclosure auction volume in those four states was less than 50% below year-ago levels in September.

Similar to REO auctions, competition for foreclosure auctions has also heated up during the pandemic. The foreclosure sales rate (percentage of properties brought to auction that ended up selling to a third-party buyer) increased to a seven-year high of 55.6% in August, according to data from the Auction.com platform. The foreclosure sales rate in 2019 averaged just under 40%.

But unlike REO auctions, the additional competition at foreclosure auctions has not resulted in an increase in the average price per square foot. In fact, the opposite is true. In September, the average price per square foot for foreclosure auctions sold on the Auction.com platform was $78.20, down 20% from January and down 21% from a year ago.

The lower price per square foot is likely a result of the shift toward vacant and abandoned properties, which tend to have more deferred maintenance and represent the type of value-add opportunities that attract renovate-and-resell investors like Hallman.

“They’re an eyesore for the neighborhood and nobody likes that property on their block,” said Hallman, adding that he typically sells to owner-occupant buyers after extensive renovations. “I sell them like I’m going to live in them. We don’t skip corners. …They look beautiful when we get done with them.”

Daren Blomquist is vice president of market economics at Auction.com. In this role, Blomquist analyzes and forecasts complex macro and microeconomic data trends within the marketplace and greater industry to provide value to both buyers and sellers using the Auction.com platform.

Blomquist’s reports and analysis have been cited by thousands of media outlets nationwide, including all the major news networks and leading publications such as The Wall Street Journal, The New York Times and USA TODAY. He has been quoted in hundreds of national and local publications and has appeared on many national network broadcasts, including CBS, ABC, CNN, CNBC, FOX Business and Bloomberg.

Leave A Comment