That’s good news for first-time homebuyers.

Foreclosures are gradually returning closer to pre‑pandemic levels in 2022. This is good news for many first-time homebuyers priced out of the fever dream that was the pandemic housing market. Why? Because most of those foreclosures will be renovated and resold to owner‑occupants at affordable price points.

“We love selling a property to someone we know is going to occupy,” said Tony Tritt, an Atlanta-area real estate investor who has been renovating distressed homes and reselling them—mostly to owner-occupant buyers—for 25 years.

Tritt recently sold one his renovated homes to an owner-occupant buyer who is a veteran, something that was particularly fulfilling given the high level of interest the affordably priced property attracted. Situated on two acres in Carrollton, Georgia, the three-bedroom, two-bathroom home sold for $264,900.

“The particular end-user purchasing this property is a veteran,” said Tritt, an Auction.com buyer who purchases about 50% of the homes he renovates at foreclosure sale. “You’ll hear very much in our market how tough it is for veterans to get houses right now because… sometimes those offers don’t seem attractive compared to other offers.”

That’s because VA-direct and VA-backed home loans often require no money down or have low down payment terms. To sellers, these offers may seem more likely to fall through than all-cash offers or offers with a larger down payment.

Of the 31 properties Tritt has purchased via the Auction.com platform at foreclosure auction since 2016, 25 (81%) are now owner-occupied, according to an analysis of county tax assessor data from ATTOM Data Solutions.

Added Value, Still Affordable

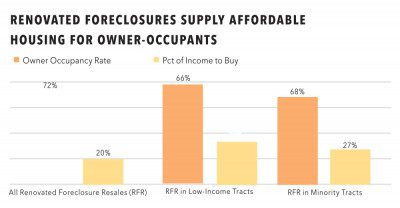

The high owner-occupancy rate for Tritt’s renovated foreclosures is the rule, not the exception. Of more than 77,000 homes renovated and resold after being purchased by third-party buyers at foreclosure auction via the Auction.com platform since 2016, more than 56,000 (72%) are owner-occupied, according to county tax assessor data from ATTOM Data Solutions.

The high owner-occupancy rate for Tritt’s renovated foreclosures is the rule, not the exception. Of more than 77,000 homes renovated and resold after being purchased by third-party buyers at foreclosure auction via the Auction.com platform since 2016, more than 56,000 (72%) are owner-occupied, according to county tax assessor data from ATTOM Data Solutions.

Buyers like Tritt are getting previously foreclosed homes into the hands of owner-occupants in an average of about 10 months (305 days) after the foreclosure auction, even while adding substantial value through renovation. Compared to their 2022 estimated full-market value, the 56,000 renovated foreclosures sold to owner-occupants gained an average of 31 percentage points in value between the foreclosure sale and the subsequent resale.

Despite this increase in value—which helps lift all home value boats in the surrounding neighborhood—the renovated foreclosures are selling at affordable prices for families who already live in the surrounding community. Renovated foreclosures sold at a price that would require 20% of the median family income in the surrounding census tract on average, based on 2019 median family income data from the census bureau via Federal Housing Finance Agency (FHFA). That same data shows that even in low-income and minority census tracts, buying a renovated foreclosure required less than 30% of the median family income.

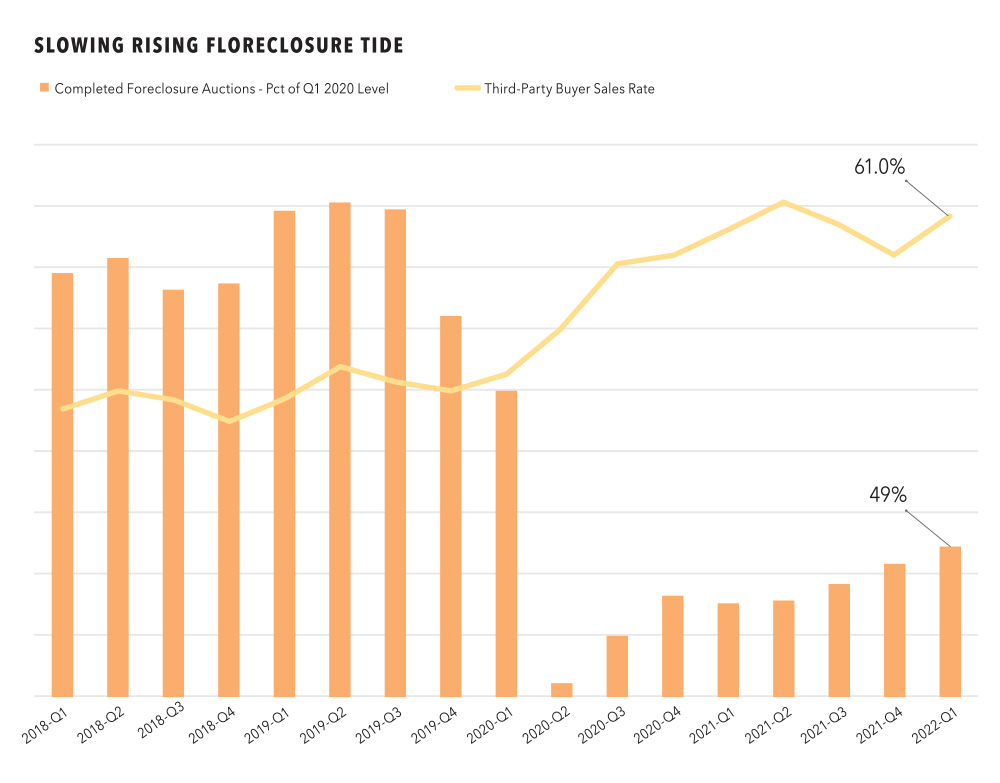

The flow of renovated foreclosures going to owner-occupants slowed in 2020 and 2021 because the pipeline of foreclosure auctions was drastically restricted by pandemic-triggered foreclosure prevention. But proprietary Auction.com data along with market-wide data shows foreclosure volume has slowly but steadily begun to rise in 2022 as those protections fade. The data also shows foreclosure volume will likely continue on that gradual upward trend through the rest of the year and into 2023. That’s good news for real estate investors looking for distressed inventory to purchase and renovate. It’s also good news for first-time homebuyers and other owner-occupant buyers looking for quality, affordable homes to purchase.

Slowly Rising Foreclosure Tide

Completed foreclosure auctions on the Auction.com platform—which accounts for more than one-third of all completed foreclosure auctions nationwide—increased 13% in the first quarter of 2022 compared to the previous quarter and were up 60% from a year ago. The first quarter numbers were still less than half (49%) of pre‑pandemic levels in first quarter 2020. Still, they represented a new pandemic high.

Most completed foreclosure auctions on Auction.com in first quarter 2022 (61%) were sold to third-party buyers like Tritt rather than reverting to the foreclosing lender as real estate owned (REO). That’s the reverse of trends before the pandemic, when less than 40% of foreclosure auctions went to third-party buyers. It’s good news for first-time homebuyers because local investors like Tritt are more efficient than banks at renovating and returning properties to owner-occupants.

Scheduled foreclosure auction data points to a continued increase in completed foreclosures in the coming months. Scheduled foreclosure auctions on the Auction.com platform were already at 54% of pre-pandemic levels for second quarter 2022 as of May 15, 2022—only halfway through the quarter.

More Foreclosures Coming

Moving further upstream in the foreclosure process, foreclosure starts data also point to more completed foreclosure auctions into the second half of 2022 and early part of 2023. Data from the Mortgage Bankers Association shows the rate of foreclosure starts in first quarter 2022 increased 325% from the previous quarter and were up 467% from a year ago. The foreclosure start rate for mortgages insured by the Federal Housing Administration (FHA) increased even more, up 600% from the previous quarter and up more than 1500% from a year ago. Despite these sharp percentage increases off historically low levels a year ago, the overall foreclosure start rate was still 8% below the pre-pandemic rate in first quarter 2020. The FHA foreclosure start rate in first quarter 2022 was 26% above the pre-pandemic first quarter 2020 rate.

Many of the properties now starting, or restarting, the foreclosure process, are secured by mortgages that have been delinquent for years, not months. Residential mortgages in foreclosure were an average of 1,370 days delinquent, according to the April 2022 Mortgage Monitor Report published by Black Knight. That has come down from a record high of 1,800 days in Dec. 2021, as mortgage servicers have begun to slowly work through the pandemic backlog of distress.

That servicers are carefully but steadily working through a backlog of deeply delinquent and often vacant distress is the beginning of the good news for first-time homebuyers. It is the start of a process in which blighted, often uninhabitable properties, can be transformed into attractive and affordable homes that are sold primarily to owner-occupant buyers.

The transformation starts with local investors like Tritt who are willing to take on the risk of buying distressed properties, with all cash and sight unseen.

“Yes, this house burned down,” he said of a property he bought at foreclosure auction in January.

The occupied property burned down before he could take possession of it. “It will impact our bottom line for the year, but it’s not going to cause us to go into bankruptcy, and we’re not going to lose our primary home that we live in because of it. That puts us in a position where we can take some of these risks … And we can renovate those houses and we can create that product and that experience and sell to that end user. That’s something that feels good. … We feel like we have an impact on our community.”

Leave A Comment