The Mortgage Office Earns G2 Award in Milestone for Private Lending Tech

Huntington Beach, CA – February 19, 2026 — The Mortgage Office (TMO) today announced that it has been recognized as a 2026 G2 Best Software Awards winner, ranking #2 for the Best Financial Services Software [...]

Stock Value Begins with Strategy

Investable enterprises require systems, capital strategy, and repeatable performance. If you were buying your business today, what would you pay for it—and why? What systems, processes, and data would make you confident enough to write [...]

Discipline Over Hype

In an environment where many race to brag about record deal counts and lightning-fast closings, discipline might seem like a buzzkill. Brock VandenBerg, founder and CEO of private lending firm TaliMar Financial, wants discipline to [...]

Member Spotlight | Nichole Moore

Our February Member Spotlight shines on Nichole Moore! How long have you or your company been an AAPL member? Over 10 years! What have you found to be most beneficial from AAPL membership? AAPL provides [...]

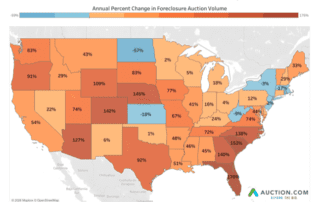

Forclosure Auction Volume Increased 48% In Q4 2025 To A Nearly Six-Year High, Still 39% Below Pre-Pandemic Level

Irvine, Calif. — Jan. 29, 2026 — Auction.com, the nation’s leading distressed real estate marketplace, today released its Q4 2025 Auction Market Dispatch, which shows that foreclosure auction volume in the fourth quarter of 2025 [...]

AAPL Launches “AAPL Constituency”: The Voices Behind the Industry

As private lending continues to grow in influence and complexity, the need to elevate authentic industry voices has never been more important. The American Association of Private Lenders (AAPL) is proud to introduce AAPL Constituency, [...]

Building a Stronger Private Lending Community Through Education and Ethics

As private lending continues to mature, the need for ethical, well‑educated, and professionally aligned lenders has never been greater. North Oak Investment is helping lead that evolution by embracing AAPL’s standards and advancing responsible practices [...]

Diversify with DSCR Without Losing Control

Success comes from balancing bold expansion with disciplined safeguards. In the game of business, the path to industry domination is shaped by how we handle risk—both good and bad. The strategy behind effective risk management [...]

Lightning Docs Recognized as the Private Lending Industry Standard for Business‑Purpose Loan Documents

As the private lending industry continues to expand, lenders are placing greater emphasis on accuracy, compliance, and efficiency in their loan documentation processes. A recent feature highlights how Lightning Docs has emerged as the trusted [...]

AAPL Annual 16: Insights, Strategy, and Connection Driving the Future of Private Lending

The private lending industry continues to evolve at a rapid pace, and events that bring professionals together for education, strategy, and collaboration are more essential than ever. AAPL’s Annual Conference remains one of the most [...]

AAPL Continues Building a Stronger, More Connected Private Lending Industry

As private lending grows in scale and influence, the need for a unified professional community has never been more important. The American Association of Private Lenders (AAPL) is stepping into that role with renewed purpose—strengthening [...]

Debate Grows Over Proposed Restrictions on Institutional Investors in Single‑Family Housing

The national conversation around housing affordability continues to escalate as a proposed ban on institutional investors purchasing single‑family homes sparks strong reactions across the real estate and private lending sectors. Supporters argue the measure could [...]

Building the Future of Private Lending: Insights from Industry Leader Linda Hyde

The private lending industry is experiencing rapid growth, increased regulatory attention, and a rising demand for strong professional standards. As lenders look for guidance on navigating this evolving landscape, industry leadership becomes more important than [...]

From Burnout to Breakthrough

From exits to evolution, the next chapter in private lending is defined by maturity, specialization, and grit.” The private lending world is relentless. Big deals, little deals, easy deals, complex deals—and everything in between. Succession [...]

Use Automation and AI with Integrity

AI creates real efficiency only when it’s designed around transparency, human handoffs, and accountability. Lett me start with the simple part: This is not legal advice. I’m not your counsel, and I’m not here to [...]

Member Spotlight | Steven Ernest

Our January Member Spotlight shines on Steven Ernest! How long have you or your company been an AAPL member? Over 10 years! What have you found to be most beneficial from AAPL membership? I get [...]

From Boom to Balance

Inventory, pending ratios, and price cuts reveal a market recalibrating fast—and creating new investor openings. The housing market downshifted decisively in 2025 as stubbornly high mortgage rates, tariff uncertainty, and a more laissez faire housing [...]

Sitewire Launches BudgetIQ™ and PermitIQ™ to Make Pre-Construction Risk Standardization the Default

Lafayette, California — December 10, 2025 — Sitewire, the draw management and inspections platform for construction finance, today announced the launch of BudgetIQ™and PermitIQ™, two products designed to standardize pre-construction risk checks before budgets are [...]

Junior Mortgages Doomed After AB 130?

Republished with permission from Doss Law. Original article published 7/1/2025 on dosslaw.com On July 1, 2025 California AB 130 became operative law in California. It is intended to remedy “zombie loans,” which are typically dormant [...]

Scale Your Platform

An Unbeatable Partnership in Real Estate Finance Fidelis Investors: Entrepreneurial speed meets institutional strength. When you combine a capital partner with a true capability of balance sheet lending and flexible underwriting, Fidelis's 29+ years of [...]