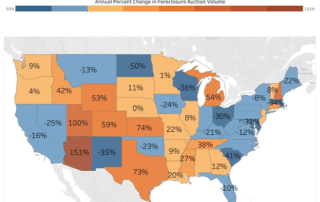

Foreclosure Auction Volume Increases 4 Percent Annually to Six-quarter High in Q1 2025

Foreclosure auction volume up from a year ago in 26 states VA foreclosure auction volume spikes 104% as VA foreclosure moratorium expires Auction buyers pull back on price they are willing to pay as economic [...]

Federal Bill Needs Your Support

This article was updated 7.1.25 to reflect a business name change. Main Street Tax Certainty Act makes key tax deduction permanent. The Main Street Tax Certainty Act (S.1706/H.R.4721) would make permanent Section 199A, a key [...]

Buy or Hold? Local Developers Have the Answer

Bidding activity at foreclosure auctions provides early clues to 2025’s real estate market winners and losers. Bidding trends at foreclosure auctions in late 2024 indicate which local markets are likely to see gains or losses [...]

One Final Detour

Kemra Norsworthy isn’t supposed to be here. Not in the male-dominated private lending industry. Not in business ownership, given a childhood that began in poverty and could have defined her future. And not in this [...]

Energy Management: The Key to Business Mastery

Achieving business success prioritizes big concepts, strategies, and ideas. But what if the secret to thriving isn't just about executing the right plan or having the perfect innovation? What if it's about something simpler, something [...]

Auction Buyer Optimism at Three-Year High in 2025

64% expect purchases to increase in 2025, up from 60% in 2024 and 54% in 2023 33% expect home price decline in 2025, down from 40% in 2024 43% describe market as overvalued, down from [...]

Bridge and DSCR Activity Surges

Driven by strong secondary market conditions, bridge and DSCR loan originations grew rapidly in 2024, setting the stage for continued momentum in 2025. During the last six years, Lightning Docs, a platform built for private [...]

AAPL Annual Event Conference #15

The nations's largest private lender event. As we review a conference that blew our past events out of the water in terms turnout, collaborative education, and an invigorating atmosphere—well, our team is incredibly gratified. This [...]

Education Is Our Cornerstone

Meaningful and intentional continuing education is an essential tool enabling lenders to navigate challenges, mitigate risk, and grow their businesses—all while maintaining a high standard of professionalism and accountability. AAPL has long recognized the role [...]

Private Lending Meets Innovation

In a trailblazing entrepreneurial journey, a former investment banking analyst channeled his expertise into a groundbreaking venture with the goal of transforming the private lending landscape with innovative technology that empowers lenders. In 2014, I [...]

Redefining Wealth Management in Asia Pacific | Join Us – April 28-29, Singapore

Join the Elite at the PWM APAC Summit 2025 in Singapore Singapore, April 28-29, 2025 – marcus evans is excited to announce the PWM APAC Summit 2025, an exclusive, invitation-only forum that will gather leading [...]

Member Spotlight | Sarah Downey

Our April Member Spotlight shines on Sarah Downey, Senior Vice President of Operations at LoanBidz! Sarah Downey is a Missouri State University graduate (go Bears!) and started her career as a rental property owner, then [...]

Toorak Connect Achieves $5 Billion in Facilitated Loans

TAMPA, FL – March 25, 2025 – Toorak Capital Partners (“Toorak”), a tech-enabled investment manager of business purpose mortgage loans, announced its AI and machine-learning (ML) powered loan review system Toorak Connect has completed $5 [...]

Asset Based Lending Caps Year of Incredible Growth and Company Firsts

JERSEY CITY, N.J. – March 26, 2025 – Asset Based Lending (ABL), a New Jersey-based lender providing private capital to real estate investors, funded 1,866 loans in 2024 – a 60% increase over 2023 – [...]

Legislative Alert: Florida SB 392 – Default Interest Notification

5/5/2025 - Florida Senate Bill 392 has been indefinitely postponed and withdrawn from consideration. 3/24/2025 - The American Association of Private Lenders has been made aware of Florida Senate Bill 392, which if passed, will [...]

The Run Down for Effective Mortgage Rate Messaging

Avoid surprising your clients with mortgage rate and program changes by communicating consistently and transparently. Navigating a landscape in which mortgage rates continue to fluctuate can be particularly frustrating for investors, borrowers, and brokers. Lenders [...]

Default, Delinquency: Aggressive Collections Not the Answer

Techniques that keep communication lines open and preserve broker-borrower relationships help lenders mitigate loss and win fans. In mortgage lending, loss mitigation is a process where the lender, investor, and servicer work with a borrower [...]

Hyperlocal Due Diligence: A Look at the New York City Tristate Area

A combination of factors has led to high inventory levels in this consequential market, but could market demand be rebounding? As we always reference, the adage “location, location, location” invokes three important realms of evaluating [...]

The Rise of Constructive Capital: A Behind-The-Scenes Look With Kyle Concannon

How does a company navigate rapid expansion, market shifts, and industry challenges to become a major player in private lending? Eddie sat down with Kyle Concannon, VP of Product at Constructive Capital, to uncover the [...]

Unrealized Potential: Examining Midstream, Abandoned Construction

Originating or refinancing an incomplete construction project requires an additional set of tools and expertise to manage financial, legal, and market risks. When you start a construction project from the beginning, you can meticulously plan [...]