Supply influx converging with affordability-weakened demand would dampen price appreciation.

An imbalance between low supply and high demand has pushed U.S. home prices up by double-digit percentages for nine consecutive months, capped by a record 19% increase in April.

nine consecutive months, capped by a record 19% increase in April.

The April existing home sales report from the National Association of Realtors (NAR) shows 1.16 million homes for sale, representing a 2.4-month supply. NAR said those supply metrics continue to hover near all-time lows since it began tracking them in 1982.

But three pandemic-related housing trends point to increasing housing inventory over the next six months: (1) a pandemic surge in new home construction, (2) emerging supply from homeowners who feel safe to sell as the pandemic fades, and (3) a backlog of distressed inventory kept off the market by foreclosure prevention efforts during the pandemic.

At best, this coming influx of supply could start to correct the supply-demand imbalance, slowing the torrid and unsustainable pace of price appreciation. At worst, those additional sources of inventory could converge onto the market even while demand has begun to weaken because of out-of-reach home prices. This worst-case scenario could then lead to a correction in home prices.

At best, this coming influx of supply could start to correct the supply-demand imbalance, slowing the torrid and unsustainable pace of price appreciation. At worst, those additional sources of inventory could converge onto the market even while demand has begun to weaken because of out-of-reach home prices. This worst-case scenario could then lead to a correction in home prices.

Here’s a more in-depth look at each of the three trends driving the coming influx of housing supply.

Housing Starts Hit 15-Year High

First, builders dramatically ramped up the construction of new homes during the pandemic. This is already contributing to new supply and will continue to do so in at least the next four to nine months—the time it takes from start to completion for most new home builds, according to the U.S. Census Bureau.

The annualized pace of new housing starts increased 67% in April 2021 compared to a year ago, according to census data. The sharp increase is partially due to low levels in April 2020, when uncertainty was rife in the immediate aftermath of the pandemic declaration. Although anomalous in its size, the April increase was consistent with a longer-term trend in which the annualized pace of housing starts has increased on a year-over-year basis in 10 of the last 11 months. The average increase over that 11-month span has been 16%.

Housing completions are following suit, increasing in nine of the last 11 months, at an average pace of 9%. The annualized pace of housing completions was up 22% in April after reaching a nearly 14-year high of 1.515 million in March, according to census data.

Meanwhile March housing starts hit a nearly 15-year high of 1.733 million—the highest level since July 2006. That 15-year high in housing starts should result in another surge in completed housing units around September, six months later.

If that pace of new construction continues, it could finally start to make a dent in the housing supply deficit that ballooned in the decade following the Great Recession, as the pace of homebuilding lagged the pace of new household formation. A May 2021 analysis by Freddie Mac estimated this deficit to be 3.8 million units as of the end of 2020, up from a 2.5 million-unit deficit in 2018.

Already, the inventory of new homes for sale has been trending higher, up on a month-over-month basis in five of the last six months and rising to a 12-month high of 316,000 in April 2021, according to the Census Bureau.

Pent-Up Supply from Move-Up Sellers

Second, more housing inventory, particularly starter home inventory, should feed into the housing market in the next six months as more homeowners decide to list their homes for sale. More homeowners will arrive at the decision for two primary reasons. First, more new homes being built will give these homeowners more options for finding a new place to live. Second, the fading pandemic will help many homeowners move out of the hunker-down-at-home mentality that was necessary and pervasive during the pandemic.

The pandemic’s hunker-down-at-home mentality exacerbated the low home inventory environment that was already present leading into the pandemic. It did so on the supply side by dissuading many homeowners from listing their homes for sale. It also did so on the demand side by eventually driving up demand from prospective buyers who wanted their own home in which to hunker down.

The impact is clearly seen in housing inventory numbers from NAR. Housing inventory was already on the decline before the pandemic, down by 12% from a year ago in January 2020 and down by 10% from a year ago in February 2020. But the pace of inventory decline doubled to 20% in April, following the pandemic declaration. The trend toward steeper year-over-year declines in inventory continued through February 2021, when inventory hit a new all-time low and was down 30% from a year ago.

Since February, for-sale inventory has increased for two consecutive months, indicating more homeowners are slowly starting to list even as demand has continued unabated—as evidenced by the accelerating home price appreciation. Despite two months of increases in February and March 2021, April 2021 was still down 21%, similar to April 2020.

This gradual upward trend in existing home inventory should continue into the summer and fall as more new home inventory becomes available and health concerns tied to the pandemic recede. Of course, another surge in the virus would quickly reverse this trend.

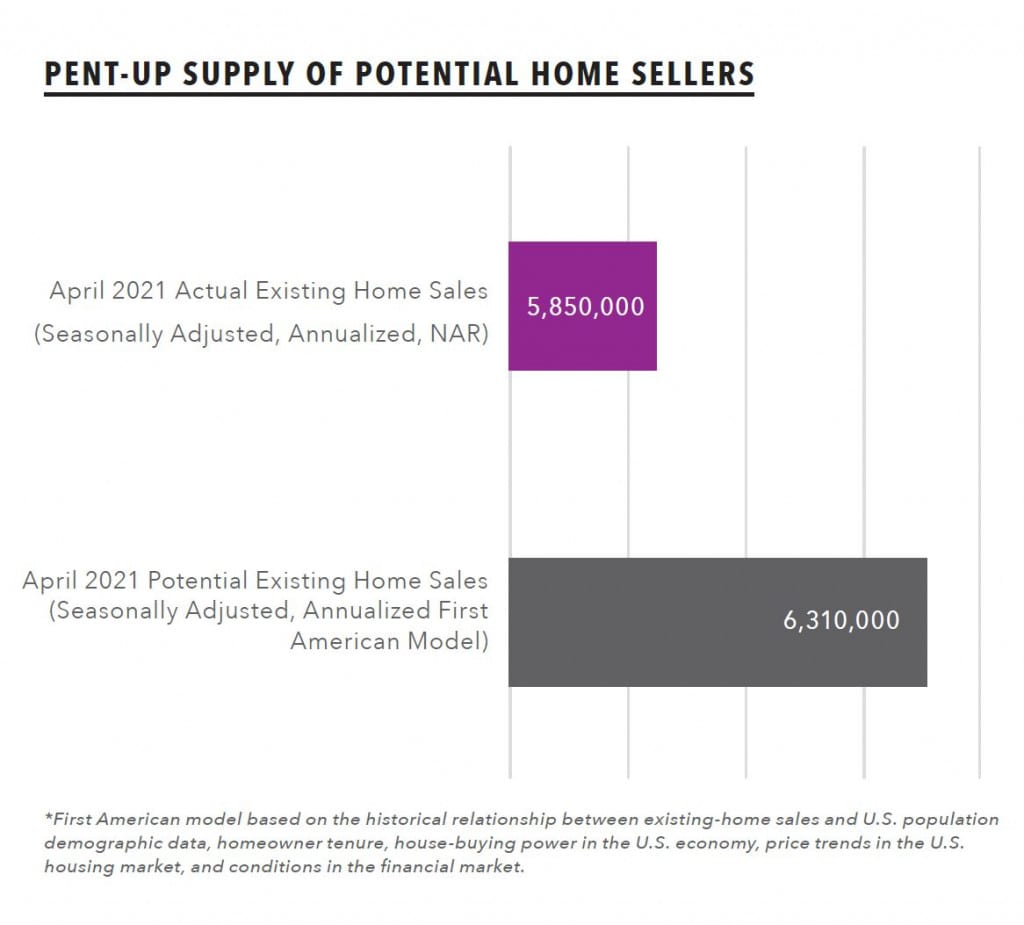

Homeownership tenure data indicates a significant amount of pent-up supply from existing homeowners. The First American April 2021 Potential Home Sales Model shows an average homeownership tenure of 10.56 years, a new historical high. The First American analysis calculated that “existing homeowners staying put accounted for more than 15,000 fewer potential home sales in April 2021.”

Furthermore, the First American model shows potential existing home sales in April of 6.31 million on a seasonally adjusted, annualized basis. That is 460,000 more than the actual number of existing home sales reported by NAR for the month—5.85 million on a seasonally adjusted, annualized basis.

Furthermore, the First American model shows potential existing home sales in April of 6.31 million on a seasonally adjusted, annualized basis. That is 460,000 more than the actual number of existing home sales reported by NAR for the month—5.85 million on a seasonally adjusted, annualized basis.

Distressed Property Backlog

The pent-up supply of existing retail homes for sale could start spilling into the market at about the same time that another source of pent-up supply begins to emerge: distressed home supply held back by a nationwide foreclosure moratorium combined with widespread mortgage forbearance.

An Auction.com analysis of delinquency and forbearance data estimates this building backlog to reach as high as 445,000 as of September 2021, the final month of forbearance for mortgages that entered into forbearance on the heels of the pandemic declaration in March 2020. The nationwide moratorium on government-backed mortgages likely will be lifted by September. As of the writing of this article, the moratorium was scheduled to be lifted July 31, 2021.

The bulk of this distressed backlog is comprised of properties secured by mortgages that never entered forbearance or have already exited forbearance. Black Knight data shows that as of the end of March, 211,000 seriously delinquent mortgages—those where the borrower was at least 90 days behind on mortgage payments—had never entered forbearance. An additional 89,000 seriously delinquent mortgages had exited forbearance but had no loss mitigation plan in place to help get the mortgage back to reperforming status.

Added to that non-forbearance backlog of 300,000 are an additional 145,000 seriously delinquent mortgages still in forbearance but projected to exit forbearance by September, with no loss mitigation in place. The 145,000 represents 15% of the 975,000 seriously delinquent mortgages scheduled to exit forbearance by September, according to the Auction.com analysis of Black Knight data. The 15% is based on MBA data showing the to-date rates of forbearance exits that result in still-delinquent mortgages with no loss mitigation in place.

Added to that non-forbearance backlog of 300,000 are an additional 145,000 seriously delinquent mortgages still in forbearance but projected to exit forbearance by September, with no loss mitigation in place. The 145,000 represents 15% of the 975,000 seriously delinquent mortgages scheduled to exit forbearance by September, according to the Auction.com analysis of Black Knight data. The 15% is based on MBA data showing the to-date rates of forbearance exits that result in still-delinquent mortgages with no loss mitigation in place.

The estimated distressed backlog of 445,000 properties will not all hit the market at once after the forbearance program expires and the foreclosure moratorium is lifted. The backlog will likely be spread over many months, and even years, as lenders start or restart the foreclosure process on these loans. The length of the foreclosure process varies widely from state to state.

This is also true for the other incoming sources of housing inventory. The pent-up supply of retail homes for sale will most likely not hit all at once, nor will the new homes now in the construction phase. But come September 2021, the stage will be set for a shifting tide when it comes to housing inventory. New home completions will likely be surging to a nearly 15-year high, helping to free up inventory of existing homes. Along with a fading pandemic, that gives current homeowners more confidence to list their homes for sale. Meanwhile, the distressed property tide will more rapidly rise as barriers to foreclosure are removed.

The loosening of the housing inventory logjam should be good news for most in the real estate market, including real estate investors hungry for more supply. The influx of supply, which should begin in earnest around September, will at the very least cool down overheated and unsustainable home price appreciation. If this inventory influx comes at a time when demand is weakening—most likely triggered by affordability constraints caused by too-high home prices or rapidly rising mortgage rates—it could result in a home price correction.

Leave A Comment