DSCR: Conventional Lenders Edging Out Private Market?

As residential refinance activity declines, the origination-starved conventional mortgage industry has more than doubled its appetite for debt service coverage ratio loan products. Originations—both conventional and private—have been increasing annually since 2019, peaking in 2022. [...]

Unsung Underwriting Tools: Insurance Resources

Property insurance not only protects loan collateral, it provides unique insight into underlying geographic, property, and borrower risk. The availability of insurance and its cost can significantly impact the overall risk of financing an investment [...]

Member Spotlight | Shaye Wali

Our March Member Spotlight shines on Shaye Wali, CEO at Baseline! Shaye Wali is the Founder and Chief Executive Officer at Baseline, a technology platform that helps origination and servicing teams streamline their workflows, leverage [...]

State of the Industry: Unanticipated Loan Activity Signals Market Shift

In 2024, private lenders are witnessing an unexpected uptick in bridge and DSCR loan activity, reflecting growing investor demand for flexible financing options amid market uncertainty. Lightning Docs is a software company specializing in loan [...]

Distressed Auction Data Reveals Hidden Market Potential

New data shows fewer than one in four purchases at foreclosure and REO auctions involve financing, underscoring a substantial, untapped opportunity. Nearly eight in 10 homes purchased at distressed property auctions are not financed by [...]

Major Capital Exits, Freezes Signal CRE Market Disruption

Meanwhile, shifting demand from office space and traditional multifamily to mix-use development heralds a new wave of opportunity in commercial real estate. As 2025 kicks off, commercial real estate (CRE) is buzzing with opportunities and [...]

Federal Bill Needs Your Support: Main Street Tax Certainty Act

This article was updated [date] to reflect a business name change. The Main Street Tax Certainty Act (S.1706/H.R.4721) would make permanent Section 199A, a key tax deduction which as of now will sunset at the [...]

A Solution for Every Problem

While Chris Fuelling, CEO of LendingWise, describes himself in terms of tenacity, gumption, and fortitude—all undoubtedly true—a solutions-first core and builder’s heart is where the real story is. It’s why he launched his first business [...]

Unlock Your Access to Bank Lines of Credit

Follow this roadmap for how to assess bank sizes, meet LOC criteria, and forge productive banking relationships that support your goals. Finding the right bank to provide a line of credit (LOC) for your private [...]

Managing the Blind Spot

Series Note: This is the second article in a series about operational risk in construction and renovation lending. The series, written from the perspective of a chief lending officer, examines examples of operational risk, addresses [...]

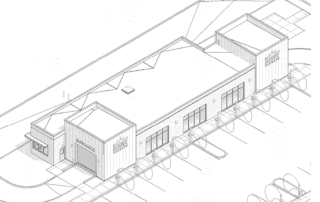

A Car Wash with a Purpose

Milton, Washington’s newest car wash combines cutting-edge technology with environmental goals, supported by a loan that meets both lender and borrower needs. The Glacier Car Wash project is a 4,200-square-foot state-of-the-art facility, which will feature [...]

Master DSCR: Learn DSCR Secrets With Benn Jackson

Is your real estate portfolio working as hard as you are? Eddie sat down with Benn Jackson from Constructive Capital to break down the strategies and tools every real estate investor needs to succeed in [...]

Member Spotlight | Justin Land

Our February Member Spotlight shines on Justin Land, Co-Founder at Merchants Mortgage & Trust Corporation! Justin Land has extensive expertise in the industry and has a passion for empowering investors. He is committed to delivering [...]

Foreclosure Auction Volume Drops to 3-Year Low to End 2024

Auction demand down in Q4 overall but posts decisive rebound in December following election KEY POINTS Uptick in scheduled auctions indicates possible Q1 rebound in completed auctions Q4 demand increased annually in 59 percent of local [...]

Bulletproof Your Business Blueprint

A brand will sell itself if you build it from the inside out. As the old business adage goes, "Sell a product that can sell itself." Talk about an infallible business plan! If it's that [...]

Circuit Court Vacates SEC’s New Rules for Private Funds

In a significant legal turnaround, the U.S. 5th Circuit Court of Appeals has nullified SEC regulations intended for private funds, marking a pivotal moment for private lenders and fund managers. During the past year, you [...]

SoBo Duplex Makeover Pays Off

In Denver’s rising SoBo neighborhood, which has been transformed from a transportation corridor to a vibrant hub of boutiques, music venues, and restaurants, a rundown 1963 duplex sat waiting for a developer to tear it [...]

Real Estate Strategies: Insights From Mark Burch From Temple View Capital

Want to know the strategies top investors are using to dominate the market right now? Eddie sat down with Mark Burch of Temple View Capital to uncover the secrets behind today’s biggest opportunities. Eddie and [...]

What’s REALLY Driving the Market?

What’s really happening in today’s real estate market? Is it all doom and gloom, or are there hidden opportunities waiting for you to grab? Eddie sat down with Bill Tessar, President, and CEO of CV3 [...]

An Ending, or a Beginning?

Year’s end is characterized as a time of reflection … a slower pace … a moment to catch a much-needed breath. Fall and early winter recall cozy moments by a fire, warm sweaters, and quality [...]