Local community developers are less vulnerable to downturns because they add value through renovation.

Led by tech- and venture capital-fueled upstarts coronated as iBuyers, home-flipping profits plummeted in the second half of 2022 as the housing market slowed to a crawl. But community-focused, low-volume investors bucked the trend by stubbornly sticking with the sustainable strategy of buying low and adding value.

It’s yet another example of how old-fashioned responsible investing by local community developers is the tortoise that ultimately beats out the hare of algorithm-driven investing employed by far-away institutions. It turns out too that old-fashioned responsible investing results in a healthier housing market and more stable neighborhoods.

“It is a very passionate business. In addition to working here, I also own several investment properties. In addition to making money, I am also helping families,” said Austin Kerr, senior vice president at Equity & Help, a Clearwater, Florida-based company that connects mission-driven investors with distressed properties in often-overlooked markets, primarily in the Midwest and Rust Belt. “We also deal in small markets because we find it’s what works. … Our investment model becomes really the only way that those properties can get more life out them.”

Flipping Profits Fall to 13-Year Low

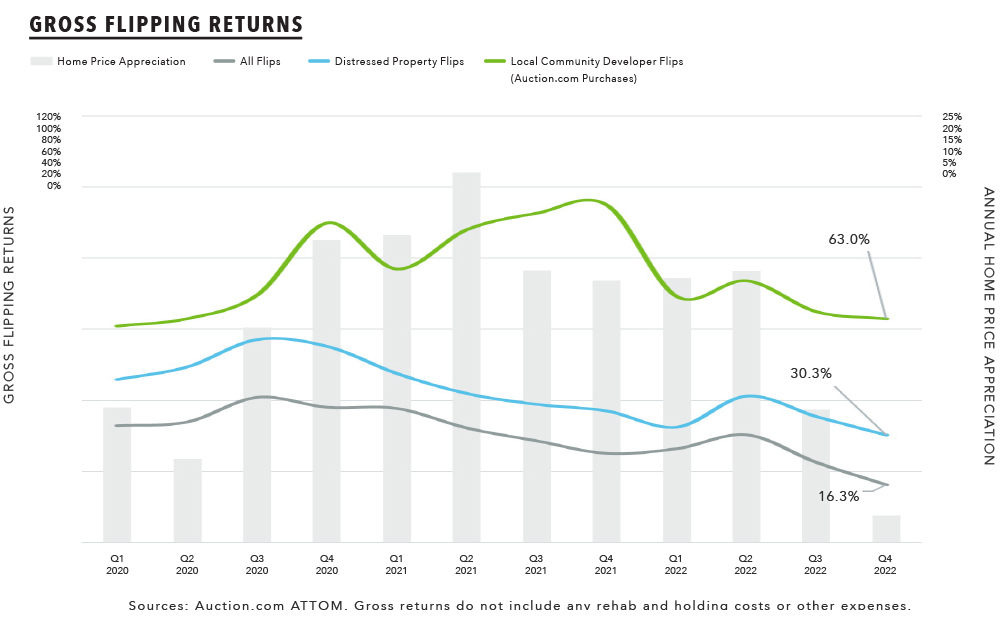

Unlike Kerr and other local community developers like him, investors employing a home-flipping strategy that is highly dependent on home price appreciation are much more susceptible to housing market slowdowns like the one occurring in the second half of 2022.

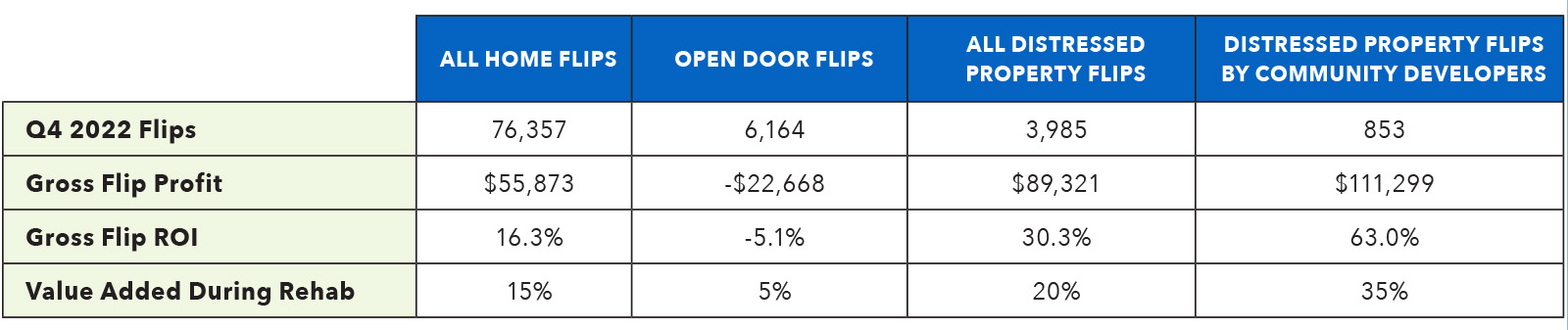

As U.S. home price appreciation rapidly decelerated to single digits in the fourth quarter of 2022, overall home-flipping profits plummeted to the lowest level in 13 years. Properties flipped (sold for the second time within a 12-month period) in the fourth quarter of 2022 sold for $55,873 more than what they were purchased for, a 16.3% average gross flipping return, according to data from ATTOM. That 16.3% return was the lowest since fourth quarter 2009, when it dropped to a record low of 9.5%.

High-volume home flippers relying on algorithm-driven pricing and light rehab were most susceptible in the 2022 real estate slump. An analysis of more than 6,000 homes flipped in fourth quarter 2022 by Opendoor, the largest iBuyer, illustrates this vulnerability. Those homes sold for an average of $22,668 less than Opendoor purchased them for, representing an average gross flipping loss of 5.1%.

The soft underbelly of the iBuyer flipping strategy lies in its divergence from the first half of the old-school investing maxim: buy low, sell high. Homes flipped by Opendoor in the fourth quarter were originally purchased by Opendoor for 98% of estimated full market value on average, a discount of just 2%. Opendoor sold the homes for 102% of estimated full market on average, but that 2% premium was not enough to make up for the loss in market value that occurred between the purchase and resale because of the slumping market.

Kerr said investors using the Equity & Help model are undeterred by a slowing housing market because the model does not rely heavily on rapid home price appreciation to succeed.

“The model was born out of 2008. Situations where there are a lot of dilapidated properties,” said Kerr, noting that foreclosure and bank-owned (REO) auctions are an important acquisition source. “We’re making sure those properties actually get in the hands of families rather than being left on the wayside.”

That’s evident in a subset of the ATTOM home flipping data where the original purchase was for a distressed property, either in foreclosure or REO. Although average gross flipping returns on these distressed property flips decreased to a three-and-a-half-year low of 30.3% in the fourth quarter of 2022, that 30.3% return was still nearly double the average return for all home flips—and infinitely better than the negative gross returns realized by Opendoor.

Adding Value During Rehab

Local community developers like Kerr, who are reselling renovated properties originally purchased on Auction.com fared even better, with an average gross return of 63% in the fourth quarter of 2022. These investors are cushioned against a market downturn because their returns are based less on how the market behaves and more on how much value they add between purchase and resale.

“The last two I’ve completely gutted the houses,” said Rick Starnes, who said he has purchased seven investment properties since he started buying in 2018, five of them on Auction.com and all of them in the Richmond, Virginia, area. “When I walk away from (the homes), I want (buyers) to think they are buying a new house. I’m an engineer and I don’t want to do it halfway.”

High renovation expenses result in net returns that are far below the average 63% gross returns for Starnes and value-add investors like him. But the dollars they spend on renovation come back in the form of a higher resale price.

“You’re wasting your time if you’re not doing a good job and expecting to get top dollar for the house,” said Starnes, providing as an example his most recent renovation. “It was in a lot of need of some love. It needed $170,000 worth of love.”

Improving, Not Inflating

With often-extensive but responsible renovations, local community developers like Starnes and Kerr are improving neighborhood home values without inflating them. Renovated homes originally purchased on Auction.com sold slightly below estimated full market value—97.4% on average—in the fourth quarter of 2022.

Auction.com renovators who resold in fourth quarter 2022 added an average of 35 points in value between purchase and resale, based on the price-to-after-repair-value ratios at those two points. By comparison, all home flippers added only 15 points in value between purchase and resale and all distressed property flippers added 20 points in value.

Affordable Inventory for Owner-Occupants

Formerly distressed homes also tend to land in the more affordable segment of the housing market, even post-renovation. The average resale price of a renovated resale originally purchased on Auction.com was $287,851 in fourth quarter 2022, more than $100,000 below the average resale price of all home flips in the fourth quarter.

Kerr said the Equity & Help model focuses on adding value between distress and resale by providing a more accessible and affordable path to homeownership for underserved buyers who often don’t qualify for traditional financing. The model incorporates necessary rehab but still aims to resell homes to buyers for at least 25% below the estimated “after-repair” value.

“We’re selling that property at a discounted rate to a family,” he said, noting that gives the family plenty of home equity from the start. “We’re not charging families an arm and a leg … they are able to take that extra money … they can pass that on to their children.”

Whether the added value comes primarily through renovation or through more accessible and affordable homeownership, local community developers are reselling mostly to owner-occupants rather than other investors. Sixty-two percent of the fourth quarter resales went to owner-occupant buyers. Since 2016, 72% of all resales of renovated homes originally purchased on Auction.com are owner-occupied, according to an analysis of county tax assessor data from ATTOM.

“The truth is most of the families who buy our homes had given up on homeownership,” Kerr said.

Leave A Comment