Higher demand bodes well for the retail market and benefits sellers and distressed homeowners.

Demand from local real estate investors turned a corner in early 2023 after bottoming out in late 2022, a good sign for the private lending industry and the retail housing market in the second half of the year.

“The market is taking a shift,” said Jermaine Morgan, a Columbus, Georgia-based real estate investor who buys distressed properties at foreclosure auction. Morgan noted that the out-of-state, hedge fund investors who drove up prices before the pandemic have now exited the market. “They would bid to crazy high prices. They would outbid all of us … When the market changed, all of those investors went away.”

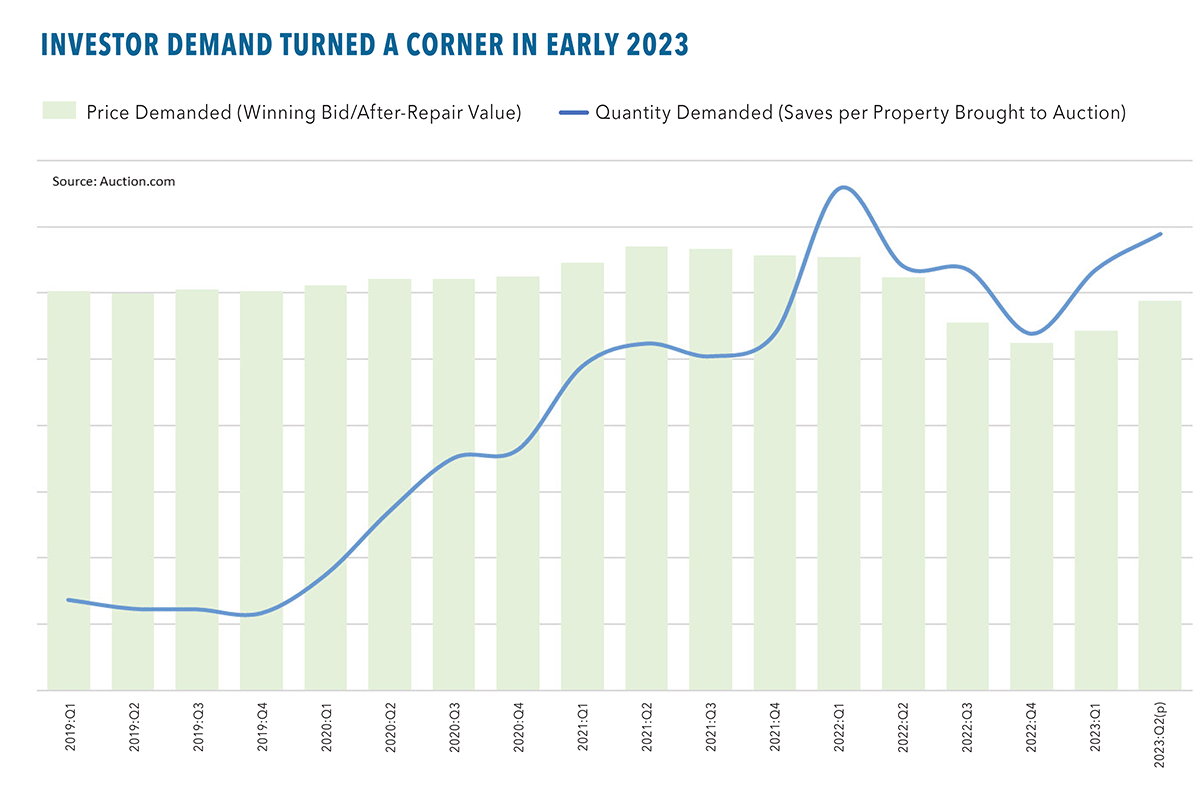

After reaching record highs in 2021 and 2022, investor demand dropped rapidly in the last three quarters of 2022, both in terms of quantity demanded and in terms of price demanded. That’s according to bidding data from Auction.com, which accounts for close to half of all completed foreclosure auctions nationwide.

Quantity demanded is measured by the average number of online saves for properties scheduled for auction. Price demanded is measured by the average winning bid as a percentage of the estimated after-repair value of properties that sell at auction.

Both of those measures bottomed out in the fourth quarter and turned higher in the first quarter of 2023, according to the Auction.com data. The average number of saves per property scheduled for auction increased 18% on a quarter-over-quarter basis while the winning bid-to-value ratio increased 3% from the previous quarter.

Both demand metrics were still down from a year ago, but the first quarter increase marked a reversal of a three-quarter downward trend. Preliminary data from the second quarter indicates both demand metrics will continue their upward trajectory at least through the first half of the year.

Quantity demanded—saves per property scheduled for auction—is on track to increase another 7% in the second quarter. Price demanded—the average winning bid-to-value ratio—is on track to be up another 8% in the second quarter.

Robust Bidding

“There is robust bidding at the courthouse steps. It came back in full force about two months ago. We were seeing some people come in who I haven’t seen before … bidding big numbers,” said Tony Tritt, a Carrollton, Georgia-based real estate investor who buys at foreclosure auction.

Tritt said some investors paused their acquisitions in late 2022 and early 2023 because of the shifting market. Those investors are now back at the foreclosure auction, but still bidding somewhat conservatively in terms of price.

“They are definitely hot and heavy back in. Their numbers are still conservative,” he said, going on to explain his bidding approach. “I’m not buying thinking that in six months when I sell that prices are going to go down. But I don’t necessarily think they’re going up… Now I’m playing it more like it’s going to be flat.”

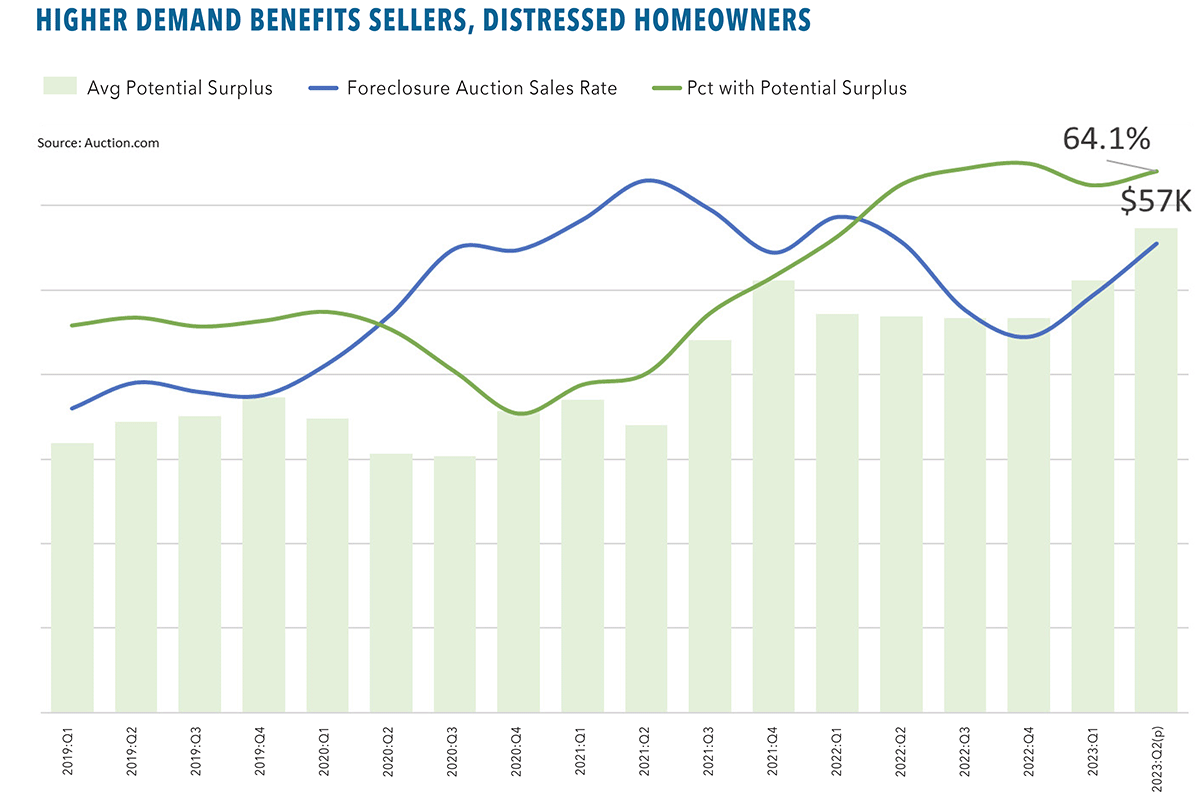

Higher demand from local community developer investors like Tritt and Morgan not surprisingly translates into more sales at auction. The foreclosure auction sales rate—the percentage of properties up for auction that sell to local community developers and other third-party buyers—increased 11% on a quarterly basis in the first quarter of 2023. It is on pace to increase another 12% in the second quarter, which would bring it to about on par with the sales rate a year ago.

Benefits of Higher Demand

The increasing demand is also pushing up price execution at foreclosure sale, which along with the higher sales rate is good for sellers. The average winning bid as a percentage of the seller’s credit bid—the minimum amount the seller is able or willing to accept to sell the property—is on track to hit a record high of 128% in the second quarter of 2023, according to Auction.com data.

More sales and higher price execution at foreclosure auction is also good for distressed homeowners. Any surplus generated by the sale above the total debt owed to the foreclosing lender goes to the distressed homeowner after any other lien holders are paid off. The average potential surplus generated by foreclosure sales was more than $57,000, a record high, according to preliminary second quarter data from Auction.com. That same data shows that 64% of foreclosure sales generated a potential surplus for distressed homeowners in the second quarter, up from 62% in the previous quarter and up from 63% in the second quarter of 2022.

Implications of Higher Demand

The increasing demand boosting the sales rate is driven largely by local community developers like Tritt and Morgan who are regaining confidence in a retail market that is stabilizing after it was left reeling in 2022 by skyrocketing mortgage rates.

“People say the market is crashing. To me the market is going back to what it was pre-COVID,” Morgan said. “For me real estate is a game of numbers. If the numbers make sense, I will buy.”

And the numbers are beginning to make sense for Morgan on more properties brought to foreclosure auction. Auction.com data shows he purchased two properties at foreclosure auction in Columbus in the first half of 2023 after purchasing one in all of 2022.

This confidence-driven increase in foreclosure auction acquisitions bodes well for the broader retail market, both in concrete terms as well as in psychological terms.

Given that the local community developers will be selling or renting back into the retail market about six months down the road, following renovation of the properties they purchased at auction, the increasing sales at foreclosure auction means more inventory in the retail market in the next six months.

Affordable Housing Supply

That additional inventory will skew toward the affordable end of the housing spectrum. An analysis of public record sales data post-auction shows that resales of renovated foreclosures in 2022 sold for an average price of $267,869, 40% below the average sales price of $447,755 for all existing home sales, according to ATTOM Data Solutions data.

“I can sell a $250,000 property all day long, so I can be a little bit more aggressive (when buying),” said Tritt, adding that some renovated properties over the $350,000 mark are taking longer to sell in his market.

Morgan said $350,000 is about the maximum “after-repair” value for the properties he purchases.

The psychological implications of increasing investor confidence are also a good sign for the retail market. Local community developers buying at auction are on the front lines of their local markets and are well-versed in reading the market tea leaves—their success depends on doing so accurately. If these front-line housing market afficionados are confident about the short-term health of housing in their local market, it’s likely that their local market will be healthy and humming for at least the next six months.

“If I put a 250,000 renovated home on the market, I still have more people who want to buy it. As long as that is the case, that is going to keep that price at 250,000,” Tritt said. “Your 250 house is not going to become 180. That’s not going to happen because we just haven’t done a good enough job of building that sort of (affordable) inventory.”

Reviving Properties and Neighborhoods

For local community developers like Tritt and Morgan, replenishing the supply of affordable housing inventory in their markets often involves some level of risk, both at the property level and neighborhood level. They are buying properties without an interior inspection that may require more renovation than they are budgeting for, and they are often buying in underserved neighborhoods, investing in a turnaround in those neighborhoods.

Morgan recounted a recent purchase on Auction.com in an underserved neighborhood that other investors were avoiding. But when he sold the renovated property, he got several offers well above the asking price, and suddenly that neighborhood became popular with other investors.

“Now in that area that was deprived, the market has changed. I just had several friends buy over there and they are up for resale,” he said, noting he remembers the neighborhood is starting to return to the vibrancy he remembers as a kid growing up in the area. “The vast majority is going to owner-occupants. It’s about taking something, making it better, raising the value of the area.”

Leave A Comment