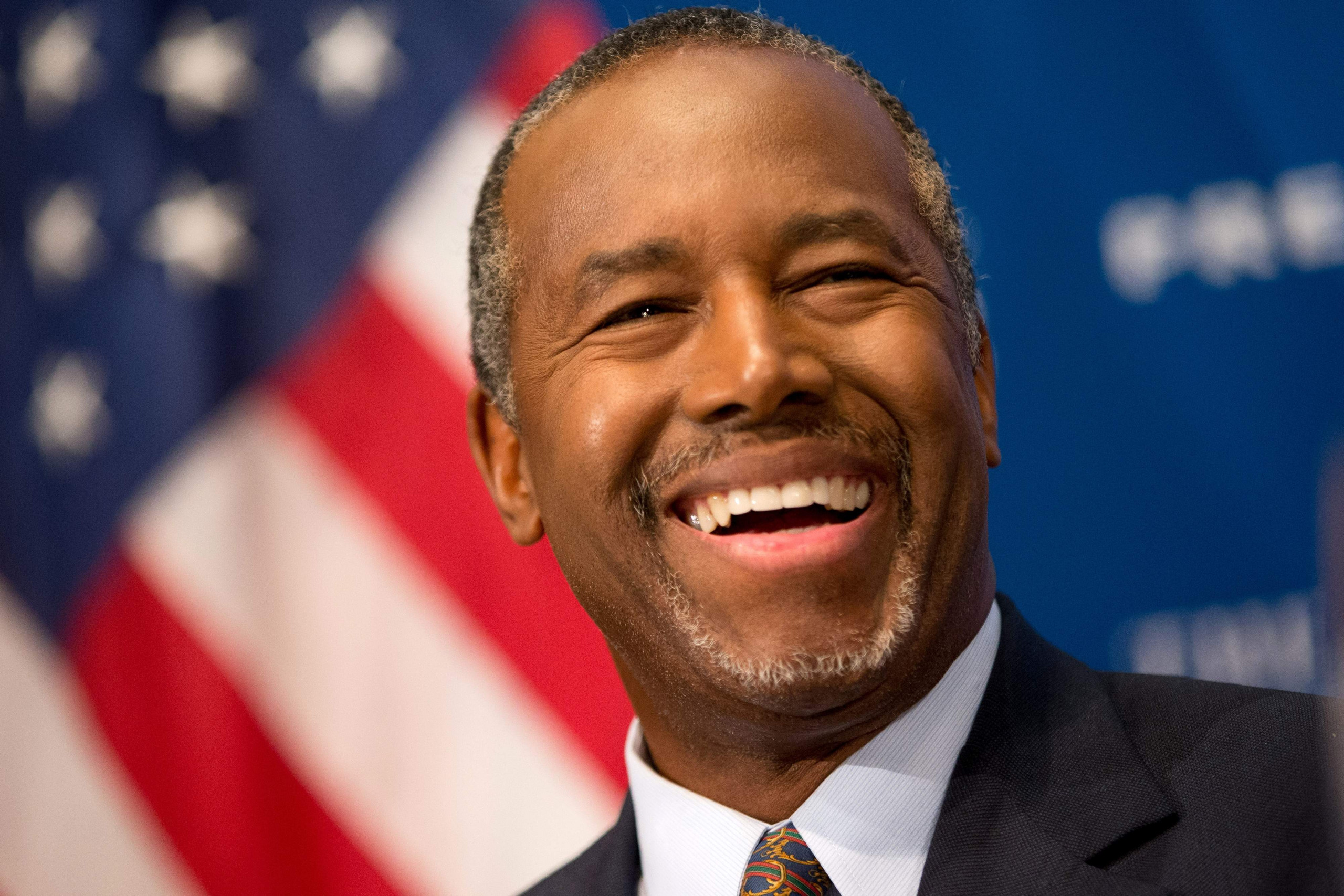

As the Trump administration embraces rapid change across many spheres of government, it is the approach to Section 8 housing that has the potential to bring opportunities for builders and the private finance industry. In this regard, it is particularly notable that President Trump nominated Dr. Ben Carson, who grew up in the inner city, to head up the Department of Housing and Urban Development. Carson, a surgeon who comes to the position with no government or policy experience, has pledged to bring new thinking and strategy to the department that oversees federal housing subsidies.

Last month Carson told The Washington Post, “Having me as a federal bureaucrat would be like a fish out of water, quite frankly.” Yet this fish out of water does have strong views when it comes to housing. Carson has been a vocal critic of HUD’s Fair Housing rule, which requires local communities to assess patterns of income and racial discrimination. He criticized this rule as being like a “mandated social-engineering scheme.” Carson went on to say, “This is just an example of what happens when we allow the government to infiltrate every part of our lives. This is what you see in communist countries.”

The Role of HUD

To understand the implications of possible changes to subsidized housing policy, it’s useful to understand just how large a role HUD plays in the residential market. HUD is a $48 billion agency overseeing public housing for low-income families. It manages federal activity under Section 8 of the Housing Act of 1937, which authorizes the payment of rental housing assistance to private landlords on behalf of approximately 4.8 million low-income households in the United States. The largest part of this section of the Act is the Housing Choice Voucher Program, which pays a large portion of the rents and utilities of about 2.1 million households.

The Voucher Program provides “tenant-based” rental assistance so a tenant can move from one unit of what is considered the least acceptable minimum housing quality to another. It also allows individuals to apply their monthly voucher toward the purchase of a home, with an estimated $17 billion going toward such purchases each year. Currently, the maximum voucher is $2,000 a month.

Section 8 also authorizes a variety of “project-based” rental assistance programs, under which the owner reserves some or all of the units in a building for low-income tenants, in return for a federal government guarantee to make up the difference between the tenant’s contribution and the rent in the owner’s contract with the government. A tenant who leaves a subsidized project will lose access to the project-based subsidy.

Thus, the main Section 8 program, the Voucher Program, may be either “project-based,” where its use is limited to a specific apartment complex from a public housing agency (PHA), or “tenant-based,” where the tenant is free to choose any suitable unit in the private sector and may reside anywhere in the United States (including Puerto Rico) where a PHA operates a Section 8 program. Under the Voucher Program, individuals or families find and lease a unit and pay a portion of the rent.

Most households pay 30 percent of their adjusted income for Section 8 housing. Adjusted income is a household’s gross (total) income minus deductions for dependents under 18 years of age, full-time students, disabled persons or an elderly household member, and certain disability assistance and medical expenses. The PHA pays the landlord the remainder of the rent. Each year, the federal government looks at the rents being charged for privately owned apartments in different communities. The Fair Market Rents (FMRs) are amounts (rents plus utilities) for medium-quality apartments of different sizes in a particular community. For example, in 2012 the FMR for a one-bedroom apartment in San Francisco was $1,522, while in many other places it was less than $500.

A landlord does not necessarily have to accept Section 8 tenants, although he or she must meet the Fair Housing laws, regardless. Depending on state laws, refusing to rent to a tenant solely for the reason that he or she has Section 8 may be illegal. On the other hand, landlords can use a general means of disqualifying a tenant, for example based on the applicant’s credit, criminal history, past evictions, etc. Many turn down Section 8 tenants because HUD requirements – inspections, ceilings placed on the amounts they may charge for rent and the judicial challenges involved with evicting non-paying tenants – are considered too much hassle. Landlords who do want to accept Section 8 tenants cannot charge more than a reasonable rent and cannot accept payments outside the contract.

Although some landlords may not embrace Section 8 tenants, others embrace them for the following reasons:

- There is a large available pool of potential renters for Section 8.

- The PHA generally pays promptly for its share of the rent.

- Section 8 tenants have an incentive to take good care of the property because tenants can be kicked out of the program if they owe a previous landlord for any property damage.

Obama’s Fair Housing Rule

With an ample supply of Section 8 renters and landlords willing to lease to them, the HUD Voucher Program thrived for decades as an effective way to provide a minimum quality of housing for millions of people. More recently, the former Obama administration made changes to the Voucher Program by establishing controversial new rules, which drew attention from critics and fans alike.

In 2015, HUD released the new rule that has been roundly criticized by Carson, Trump and many other Republicans in Congress. This new rule requires cities to analyze racial and financial segregation among their residents. In addition, Obama’s solicitor general filed an amicus brief on the side of Fair-Housing advocates in Texas Department of Community Affairs v. Inclusive Communities, a landmark Supreme Court case about the Fair Housing Act. Further, the Obama administration proposed changes to the longstanding Section 8 housing-voucher program to provide more money for the vouchers for low-income families who are living in higher-cost areas, the so-called 2015 rule to “affirmatively further fair housing.” Under the 2015 rule, cities are required to assess whether housing in their communities is racially segregated and then release the results of that assessment every three to five years. Urban leaders are encouraged, through financial incentives, to set desegregation goals, establish new low-income housing in integrated neighborhoods and track their progress on those goals.

The rule was widely panned by many conservatives, who saw it as government overreach. “The explicit purpose of HUD’s new rule is to empower federal bureaucrats to dictate where a community’s low-income residents will live,” Sen. Mike Lee, R-Utah, said on the Senate floor. President Trump has signaled his dislike of the rule too, according to The Daily Caller. In a meeting last summer with Rob Astorino, a politician in Westchester, New York, Trump reportedly said that he thought the rule took away the rights of local communities. Astorino later told reporters that Trump said that the rule “would not continue under the Trump administration.”

The new administration can take a few different tacks to eliminate or nullify the 2015 rule. On the one hand, Carson can work with Congress to rescind the rule in its entirety. On the other hand, the administration and Congress can simply not provide funding for HUD to continue adding the staff necessary to administer the rule and monitor the progress of communities in evaluating their housing stock.

Also, the executive branch could decide to stealthily reduce enforcement of the Fair Housing Act more generally, both through HUD actions and through the Department of Justice. For example, HUD now has the ability to revoke funding from communities that it determines are perpetuating segregation. This happened in Beaumont, Texas, after state and federal leaders agreed that the neighborhood the city had chosen for a new public-housing complex was excessively segregated. HUD refused to provide the expected funding for the project and told city leaders it could get the money only if the new housing complex was built in a more integrated neighborhood. Under Carson, the decision can be made to simply not pursue any such enforcement activities.

Alternately, the Trump administration may also “pocket veto” Fair Housing enforcement activity simply by directing the Justice Department not to spend the resources on civil rights housing and lending enforcement. Between 2012 and 2015, for example, the Civil Rights Division of the Justice Department filed more than 100 lawsuits to combat housing and lending discrimination. The Justice Department under incoming Secretary Jeff Sessions may choose not to prosecute so many Fair Housing lawsuits.

Other signature Obama housing efforts will likely be eliminated or replaced by Carson. These include the Choice Neighborhoods initiative, a major program started in 2010. Choice expands on Hope VI, a longtime HUD program from the 1990s, and seeks to redevelop distressed housing projects and the neighborhoods around them. Since 2010, this initiative has given out annual grants to neighborhoods and cities. Changes under the Trump administration may include more focus on privatizing public housing, and enrolling real-estate developers to take responsibility for revitalizing the neighborhoods around housing complexes. This may represent an important new stream of projects for private lenders and developers in the coming years.

Congress: HUD on the Chopping Block?

The biggest changes to HUD may not even come from incoming Secretary Carson. While he is skeptical about many of the HUD initiatives, his admitted lack of experience running a federal agency might create conditions where the seasoned department bureaucrats under his command maintain the status quo for better or worse. Rather, the big change to HUD may come from President Trump and the Republican Congress, which are both skeptical about federal funding for programs that they think are better run by the private sector. Reforming the tax code as Paul Ryan has proposed could mean changes in the Low Income Housing Tax Credit program, which is currently responsible for most affordable housing built in the United States.

Furthermore, Congress may implement deep funding cuts that would put many other programs at risk of being functionally “de-funded.” That’s because when President Obama signed the Budget Control Act of 2011, ending the recurring fight over the country’s debt limit, he put in place spending caps on federal funding for defense and non-defense programs. President Trump has generally signaled a desire to protect defense programs while lowering spending caps for non-defense programs. He also wants to cut non-defense spending by 1 percent a year for the next 10 years, which could put HUD programs at risk of widespread budgetary problems. Spending cuts could lead to fewer Section 8 vouchers, for which there are already very long wait-lists around the nation, as well as lower overall spending on public-housing complexes.

Rapid Changes Ahead?

Private lenders and participants in the construction and development sectors need to be vigilant about the changes, if any, that are around the bend for HUD. For projects with any significant degree of low-income housing stock, there will be an increased risk profile if federal subsidies for housing are reduced or eliminated. Even if a project does not involve Section 8 funding, the possible sizeable reductions in federal vouchers would shrink demand for rental units as many families are priced out of the market. And with reduced demand, market prices could tumble precipitously.

More complicated projects involving redevelopment of large tracts or neighborhoods that use federal funds, for example under the Choice Neighborhoods program, are at risk. Even state- and municipal-sponsored projects may run into budget problems if reduced funding by the federal government in housing has a knock-on effect downstream.

Keep in mind the famous quote from the ancient writer Sun Tzu: “In the midst of chaos, there is also opportunity.” For private lenders, there may be an increase in deal flow in cases where federal funding is pulled away from projects that are otherwise quite viable. The reduction in Section 8 housing vouchers may result in new buildings or whole neighborhoods being suitable for redevelopment at higher target prices. And landlords relying on HUD subsidies may find themselves either borrowing to improve the marketability of their rental units, or putting them up for sale to cash buyers. Combine the broader context of deregulation under the Trump administration and the Republican Congress; the growing concern that the commercial market may be a bubble ready to burst; and the likely changes to HUD under Dr. Carson’s surgical scalpel, and you have a mix of factors that will make the next few years very, very interesting.

Jeff Levin’s article originally appeared in Private Lender by AAPL: March/April 2017.

Leave A Comment